Disha Gupta

Insurance agent training is an indispensable aspect of the insurance industry, acting as the cornerstone for equipping agents with the necessary knowledge, skills, and competencies to navigate the complex landscape of insurance policies, regulations, and customer service. In an era where customer expectations are constantly evolving, and the regulatory environment is becoming ever more stringent, effective training has never been more crucial.

This article delves into the multifaceted world of insurance agent training, exploring the latest trends, techniques, and technologies that are shaping the future of this field. From traditional classroom learning to innovative digital platforms, we examine how training programs are being transformed to meet the demands of the modern insurance sector, ensuring that agents are well-prepared to provide exceptional service and advice to their clients.

Because insurance agents require extensive training in very specific subject areas, there are a variety of challenges commonly associated with training them:

Because regulations and compliance requirements vary across not only the different types of insurance but from state to state as well, developing effective L&D programs can be extremely difficult.

For organizations that operate in several states, training and development programs need to match up with the various compliance requirements and be easily adapted to the latest regulations. This challenge is important for insurance companies to address in order to ensure that agents steer clear of legal issues and uphold the highest ethical standards in their work.

In many industries, role-playing is an effective method for training employees. Because each insurance agent on your team may sell different types of insurance and deal with specific sets of customer needs, designing role-playing activities can be extra difficult.

In addition to keeping up with the latest products and regulations, insurance agents need to use your organization’s insurance agency management systems to make sales and maintain relationships with clients. Adapting to new technologies can be challenging for all employees, especially for those accustomed to hard copies and physical filing systems.

When conflicts with policyholders arise, insurance agents must be able to tap into their product knowledge and communication skills. In cases of coverage disputes or claim denials, policyholders might struggle to comprehend their plans or have emotional responses to decisions. Insurance agents need to be adept at managing expectations and communicating clearly and calmly to maintain positive relationships with clients.

When policyholders file claims as a result of a disaster or personal injury, emotions are inevitably running high. Empathy is especially important when handling these types of situations. Workplace training that emphasizes the importance of empathy and emotional intelligence ensures that agents are equipped to handle these situations with care and consideration.

Though these insurance challenges are ubiquitous across the industry, learning and development teams can develop programs that empower agents to overcome them.

As insurance agents increasingly rely on digital solutions to manage their sales process and communications, adoption platforms can be integrated into the software they use to guide them through different tasks. In-app guidance provides users with interactive, context-based support as they navigate through a given process. This can come in the form of walkthroughs or checklists to facilitate the path to proficiency.

As insurance agents go through training and begin to sell policies and interact with policyholders, they should receive prompt feedback that helps them correct and adjust in real time. Particularly effective mechanisms include training assessments, regular performance reviews, and verbal feedback from supervisors.

Much of what separates great insurance agents from the rest is their mastery of soft skills. These are non-technical skills like emotional intelligence, active listening, and self-regulation that play a huge role in interpersonal communication and relationship building.

Prioritizing soft skills in insurance agent training empowers agents to establish trust and communicate effectively with policyholders, making more sales and building strong client relationships in the long run.

Incorporate a philosophy of continuous learning into your organization’s L&D program to ensure that agents are keeping up with insurance industry trends and updated regulations. Provide opportunities for learning on an ongoing basis to build a high-quality workforce and demonstrate the company’s commitment to the growth and success of its agents.

Keep agents engaged by incorporating a variety of approaches and methods into L&D programs. This will ensure that the needs of agents with different learning styles are met and that the information can be observed on multiple levels.

At the end of the day, it is most helpful to build on initiatives that are most impactful and pull back on ones that aren’t. Incorporate data analytics software into training programs to make the most educated training decisions to improve learning outcomes and maximize return on investment.

