Andrew Dennis

The insurance industry is a highly regulated sector that protects businesses and individual policyholders from liabilities to their assets, homes, and health. This unique positioning, combined with the digital transformation of insurance, creates various challenges for the industry.

In this article, we’ll discuss seven of the most critical challenges facing the insurance industry today and present solutions for P&C insurance providers to overcome these barriers to succeed in today’s digital world.

Here are a few of the most critical digital challenges that face insurance providers:

Like many sectors, the insurance industry has faced challenges adapting and adopting rapid technological advancements. This digital transformation has changed how insurance providers model their businesses, provide services to customers, and operate internally.

While the benefits of new technology and digital advancements present massive opportunities and growth for providers, the legacy application modernization process creates challenges such as guiding policyholders and employees through the transformation, developing new digital business processes and applications, retiring legacy applications, rethinking traditional business models, upskilling and supporting technology end-users, and more.

A few examples of new technology and enterprise software insurance providers must integrate into their infrastructure and workflows include:

Insurance policies and premiums are determined by risk and underwriting. These complex and dynamic factors require careful analysis and innovative solutions when issues arise. From cybersecurity threats, adopting new automated underwriting processes, data quality issues, ever-evolving regulations, and underwriter end-user errors, insurance organizations must remain agile to ensure the accuracy and quality of assessments.

As technology, risks, and economies change, insurance agents and other employees require digital upskilling, guidance, and support from insurance providers to acquire new digital skill sets and reinforcement learning to succeed.

This necessitates that organizations adopt philosophies of continuous learning, providing employees with frequent opportunities for upskilling and workplace training. This requires learning and development teams to invest in instructional design professionals, create contextual training content resources, and organize, manage, track, and analyze this repository of learning content, company knowledge, and training resources.

Processing claims and detecting fraud involves complex verification mechanisms that can pose challenges as fraudulent tactics evolve, when technology and resources are inadequate, and when processes aren’t standardized. The capacity to detect and prevent fraud is necessary to maintain the integrity of the company and the insurance industry. This is another area where digital transformation, advanced analytics, and even artificial intelligence are beneficial.

Evolving customer expectations require insurance providers to adapt to meet new demands and improve policyholder experiences. Today’s consumers expect efficient digital interactions, personalized coverage, data privacy, and a higher level of corporate social responsibility than ever before. Insurance companies must prioritize these expectations as they create products and build relationships with policyholders.

The quality of an insurance company’s workforce impacts its capacity to grow, adapt to changing markets, and provide exemplary customer service. Post-COVID has presented all organizations with talent shortages, and the insurance industry is no exception.

This is further strained by the fact that 400,000+ insurance employees are expected to retire in the next two years, and that 44% of millennials are not interested in a career in the insurance industry.

Additional concerns in this area include succession planning, bridging skill gaps, building a diverse workforce, and appealing to the younger generations as they enter the workforce.

When it comes to natural disasters and other large-scale accidents, insurance companies are inundated with a surge of claims, which can overwhelm processing systems and personnel. As climate change and political unrest grows, insurance providers must address catastrophe claims management head on.

Employees need adequate resources and technology to respond quickly while ensuring compliance, providing stellar customer service, and guarding against fraud. Organizations need backup plans for when they require additional agent support.

As insurance companies have went digital, so too have the challenges these providers face – with almost all problems revolving around complex technologies and end-user challenges.

A digital adoption platform (DAP) like Whatfix empowers organizations to analyze and create better technology experiences that enable end-users with contextual in-app guidance and real-time end-user support that overlays your technology experiences for both internal employees and external policyholders.

Let’s take a closer look at digital adoption in the insurance sector.

With Whatfix, shorten time-to-proficiency for your application users, helping you to achieve technology ROI faster and achieve your digital transformation goals.

