The Future of Insurance Fraud Detection is Predictive Analytics

Fraud creates the biggest financial risks for insurance organizations. That’s why insurers should spare no expense in evolving their fraud prevention methods.

While it has been around for a long time, predictive analytics just recently hit mainstream status in the insurance industry. Today, it’s the most powerful method for fraud detection, driving a tremendous effect on insurance technology.

Insurance companies that haven’t implemented high-tech solutions yet should hurry up. Artificial intelligence (AI) and predictive analytics are shaping the future of the entire industry, giving significant competitive advantages to organizations that are already making use of these technologies.

In this article, we’ll dive into the newest insurance fraud prevention methods, uncover the benefits of predictive analytics, and feature the three best insurance claims fraud detection software tools.

Top 3 Insurance Claims Fraud Detection Software

- FRISS Fraud Detection

- SAS Detection and Investigation for Insurance

- SEON

What is Insurance Fraud?

Insurance fraud is an act of deliberate submission of false information by policyholders to an insurance company for financial gain. It covers activities like exaggerated claims, falsified medical history, faked incidents, etc.

The problem of insurance fraud is more urgent than ever:

- In 2022, insurance adjusters suspect 20% of claims might contain fraud.

- Instances of digital insurance fraud in the US increased by 11.1% from 2020 to 2021.

- 29% of healthcare, social security, and unemployment insurance organizations were affected by public benefits fraud schemes in early 2022.

- In the UK, a new insurance scam is detected every five minutes.

- 68% of respondents agree that the amount of suspected fraud against their company has increased over the last three years.

Ironically, with increased digitalization, the risk of insurance fraud is increasing.

SEAN KEVELIGHAN, PRESIDENT AND CEO of INSURANCE INFORMATION INSTITUTE

While technologies do help insurers foresee risks and proactively prevent them, digital activity – and specifically, digital claims processing – may create opportunities for claims fraud if no security system is set up.

Insurance Fraud Types

Insurance fraud cases aren’t limited to claims fraud. Here are two major insurance fraud types you should be well aware of:

- Hard fraud is the act of deliberately faking the injury or damage to get money from an insurance company.

- Soft fraud involves exaggerating the damage caused by a real accident to get more money out of the claim.

More specifically, these are some of the most common insurance fraud types split by niche:

- Auto insurance fraud: false repair claim, staged accident, intentional damage claim, auto shop scam, falsifying the date or details of an accident, etc.

- Disability and healthcare fraud: billing for services not provided, faking documents to bill for a more expensive service than what was actually provided, faking documents to get and billing for unnecessary services, double billing, fake disability claim, submission of forged documents to continue a disability claim, etc.

- Benefit fraud: working while receiving unemployment benefits, forging receipts, faking injury, sharing benefits with others, etc.

- Property insurance fraud: false or inflated property damage, false or inflated burglary or theft report, arson, intentional damage claim, etc.

Cost of Insurance Claims Fraud

How much can you lose to insurance fraud?

Fraudulent activities top the charts as the biggest source of financial loss for insurers. Here are some stats on the costs of insurance fraud for both insurers and consumers:

- About 10 cents of every dollar budgeted for Medicare is stolen or misdirected. The organization loses approximately $60 billion to fraud every year.

- In the UK, frauds worth £3.3 billion are detected every day.

- The same report reveals that the average value of a dishonest claim is £11,500.

- Insurance fraud causes $80 billion worth of damage to US consumers yearly.

- Fraudulent activities cost the average US family from $400 to $700 a year in the form of increased premiums.

Insurance customers cover carriers’ financial losses through higher premiums and rates. That being said, insurance fraud probably has a stronger financial impact on policyholders than on insurers. So a strong fraud prevention system is essential for companies willing to not only protect themselves from fraudulent actions but also to offer lower rates and a more delightful experience to customers.

What is Insurance Fraud Detection?

Insurance fraud detection is a set of practices implemented by insurers to identify and prevent fraud from policyholders or third parties.

