Automated Underwriting: The Future of P&C Insurance is Here

- December 11, 2022

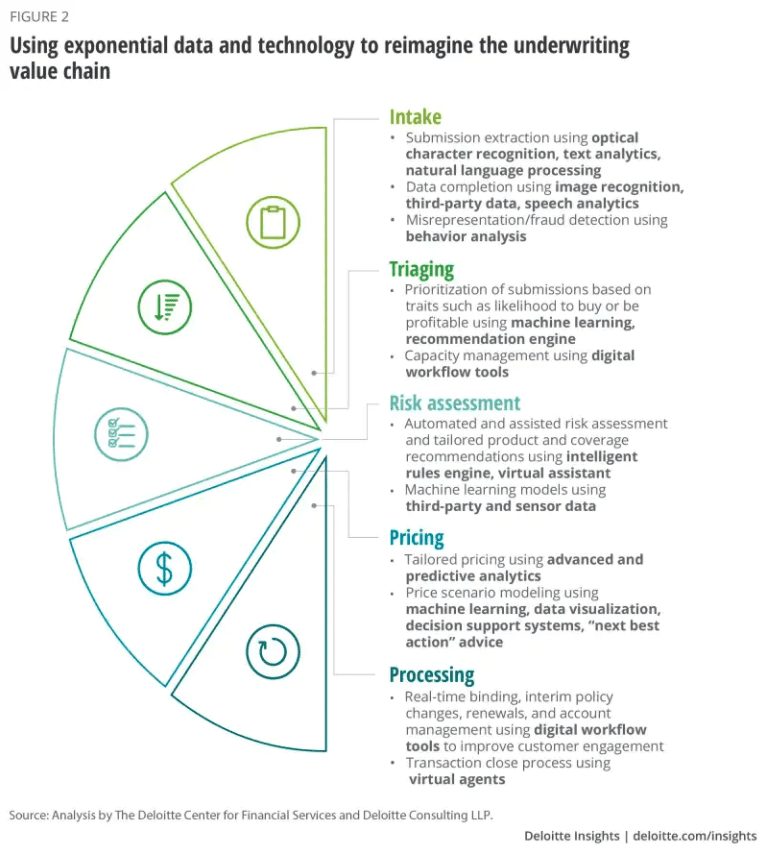

Digital transformation in the P&C industry has led to advancements in digital underwriting. COVID-19 furthered the rapid digitalization of the insurance space – with Deloitte forecasting that historical data may be less valuable to the underwriting process. Deloitte identified automation, which includes automated underwriting, as a way for P&C insurance companies to adapt to a changing market during the pandemic.

What Is Automated Underwriting?

Automated underwriting is a computerized process where robotic process automation (RPA) software and artificial intelligence uses algorithms to generate insurance quotes and underwrites the potential risk of clients, taking out the need for real people. This helps insurers with a more streamlined, less biased, and overall better underwriting process to assess, estimate, and price risk using aggregate or personalized data.

Once an algorithm completes its calculation, an industry professional reviews the quote or decision, digs into the logic to see why the automated underwriting system recommended the result that it did, and adjusts if necessary.

Take Fannie Mae, for example: their Desktop Underwriter system recommends decisions for mortgage lenders like “refer,” “refer with caution,” or “approve.” Mortgage lenders want to issue more loans, but they need to do so with caution to minimize financial risk. When a lender gets a “refer” or “refer with caution” recommendation from the automated system, they’ll either underwrite the loan manually or reject the application depending on specific risks identified by the algorithm.

P&C insurers use a similar process to assess risk and price policies like homeowner’s insurance, car insurance, and renter’s insurance. Approved customers can sign up for a policy digitally without speaking to a human underwriter. A P&C professional can manually amend a policy, if appropriate, once the customer is already insured.

Automated Insurance Underwriting vs. Manual Underwriting

While automated insurance underwriting uses AI and machine learning to generate loan decisions, manual underwriting is the exact opposite.

Manual underwriting is the act of an insurance underwriting professional manually underwriting a quote and determining risk. This takes much longer to finalize and can be riddled with human errors.

Manual underwriters also require those applying to submit quite a bit of paperwork – including bank statements, tax returns, employment history, medical records, recommendations, and more.

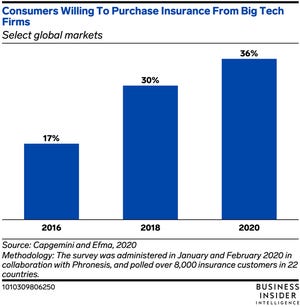

Now with automated underwriting systems, those applying for insurance can complete the process without ever talking to a real person. And the amount of consumers willing to do that is growing rapidly over the past few years – from 17% in 2016 to 36% in 2020, an increase of over 110%.