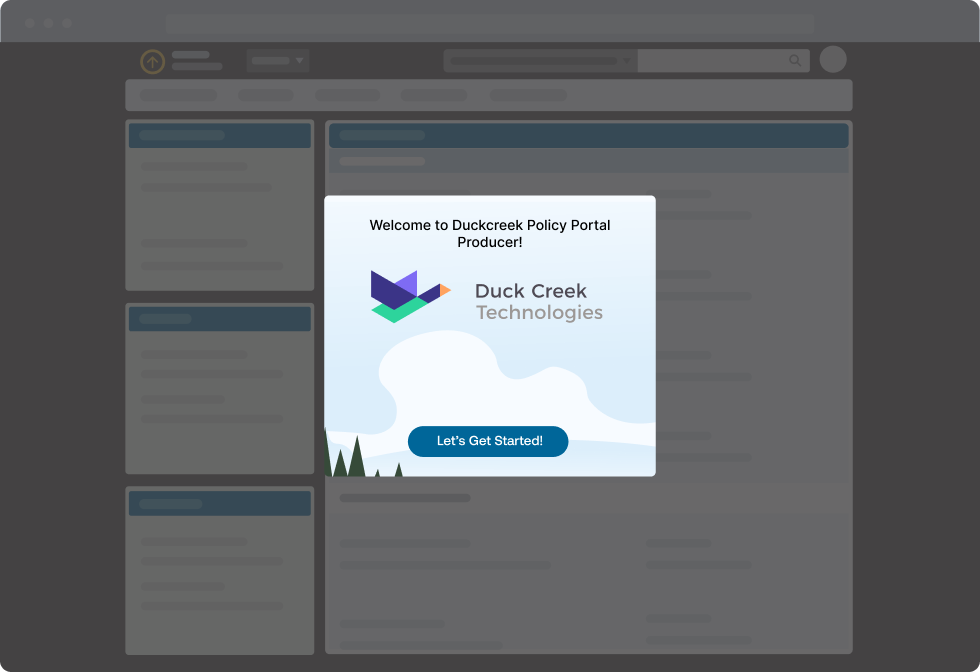

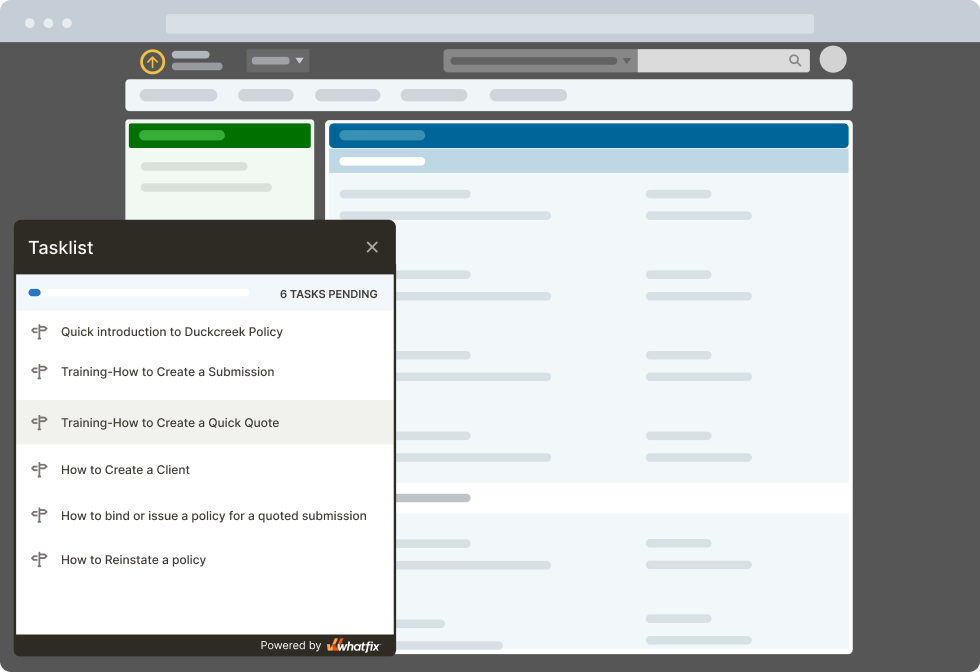

Enable your end-users, both internal employees and external policyholders, to quickly adopt new technologies with contextual end-user onboarding built for specific roles with Whatfix’s in-app guidance and real-time support. Insurance providers can create in-app Task Lists and Tours to quicky onboard new and exisiting employees to software.

