Insurance Analytics (Benefits and Examples) in 2024

- December 15, 2022

- Updated: April 2, 2024

In the insurance industry, the more data you have, the more money you save. Historical data does not only help you with claims processing and fraud detection, it also allows you to anticipate financial risks and optimize pricing.

With predictive analytics, you can turn data into your biggest profit driver. It’s also the only way for today’s insurance companies to stay competitive in the market and overcome common insurance challenges. With more than two-thirds of insurers planning to invest more heavily in data collection and analytics in the upcoming years, advanced analytics and artificial intelligence (AI) will have a significant impact across the insurance industry.

Whether you represent an enterprise or a small insurance company, you need to find a way to integrate automated predictive analytics into your day-to-day operations. And here’s everything you need to know to get started.

What Is Insurance Analytics?

Insurance analytics refers to using predictive analytics to predict future trends, manage risks, and enhance product offerings in the insurance sector.

It involves the collection, examination, and interpretation of vast amounts of data to find actionable insights that inform strategic decisions. Insurance analytics requires advanced statistical software and big data technologies to identify patterns, assess risks, optimize operations, and detect fraud.

Predictive Analytics in the Insurance Industry

Predictive analytics in insurance involves the collection and analysis of large data sets to reveal repeating patterns in the past and predict the likelihood of damage, fraud, risk of policy cancellation, and other events.

The practice of using predictive analytics in insurance is not new. In fact, insurance companies have been relying on it for ages. The difference is data analysts don’t have to do it manually anymore.

Advanced data analysis is made possible with AI-powered technologies, which automate as much manual effort as possible. However, you still need a data scientist to give directions to the system and test and refine its decisions.

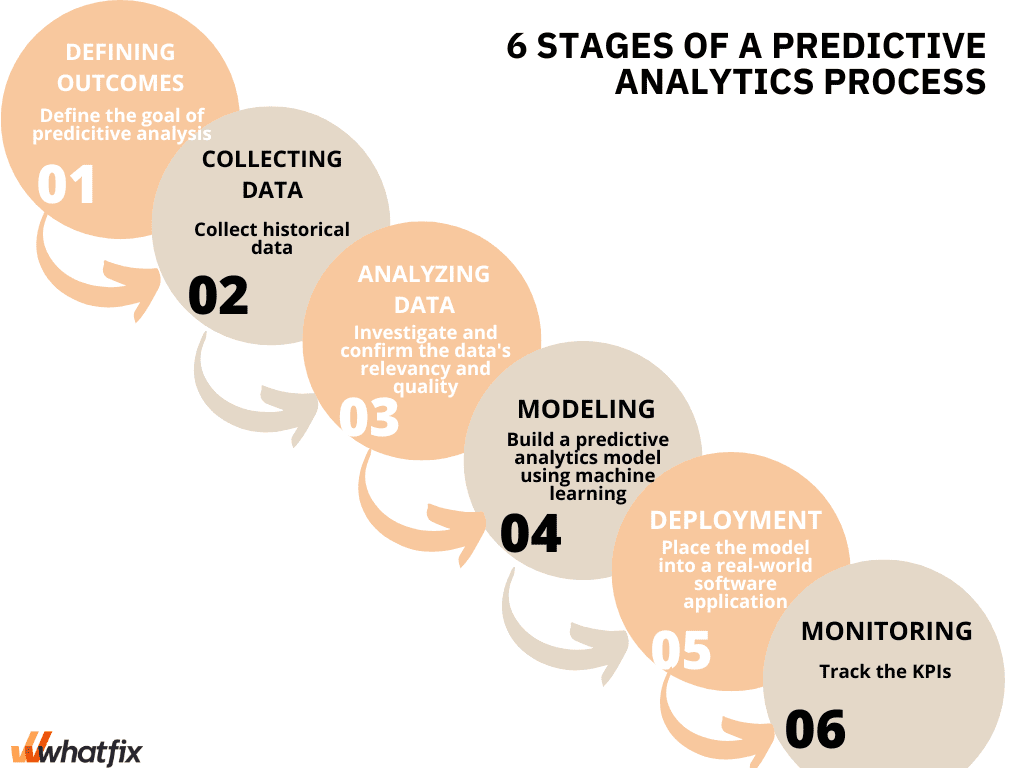

Stages Of a Predictive Analytics Process

To make accurate, data-driven predictions, a data analyst will go through six major stages of the predictive analysis process.