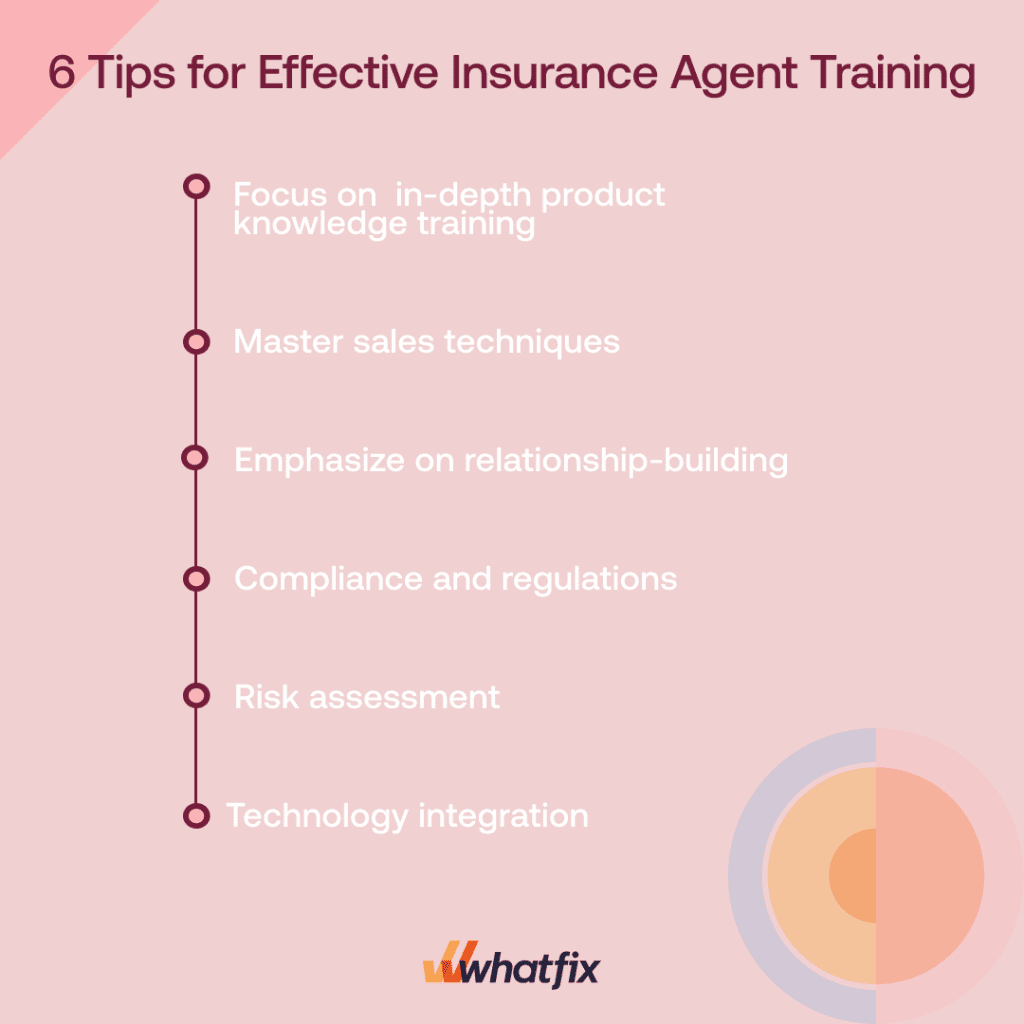

Here are some tips your insurance company’s L&D teams can use to make training programs more effective:

First things first, insurance agents need to be intimately familiar with the different policies they offer. The bulk of training should focus on learning the ins and outs of insurance policies, compliance requirements, and state-mandated regulations. This information will form the foundation from which agents work and grow.

First things first, insurance agents need to be intimately familiar with the different policies they offer. The bulk of training should focus on learning the ins and outs of insurance policies, compliance requirements, and state-mandated regulations. This information will form the foundation from which agents work and grow.

Customer relationship management is an essential component of an insurance agent’s responsibilities. Provide your organization’s agents with the tools, knowledge, and skills they need to build strong relationships with clients. Trust, credibility, and positive attitudes are critical for ensuring that policyholders feel confident in their agents and their coverage.

The insurance industry is structured around laws and regulations that vary across states and insurance types. Insurance agent training programs should include developing a thorough understanding of the compliance requirements and regulations that apply to each individual agent.

Training programs for insurance agents should equip them with a solid foundation that helps them understand fundamental concepts related to risk concepts, underwriting principles, and legal and regulatory compliance. Over the course of training, they should come to understand these subjects from both theoretical and practical angles to ensure that they can effectively evaluate potentially risky situations in their day-to-day work.

The world of corporate training has moved well beyond strict adherence to traditional classroom-based learning, and the insurance industry is no exception. In order to maximize the effectiveness of training programs, leverage technology for training that meets the needs of agents and keeps them engaged as they become highly effective in their roles. This might mean incorporating eLearning platforms or VR into training programs or utilizing digital adoption platforms to enhance training on the software they will be expected to use in their jobs.

DAPs significantly enhance insurance agent training by providing an interactive and personalized learning experience. DAPs offer real-time, in-app guidance, simplifying the learning process. Interactive features such as step-by-step walkthroughs, contextual tips, and on-demand help resources address individual learning needs, fostering faster proficiency. Moreover, these platforms can track learning progress and identify areas where agents may need additional training, allowing for a more targeted and efficient training approach. This modern method of training not only accelerates the learning curve but also ensures that agents are well-equipped to provide high-quality service in a rapidly evolving industry.

Above: In-app employee guidance created with the Whatfix Digital Adoption Platform

Whatfix’s DAP empowers organizations with a no-code editor to create in-app guided flows, onboarding tasklists, pop-ups, tooltips, alerts, reminders, self-help wikis, and more to enable employees to use software better. Enable your employees to become proficient in new applications faster, create interactive process documentation, guide users through process changes, assist employees through infrequent tasks, and provide self-help performance support on your CRM, ERP, HCM, or any desktop, web, or mobile application.

Whatfix is a digital adoption platform that empowers insurance to leverage their digital tools through:

Whatfix enhances technology adoption by providing interactive, in-app guided experiences. Flows and task lists offer step-by-step guidance, leading agents through complex processes within their software environment. This hands-on approach helps agents understand and utilize their digital tools effectively, reducing the learning curve and increasing proficiency in using critical software.

Whatfix’s self-help feature provides agents with immediate, context-specific assistance within their applications. This means that agents can access help resources, FAQs, and troubleshooting guides in real-time, without needing to exit their workflow.

Smart Tips are contextual hints or reminders that appear within the application, guiding agents through specific tasks or drawing attention to important features. These in-app nudges help reinforce training, ensure that best practices are followed, and reduce errors, leading to more efficient and effective use of digital tools.

Whatfix uses Pop-Ups and Beacons to alert agents to new features, announcements, or changes in processes. This is crucial in the dynamic insurance sector, where keeping up with regulatory changes and internal updates is essential.

Field validation ensures that data entered by agents is accurate and conforms to required formats, reducing the likelihood of errors and improving overall data quality.

Behavior analytics tracks how agents interact with their applications, providing insights into usage patterns, training needs, and adoption challenges. It enables insurance companies to tailor their training programs and user support strategies more effectively, ensuring that agents are fully equipped to leverage their digital tools.

Thank you for subscribing!