Create in-app Tours that guide end-users through new technology platforms and help them familize themselves with its UI, core features, and more.

Use in-app Task Lists to guide new users through account setup and assist them in quickly finding value in your digital insurance investments.

With Whatfix, insurance agents can build contextual experiences depending on end-user roles. For example, create contextual user flows and experiences for your claims agents and underwriters, or for agents in different geographical regions.

Colleen Behnke, Learning and Performance Specialist, Sentry Insurance

Technology can only maximize your operational efficiency and innovate your business if your end-users can adopt it. Without adoption, end-users struggle to use applications, utilize workflows improperly, enter dirty data, and more.

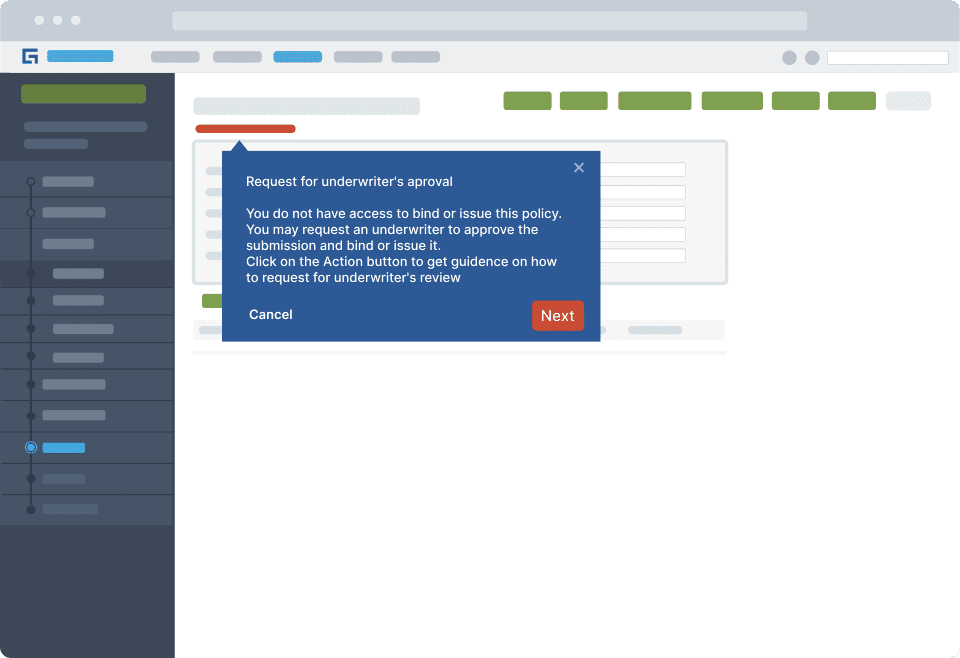

With Whatfix, insurance providers can provide real-time guidance with in-app elements like Flows, Smart Tips, and Field Validations.

With Flows, end-users are guided through complex digital processes with step-by-step walkthroughs. Each step handholds users through various stages of a workflow, helping to achieve process governance and workflow efficiency.