1. Defining outcomes

What do you hope to achieve with the analysis? You need to define a clear objective before you start data collection. The goal can be anything from eliminating fraudulent claims to optimizing pricing plans.

Next, define KPIs to measure the success of your initiative. This way, you’ll be able to evaluate the outcomes and see whether your predictive model needs improvement.

At this stage, you should also define the data sets that should be analyzed to achieve the desired objective.

2. Collecting data

It’s essential to collect large volumes of historical data to achieve accurate results from predictive analytics. Most likely, you’ll need to gather information from multiple sources, so there needs to be a data lake, i.e., a centralized repository for all your structured and unstructured data.

Of course, you don’t have to extract data manually. Your insurance technology (InsurTech) should be capable of collecting data from different sources, such as mobile applications, telematics, smart home, customer interactions, social media, etc.

3. Analyzing data

You can’t just throw the data in your data analysis system. You need to investigate and confirm the data’s relevancy and quality before you feed the information into your predictive analytics model.

Check the data format, remove duplicate data points, analyze data types presented in the dataset, and figure out how data from different sources correlates. It’s a time-consuming process, but quality insurance technology should simplify it by presenting raw data in a digestible format.

4. Modeling

When you have all the necessary data, you can build a predictive analytics model using machine learning. You must establish the hypothesis first and then choose the machine learning model.

It’s important that you distinguish between two types of machine learning:

- Supervised machine learning. This model is programmed to apply what has been learned in the past to new data for predicting future events with increasing accuracy. It requires upfront human intervention.

- Unsupervised machine learning. This type of algorithm is capable of identifying patterns without human supervision.

Both models have pros and cons. You can choose the appropriate model based on your goals.

5. Deployment

After the model has been built and tested, you can start deployment by placing it into a real-world software application. For example, you may integrate your new fraud prediction model into the claims management flow or use a predictive underwriting model to customize policy plans.

6. Monitoring

Does your predictive analytics model meet the performance and accuracy requirements when deployed? Track the KPIs you’ve set earlier to answer this question.

Even if you’re happy with the first results, the conditions may change anytime. You need to continue monitoring the outcomes delivered by the model in order to spot the moment it’s no more relevant.

Benefits of Insurance Analytics

Building predictive analytics models for every case takes effort, but it pays off soon. Here’s how.

1. Customer relationship management

For 67% of insurers, improved customer relationships are one of the main reasons to invest in predictive analytics.

By deciphering customer behavior patterns, AI-powered data insights help you identify customers that aren’t happy with their coverage and are moving toward churn. With these insights, you can focus on nurturing unhappy policyholders and creating better customer experiences.

2. Technology innovation

Sixty percent of insurers say that technology innovation is a very important factor behind implementing predictive analytics.

Indeed, advanced data analytics helps minimize waste and increase the effective utilization of resources by creating new combinations of existing technologies.

3. Enhance revenue growth over competitors

Competition is a powerful motivator for most companies. Insurers turn to predictive analytics to stay one step ahead of their competitors and enhance revenue growth by winning the market.

With predictive analytics, you can offer reasonable insurance plans, speed up claims processing, and offer more personalized customer experiences. All these create a competitive advantage that attracts new clients and retains existing ones.

4. Cost savings

Sixty-seven percent of life insurers report a reduction in expenses after implementing predictive analytics.

Using predictive data reduces time spent on underwriting and eliminates repetitive tasks, which translates into lower headcount-related expenses. Moreover, predictive analytics improves fraud detection rates and minimizes fraud-related losses.