Why Should P&C Insurers Adopt Automated Underwriting?

Automated underwriting can be a powerful way for P&C insurers to lower their costs, maximize workforce productivity, and generate more revenue without increasing their tolerance for risk.

In fact, it is very similar to what digital transformation is in the banking industry with more and more consumers preferring to transact digitally than going to banks.

1. Drives New Revenue

Today’s insurance shopper expects speed from their insurers. Automated underwriting is a powerful way to speed up the process of closing the deal.

Accenture pointed out, in a recent report, that millennial insurance customers “want to sign up for a policy in five minutes using a completely digital experience” — and baby boomers have similar expectations. It’s easy for consumers to shop around for the best insurance rates online, so P&C insurers must prioritize speed to compete.

Algorithmically generated pricing decisions are much faster than manually generated quotes, so customers can go from a cold lead to a quote to a signed contract within minutes.

Here’s an example: say a prospective customer wants to sign up for a car insurance policy while shopping for a car on a smartphone. They’re sitting on their couch, and realize they can buy a new car with a totally contactless process. They can sign up for financing, order the car, and it shows up at their doorstep. The one snag: they need to show proof of insurance to finalize the purchase.

If you were to undertake this process manually, and that customer had to call a human to get a car insurance quote from your company, you might have lost their business. They’re already in a contactless mindset, so they’re probably looking for a fully digital, hands-off experience.

They might sign up for a policy with your competitor instead — a competitor that is leveraging automated underwriting to improve the customer’s digital experience.

2. Creates More Efficient Pricing

Automated underwriting improves your ability to use more inputs for a stronger, more complex, more considered calculation. Your underwriting team can leverage that automation to better assess risk, which decreases the number of unexpected payouts and helps you set prices more competitively.

Closing more sales is a great strategy for P&C insurers to grow their top-line revenue — as long as those policies don’t come with unnecessary risk that ultimate hurts the bottom line.

In another recent whitepaper, Accenture said, “with additional data points and the speed of predictive analytics models, underwriters gain greater visibility to risk and their ability to more confidently price policies competitively to capture additional revenue.”

Better calculations help you identify policies that you could charge less for without losing money. Consumers want lower rates, and you can give them what they want without increasing your tolerance for risk.

Lowering rates on the right policies helps you generate more new customers, increasing your revenue in the most profitable areas of your business.

3. Reduces Operating Costs

According to a McKinsey analysis, P&C insurers increased labor efficiency by 14% between 2012 and 2017. McKinsey notes this improvement was partially “driven by substantial improvements in particular in processes and automation.” Manpower is expensive, and P&C insurers are turning to digitalization to increase productivity and save money on operating costs.

Since automated underwriting optimizes the risk assessment process, it’s a powerful way to reduce employees’ tedious workloads and make room for them to focus on higher-impact projects.

P&C insurers have struggled less than other insurers when it comes to improving productivity across their workforces. Automated underwriting might have something to do with that: McKinsey noted that “investments in automation have boosted labor productivity” for the insurance industry as a whole.

While automation is a powerful tool for P&C insurers to reduce operating costs by improving the productivity of existing human capital, it’s not a magic want to improve cost efficiency across every area. Increased IT costs might limit profit margins in the short term on the way to long-term benefits for your bottom line.

4. It Can Be Implemented in Stages

Automated underwriting is a powerful technology, but some P&C insurers are intimidated by the adoption process. Consider adopting automation in stages, not all at once.

P&C insurers can start small with their automated underwriting adoption. Leverage it on one or two products to learn how it fits into the business, and deepen technological sophistication over time. Leverage a Digital Adoption Platform like Whatfix in this process to improve the success of the transformation process and impact on business overall. Whatfix helps drive insurance digital adoption by providing end users with realtime in-app guidance and self-service support.

If you’re using a hybrid approach at first, utilizing automated and human underwriters in tandem, it’s easier to start small. Human underwriters can observe where the algorithm succeeds or misses the mark and adjust quotes manually.

Engineers on your team can use that data to improve your algorithm in stages. As your underwriting process leverages more and better data inputs, you’ll improve pricing efficiency over time.

P&C insurers might be able to compete without automated underwriting today, but that won’t last forever. Customers expect low rates and a quick signup process — benefits automated underwriting can provide.

Your competitors are already using automation to improve the experience for the end-user. If you don’t leverage it, too, your customers will leave you behind.