6 Companies Leading Digital Banking (and What You Can Learn From Them)

A recent survey of financial institutions found that 88% rank improving user experience and engagement through digital transformation as a top priority. Yet only 31% report high success rates for actually making these improvements. Though it seems digital banking is widely adopted, these numbers tell a different story.

So, how can you improve the odds that your digital transformation will succeed?

Look at the successes of top companies in the banking industry. Learn how these top six industry leaders achieved their digital banking transformation, and see how their accomplishments can help your company.

What Is Digital Transformation?

Digital transformation is the process of replacing legacy systems and traditional processes with new digital technologies to automate manual tasks, improve productivity, drive revenue, and create better customer experiences.

6 Companies Leading Digital Banking and their Learnings

1. Citibank: Adopt a “Mobile First” Digital Banking Strategy

In 2018, Citibank found that mobile banking apps were one of the top three most-used applications. As a result, the company shifted its strategy to develop mobile banking as its own experience rather than as a supplement to the website and physical branches.

The company surveyed and worked with over 50,000 customers to identify which features it should focus on first. Citibank prioritized mobile options that consumers regularly use, including digital payments and investing. The company expects that this shift to mobile, and its other digital banking transformation efforts, will save them $600 million in 2020 on top of improving their banking customer experience.

Key Takeaway: Use Customer Data to Direct Your Digital Transformation

Use information from customers to drive your digital banking transformation decisions and determine what features to prioritize.

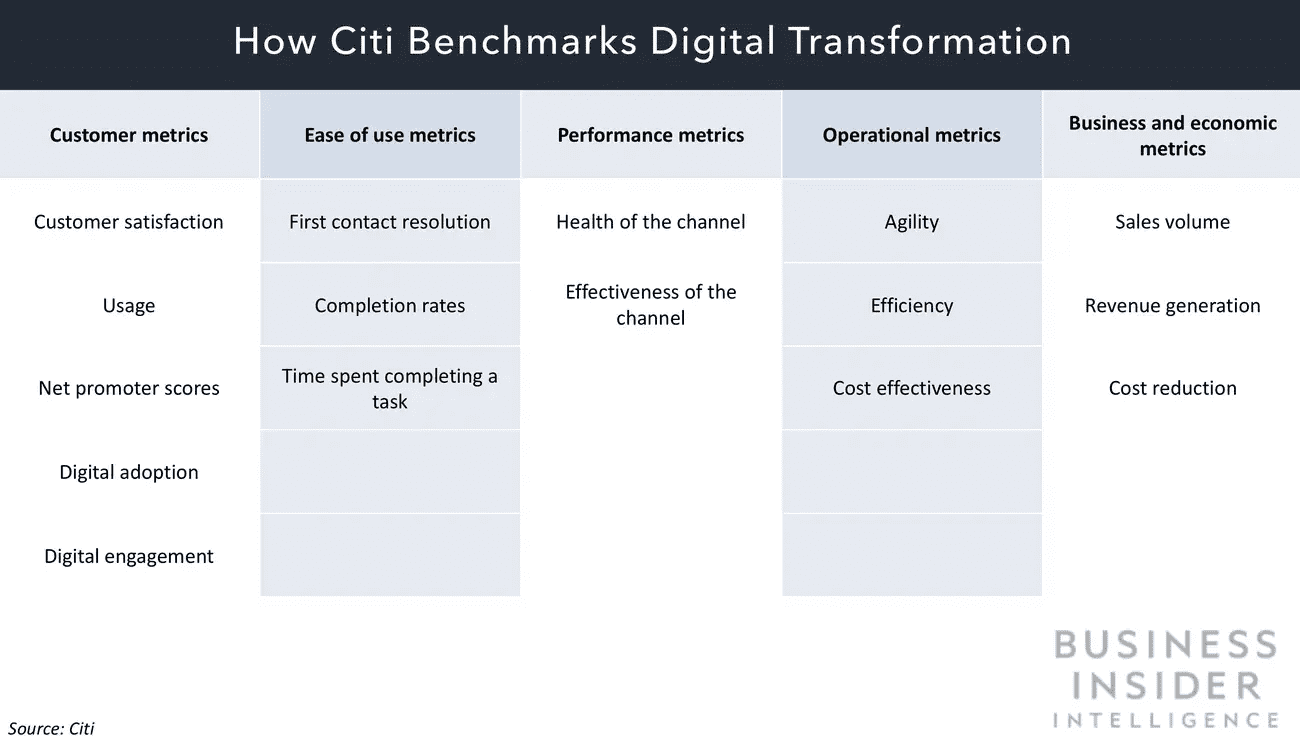

Follow Citibank’s lead and set customer-focused metrics to measure the success of your efforts.