Not so long ago, insurers were primarily relying on claims adjusters’ experience in fraud detection efforts. Later, rule-based systems appeared, allowing organizations to automate the identification of potentially fraudulent claims. Today, these traditional security methods don’t cope with sophisticated fraud. Businesses need to explore advanced big data solutions to have a competitive advantage in the fraud detection ecosystem.

In further sections, we’ll introduce you to the biggest trend in insurance fraud detection, which is predictive analytics, and suggest software you need to add to your toolkit to support your fraud prevention activities. Meanwhile, let’s talk about the state of insurance fraud detection these days.

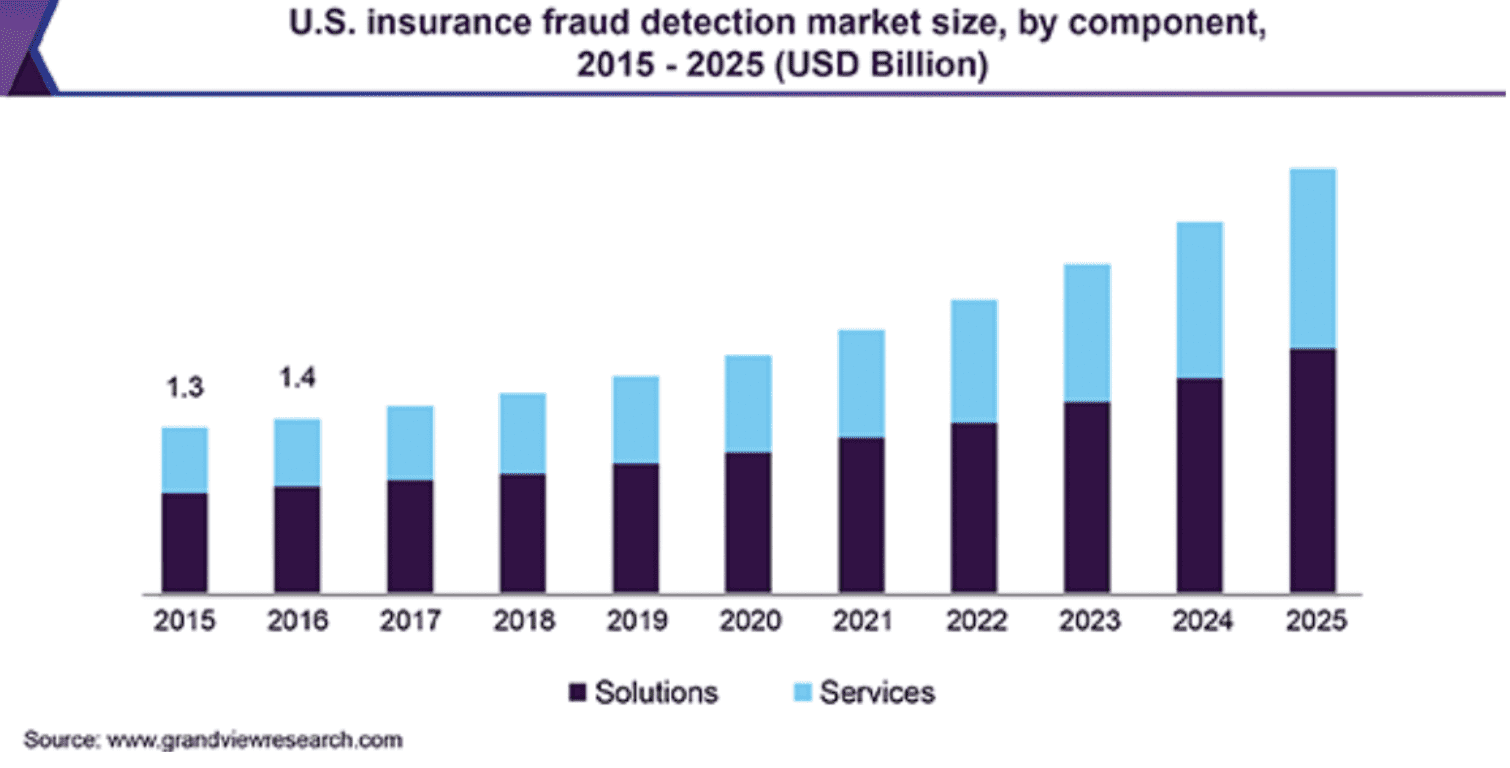

As digitalization is increasing insurance fraud risk, the insurance fraud detection market is also growing rapidly. It’s expected to grow at a compound annual growth rate of 13.7% from 2019 to 2025 and may reach $9.7 billion by 2025.

In light of evolving fraud detection technologies, insurers have already reached some remarkable milestones in proactive attempts to mitigate and reduce losses caused by fraud. With the adoption of technologies such as big data, AI, machine learning, and the Internet of Things (IoT), insurance companies are able to significantly improve their detection capabilities.

According to ABI’s latest detected general insurance fraud figures, fraud detection rates are steadily increasing year after year. For instance, while the total number of motor insurance claims has decreased since the pandemic outbreak, auto fraud detection rates increased by 0.55% to 2.05%.

Apparently, with the newest fraud detection technologies, insurers can do a better job of protecting not only their budgets but also their customers.

How AI & Predictive Analytics Have Improved Insurance Fraud Detection

100% of insurers surveyed by Friss have mechanisms helping them to identify potentially fraudulent claims. However, the report shows that only 62% have implemented fraud detection technology solutions, with as few as 42% relying on predictive models and AI.

Yet the SaS State Of Insurance Technology Study reveals very different statistics. According to the study results, as many as 88% of surveyed insurers have automated fraud detection, with 80% of insurers having already incorporated predictive modeling in their strategies.