5. Personalized customer experience

Customers always want personalized service. By anticipating customers’ needs and behaviors, you can design personalized customer interactions and build long-lasting relationships. For instance, you can use predictive analytics to offer customized insurance plans based on customers’ claims history.

6. Identify potential markets

Expanding in new and existing markets is made easier with predictive data analytics. You can use predictive data to reveal your audience’s behavior patterns and common characteristics to identify potential markets ahead of your competition and increase reach.

7. Automate workflows and make data-driven decisions

Insurance agents deal with tons of manual, repetitive tasks every day. With the help of AI, they can get data that not only helps them make better decisions but also informs which processes can be automated.

For example, AI-based engines can detect fraud automatically and reduce the workload for underwriters, allowing them to focus on making informed decisions. Today it’s essential that AI integrations are part of your insurance agent training programs.

6 Examples of Insurance Analytics Use Cases

These are six ways you can (and should) apply predictive analytics in insurance.

1. Pricing and policy optimization

These days, customers choose insurers that can provide policy plans tailored to their needs and preferences.

Instead of trying to make people fit in your fixed coverage plans based on their age or other factors used in traditional pricing models, you can use predictive analytics to create flexible policies that adjust based on customer preferences, claims history, and behavioral signals.

Assessing the odds of a policyholder being involved in a car accident to determine the policy price is one of the most common examples of using predictive data for policy optimization. The use of machine learning-enhanced AI pricing allows insurers to offer safer drivers, lower premiums and deliver better customer experiences. It also motivates drivers to drive safely to improve the conditions of their policies.

Along with customer behavior data, predictive analytics accommodates external factors, such as market conditions and associated risks.

2. Fraud detection

Identifying and preventing fraud is the top challenge for every insurance company. With predictive analytics, you can identify potential fraud by using historical data from the claimant’s activities.

AI-powered systems can identify fraud before it happens by spotting red flags in the claimant’s online activities and mismatches between the claimant’s behavior and third parties involved in the claim (e.g., hospitals, repair shops, etc.).

Furthermore, insurance agencies can also use big data analytics to fight internal fraud and application manipulation.

3. Insurance claims management

Identifying and preventing fraud is the top challenge for every insurance company. With predictive analytics, you can identify potential fraud by using historical data from the claimant’s activities.

AI-powered systems can identify fraud before it happens by spotting red flags in the claimant’s online activities and mismatches between the claimant’s behavior and third parties involved in the claim (e.g., hospitals, repair shops, etc.).

Furthermore, insurance agencies can also use big data analytics to fight internal fraud and application manipulation.

4. Dynamic customer engagement

Empowered by AI, insurance companies can gain a better understanding of their customers’ changing behaviors and needs. They can design dynamic customer journeys that adjust based on advanced customer analytics.

Some examples of creating dynamic customer engagement with predictive analytics are:

- Implementing AI-powered insurance chatbots

- Using ‘predictive routing’ to identify the best agent for a specific customer

- Tailoring communication strategy based on the customer data (e.g., sending personalized offers to retain at-risk customers)

5. Predicting customer risk

Insurers use AI-based predictive analytics solutions to segment customers by risk profile. For example, health insurers turn to predictive data to assess risks of mortality and morbidity for each customer and optimize their policies accordingly.

6. Improving underwriting processes

Using data models based on predictive analytics speeds up the underwriting process and allows insurers to make more accurate predictions about risks involved in insuring people or assets.

Moreover, predictive data helps underwriters to perform tasks faster. A majority of respondents say, the use of technology has increased their speed to quote, improved their ability to handle larger amounts of business, and given them access to more knowledge.

Predictive analytics isn’t a new method, especially in the insurance industry. It’s most likely that you applied it across various aspects of your business a long time ago. But with the rise of AI and machine learning, you need to re-think your approach to predictive analytics and implement new technology solutions in your tech stack.

Drive digital adoption of your insurance applications with Whatfix in-app guidance contextual support. Click here to learn more!

Thank you for subscribing!