By focusing on features that customers are already interested in, you can increase your odds of successful end-user adoption.

2. TD Bank: Upgrade Current Banking Technology

TD Bank used early warning signs of the pandemic as a driver for its transformation. The company rapidly upgraded its digital platforms, focusing on expanding its current technology rather than adopting new applications.

Following its efforts, TD bank was better able to handle high demand. It tripled its capacity for mobile deposits in preparation for possible branch closures. The company also launched a virtual assistant to handle customer questions. The assistant conducted over 75,000 customer sessions in its first week and freed up support staff to focus on more serious issues.

As a result of TD Bank’s updates, engagement in digital channels rose 30% in Canada and 17% in the US between February and April.

Key Takeaway: Leverage Automated Customer Support Technology

Lighten the support workload for employees by adopting a virtual assistant or digital adoption platform (DAP).

Self-service support options enable customers to quickly find answers to their questions without putting in a support ticket. This frees up your customer service staff to focus on other tasks. It also lessens frustration for consumers. They spend less time on hold and can find answers to their questions at any time of day or night.

3. BBVA: Offer “DIY” Transactions

BBVA took the self-serve aspect of digital banking a step further. It now offers do-it-yourself (DIY) options for 94% of its products and services. Consumers can conduct most of their banking needs without visiting a physical branch.

BBVA branch employees now spend less time dealing with everyday tasks like deposits. They can focus more on financial consulting and advising customers on new products. This pivot resulted in US branches selling 42% more products per month.

Self-serve options also increase efficiency. There’s no need to wait in line, and customers can perform tasks faster. This helped reduce BBVA’s average cost-per-transaction by 31%.

Key Takeaway: Create a Consistent Experience Across Channels

Build mobile apps and websites so customers have a similar experience across your digital offerings. If the design and navigation setups are consistent across channels, it’s easier for customers to learn new applications.

If you offer services in multiple countries, make your applications as uniform as possible across locations. BBVA coordinates development across countries to ensure a unified experience. According to the company, using the same framework for all their offerings and locations leads to a shorter time-to-market for new products and services. It also means faster roll-out in new countries.

4. J.P. Morgan: Accelerate Product Development

The product development side of digital banking platforms is just as important as the customer-facing aspects. J.P. Morgan’s early-stage product team, called AreaX, is responsible for moving from concept to working prototype within 6–12 weeks. They can work so quickly because they focus on developing the most basic form of the product first.

The team tests the viability of the bare-bones product to see if it’s worth investing more time and money. The company stated, “While accepting failure is a challenge, failing fast and figuring out what went wrong early is much cheaper than developing the wrong product.”

Once the team determines a product is viable, they hand it off to a larger team to develop and refine it further.

Key Takeaway: Build a Dedicated Digital Team

Having a specialized team with specific goals helps keep employees focused on the digital transformation and not distracted by working on other projects. J.P. Morgan achieves super-fast initial product development because that’s all the AreaX team does.

The company also has a Digital Innovation (DI) team. It watches for digital banking trends and potential expansion opportunities. The DI team helps guide what the AreaX team will focus on. For example, they helped with the decision to roll out digital-only banks in the UK. The decision was based on current trends: In the first half of 2019, digital-only banks increased their numbers of customers by 170%.

J.P. Morgan

5. BMO: Support Digital Banking With In-Branch Improvements

BMO Harris Bank implemented several new technologies and processes in-branch as part of their digital transformation. The company aimed to take the convenience people expect from digital banking and apply it to the in-person experience.

Adobe found that 75% of people still value in-person branches. By upgrading their physical locations, BMO increased banking efficiency for people who don’t use mobile technology or who prefer to conduct some banking in-person.

The bank implemented real-time check scanning and processing. This reduces the need for paper deposit slips, and customers can access their money in hours instead of days. It also upgraded its technology so that customers can get a debit card as soon as they open an account, rather than having to wait for the bank to mail one.