Nevertheless, the full capabilities of predictive analytics are yet to be explored by carriers. But it’s already prominent that the method is shaping the future of the insurance industry. Here’s how.

What is Predictive Analytics in Insurance Fraud Detection?

Predictive analytics is the use of historical data, machine learning algorithms, and statistical modeling to foresee future events.

Predictive analytics in insurance fraud detection is the use of data and statistical techniques to automatically identify fraud patterns and reveal potentially fraudulent claims.

To make use of predictive analytics, insurers need to apply advanced AI-powered technologies. Predictive analytics tools collect data from different sources, including customer portals, self-service apps, customer relationship management (CRM) systems, telematics, smart homes, etc. and process it to deliver accurate predictive insights.

Fraud detection is only one use case of predictive modeling in insurance. It’s also widely used in the processes like insurance pricing, underwriting, risk assessment, claims management, etc.

6 Benefits of Insurance Fraud Analytics

Proactive insurance fraud detection powered by big data carries a lot of benefits for insurers and their customers. Below are the most significant ones.

1. Faster fraud detection

AI technology not only automates the fraud detection process but also identifies fraud patterns allowing early flagging and prompt response to any potential incidents.

As the number of clients increases, claims adjusters are put under higher pressure and should either sacrifice the accuracy or the speed of the claims process. On the contrary, the more data machine learning algorithms receive, the faster they provide accurate results.

2. More accurate fraud detection

Next, predictive analytics delivers way more accurate results than a human agent can do. As a result of processing big data, digital tools have more information to make decisions with never before seen accuracy.

3. Proactive fraud detection

A purely reactive approach (response) is a thing of the past. Big data brings in more opportunities to conduct proactive fraud detection initiatives.

The technology identified the root causes of fraudulent activities and uses the data to foresee fraud and combat it proactively.

4. Fewer human interventions

By maximizing the use of technology and data analytics, insurers reduce the number of manual interventions in the claims management process. This reduces turnaround times and frees up insurance agents allowing them to focus on more valuable, high-impact tasks.