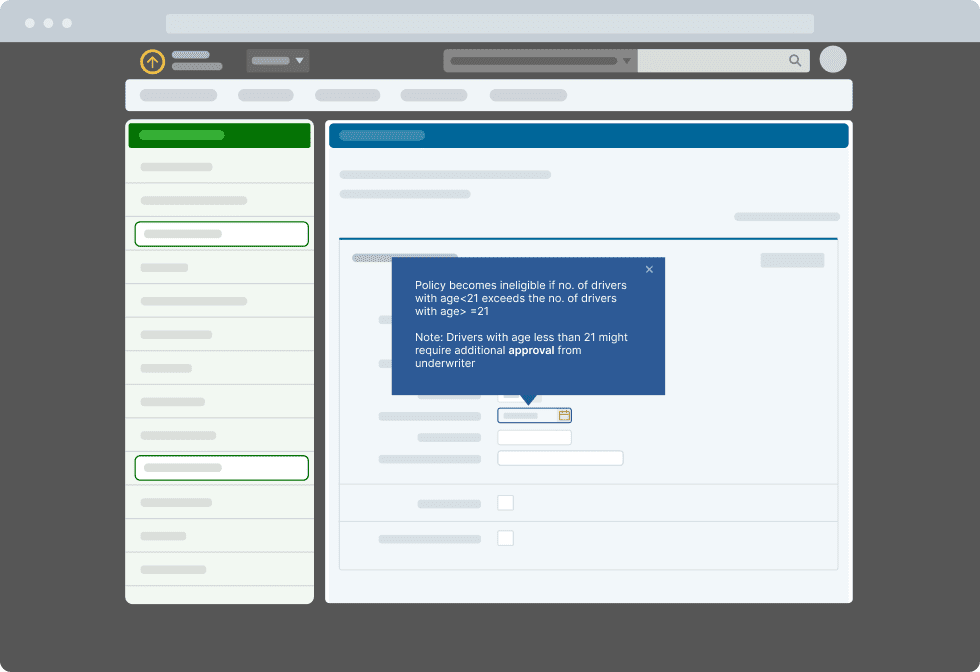

Smart Tips provide additional content and information to end-users, at the moment of need, nudging them to take specific actions.

Field Validation ensure your end-users are entering data correctly, in the right format, helping to keep your insurance data clean and complete.

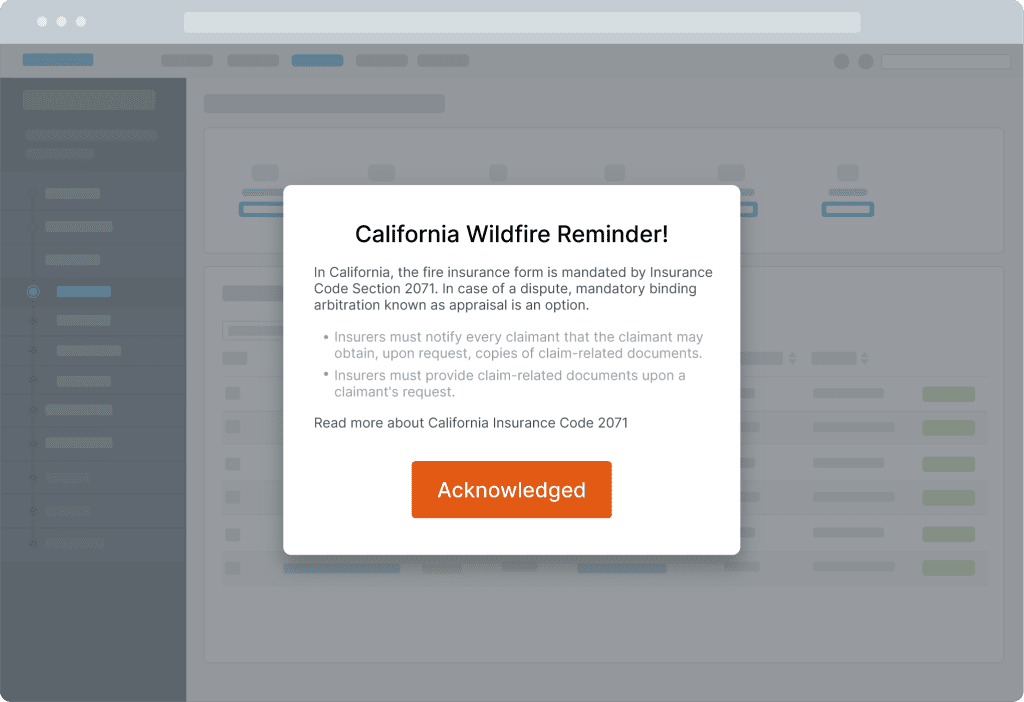

This Fortune 500 insurance provider enabled their claims agents with in-app Smart Tips overlaying their Guidewire claims process. This enabled claims agents with state-specific guidelines for rare events such as natural disasters in the flow of work, reducing claims times, enabling claims agents in the moment of need, eliminating data entry errors, and providing faster claims service to policyholders at times of disaster.