These efforts significantly increased the speed of transactions and reduced the overall numbers of people visiting branch locations. Just the reduction in the number of forms to process has saved thousands of employee work hours.

Key Takeaway: Boost In-Branch Efficiency with Digital Transformation

Automate administrative processes to improve efficiency both online and in physical locations. Adopt e-forms and e-signatures to reduce the need for physical forms.

BMO increased efficiency by 40% by automating form generation and moving to e-signatures. Automation helps standardize processes across locations. It makes onboarding customers and staff more manageable and more uniform.

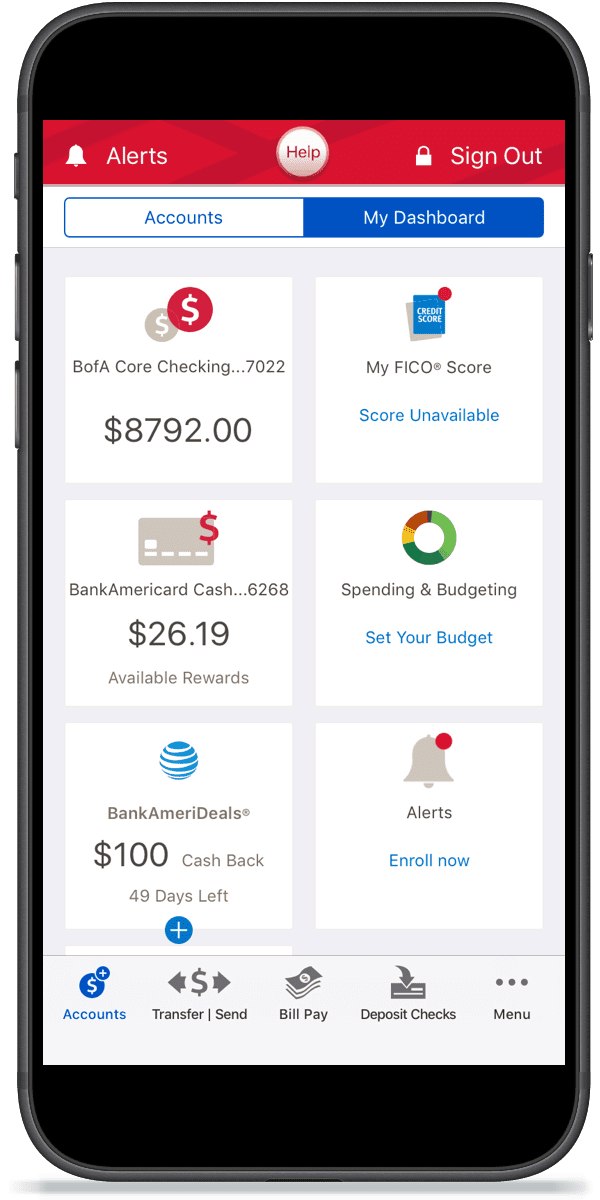

6. Bank of America: Offer a Consolidated Dashboard

Bank of America made its mobile app more valuable to customers by making it a single point of access for all their digital banking needs. The app has a single dashboard where customers can view products from across Bank of America’s services.

Users can access a variety of products, including:

- Checking and savings accounts

- Investment and retirement accounts

- Mortgage services

- Bill-pay services

- Peer-to-peer (P2P) payments

- Budgeting and planning services

During the second quarter of 2020, Bank of America saw two billion logins, 133 million digital bill payments, and over 660,000 digitally booked appointments.

Key Takeaway: Make Your App a One-Stop-Shop

Encourage customers to use your app by making it a place they can go for all your services, even ones offered through third parties.

Bank of America offers P2P payments through Zelle, a third-party person-to-person payment company. Users can access Zelle from within their Bank of America app. They can also access any investment accounts they have through Merrill Lynch.

Having all their banking services accessible through one app is more convenient than having to download separate apps for each type of product.

Only 29% of people not currently using a digital wallet are interested in starting. A large part of this is because they don’t know how digital wallets work. To help encourage the adoption of your digital banking products, consider implementing a digital adoption platform. Guided walkthroughs, videos, and self-help menus will show customers exactly how to use your application. This will help decrease user error and increase customer satisfaction.

Request a demo to see how Whatfix empowers organizations to improve end-user adoption and provide on-demand customer support

Thank you for subscribing!