5. Cost savings

With more accurate fraud detection and reduced false positives made possible by AI technologies, insurers can decrease financial loss significantly. Also, by automating repetitive processes like fraud detection, you won’t need to increase your headcount as you scale up – which otherwise would have come with extra costs.

6. Improved customer experience

All things considered, automated insurance fraud detection powered by AI and big data allows insurers to reduce costs and offer more competitive insurance plans to customers.

3 Best Insurance Claims Fraud Detection Software

To combat insurance fraud effectively, you can’t solely rely on your experience and traditional methods. You need the right technology. We offer you to choose one of the three tools below.

1. FRISS Fraud Detection

FRISS Fraud Detection is a part of the FRISS ultimate toolkit for fraud, risk, and compliance for insurers.

The FRISS Hybrid Detection Model combines AI, instant-on standardized fraud

indicators, analytical and predictive models, external data sources, and more technologies to screen each claim and identify signs of potentially fraudulent activities. The solution can be seamlessly integrated with any core insurance system with minimal effort from the IT department.

What’s most important, this AI-powered fraud detection software detects suspicious claims in real-time enabling insurers to catch fraud before claims are paid.

2. SAS Detection and Investigation for Insurance

Similar to FRISS, the platform focuses on detecting, preventing, and managing claims fraud specifically for insurance companies.

SAS Detection and Investigation for Insurance identifies suspicious activities, uncovers hidden relationships, and detects fraud patterns by using multiple techniques such as automated business rules, AI and machine learning methods, text mining, anomaly detection, etc. The software is capable of scoring millions of claims records in real-time or in batch automatically.

The key features of the platform include:

- Data management

- Automatic claim scoring

- Data visualization

- Advanced analytics with embedded AI

- Rule and analytic model management

- Fraud detection and alert generation

- Alert management

- Social network analysis

- Case handling

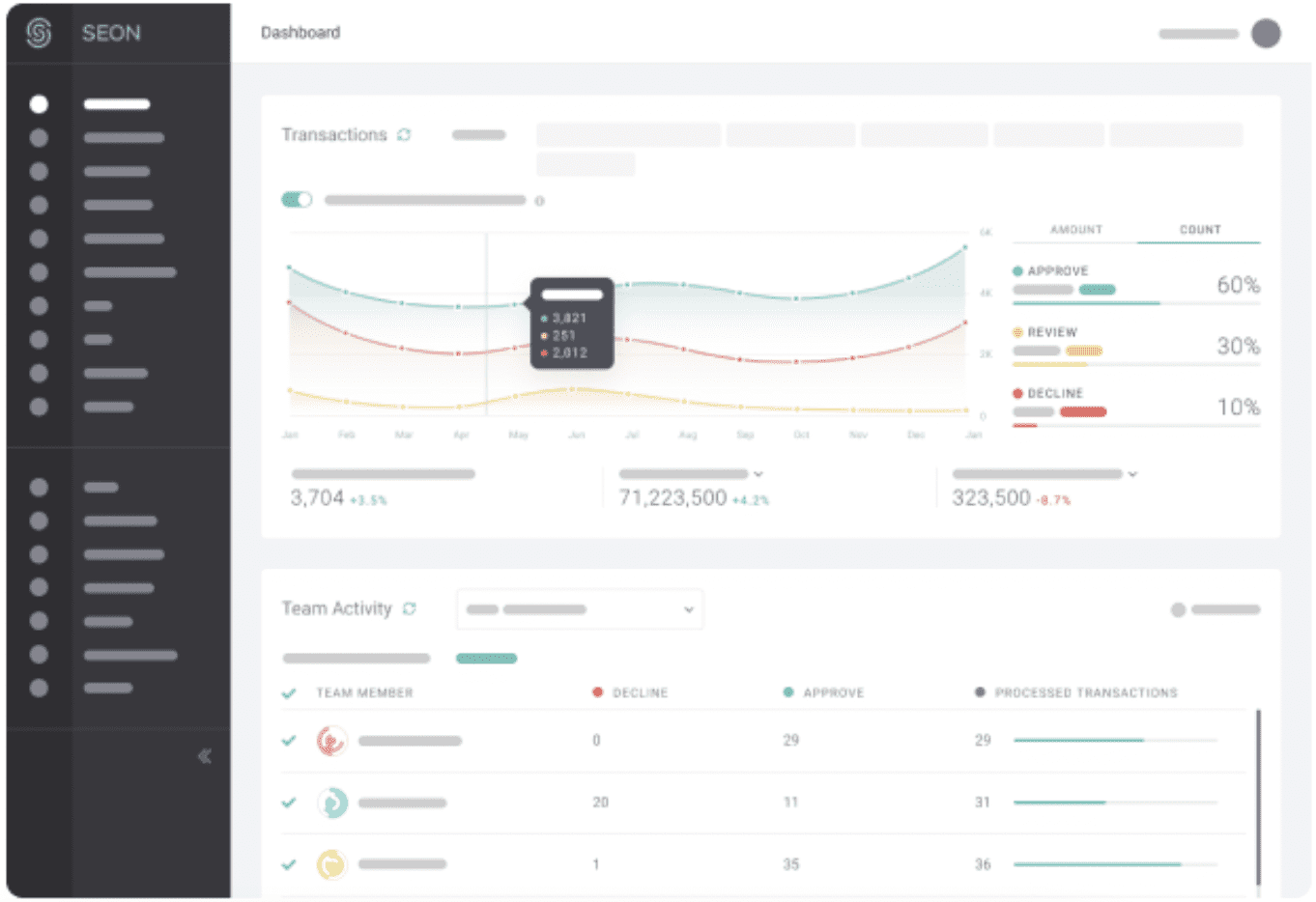

3. SEON

SEON is an anti-fraud system for online businesses. It’s not tied specifically to the insurance industry, but it offers all the necessary tools to empower insurers to promptly detect fraud threats. If you offer digital insurance services, you should definitely consider adding SEON to your toolkit.

The platform automatically handles the following tasks:

- Tailored industry rule deployment

- Social media lookups

- Precise risk scoring

- Behavior analytics

SEON uses machine learning algorithms to quickly learn fraud patterns and improve the accuracy of fraud investigations.

Insurance Fraud Detection

FAQs

What are the different types of insurance fraud?

- Hard fraud is the act of deliberately faking the injury or damage to get money from an insurance company.

- Soft fraud involves exaggerating the damage caused by a real accident to get more money out of the claim.

- Auto insurance fraud: false repair claim, staged accident, intentional damage claim, auto shop scam, falsifying the date or details of an accident, etc.

- Disability and healthcare fraud: billing for services not provided, faking documents to bill for a more expensive service than what was actually provided, faking documents to get and billing for unnecessary services, double billing, fake disability claim, submission of forged documents to continue a disability claim, etc.

- Benefit fraud: working while receiving unemployment benefits, forging receipts, faking injury, sharing benefits with others, etc.

- Property insurance fraud: false or inflated property damage, false or inflated burglary or theft report, arson, intentional damage claim, etc.

What is Insurance Fraud Detection?

Insurance fraud detection is a set of practices implemented by insurers to identify and prevent fraud from policyholders or third parties.

What is Predictive Analytics in Insurance Fraud Detection?

Predictive analytics is the use of historical data, machine learning algorithms, and statistical modeling to foresee future events.

Digital insurance applications power providers to detect fraudulent claims – but only if their agents properly utilize their claims technology. With Whatfix, providers can create in-app guidance for their new digital insurance applications that helps provide contextual learning, reinforcement training, and on-demand support for their agents and employees.

Learn more about Whatfix for digital insurance applications now!

Request a demo to see how Whatfix empowers organizations to improve end-user adoption and provide on-demand customer support

Thank you for subscribing!