Post-implementation of new digital technologies, insurance providers are faced with the burden of internal employee and external policyholder IT support for their help desk team. This quickly becomes an issue for organizations, as traditional help desk methods are not scalable and don’t provide the level of real-time support needed in the digital age.

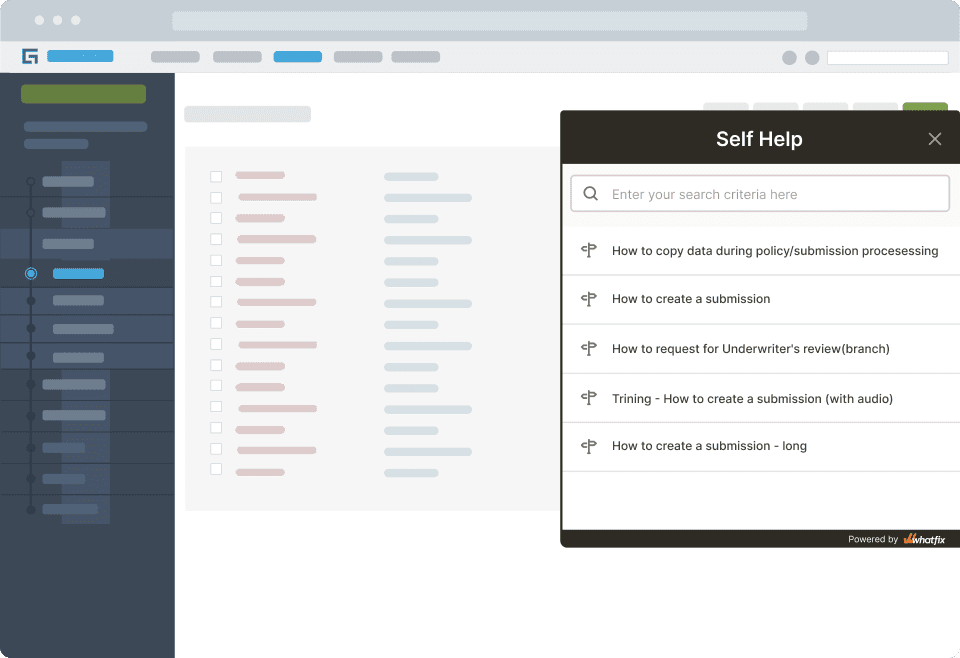

With Self Help from Whatfix, organizations can embed a resource center into their digital application’s UI. Self Help automatically crawls and aggregates your end-user training, onboarding, and support resources such as SOPs, FAQs, knowledge base articles, user guides, third-party resources, videos, and more into a searchable wiki. This knowledge center auto-populates with recommended performance support and help depending on where your end-users are in an application, as well as what their end-user role is.

Post-training and onboarding, knowledge will be lost. This requires insurance providers to provide reinforcement learning for their employees to maximize their productivity, as well as performance support in the flow of work that guides end-users through complex workflows and digital processes.

With Whatfix, enable your employees with the performance support and reinforcement training they need, directly in their workflows, supporting process compliance and governance. This deflects internal IT support requests, creates self-sufficient technology end-users that learn by doing, and improves overall technology adoption.

With user behavior analytics, insurance organizations can analyze their technology experiences and make data-driven decisions to improve end-user experience and drive adoption.

With Whatfix, insurance providers can track any custom end-user event, allowing them to:

With Whatfix’s digital adoption platform and analytics suite, analyze, build, and deliver better end-user experiences to accelerate technology adoption and enable end-users to maximize software usage. Whatfix’s no-code system enables IT teams to analyze and measure digital adoption and product usage, create in-app guidance, and provide self-help user support.

Whatfix’s DAP enables insurance companies to achieve digital transformation and streamline the adoption of software and technology by enabling end-users with contextual, guided experiences, including:

Software clicks better with Whatfix's digital adoption platform

Enable your employees with in-app guidance, self-help support, process changes alerts, pop-ups for department announcements, and field validations to improve data accuracy.

Thank you for subscribing!