9 Best Loan Servicing Software in 2024

- Published:

- Updated: May 22, 2024

The average borrowers today are much different than they were ten years ago.

They’re more tech-savvy, use multiple devices, and have more lending options than ever before—some of which are unique financial technology products that we’ve never seen before.

In 2020, millennials accounted for 53% of home-purchase mortgages. Today, it’s common to complete a loan application or manage mortgage payments on the go, virtually anywhere. This increased demand has prompted many lenders to take action.

Loan software streamlines the lending process, enabling financial institutions to implement and scale personalized digital products at every step of the loan lifecycle.

In this article, we explore the benefits of self-service loan software and nine loan platforms changing how borrowers manage their loans.

9 Best Loan Software Providers in 2024

What Is Loan Software?

Lenders use loan software to centralize information, tasks, and financial services throughout the loan lifecycle. These capabilities are often related to loan origination, refinancing, servicing, debt collection, customer management, and credit scoring.

Financial institutions use loan software to gain more visibility into client data and process it faster. With a cloud-based solution, loan officers can use automated workflows, calculations, and decision-making to collect documents, pull up pricing options, manage compliance, and engage with borrowers every step of the way.

9 Best Loan Software Providers in 2024

Here are nine loan software providers that loan officers and borrowers find most helpful.

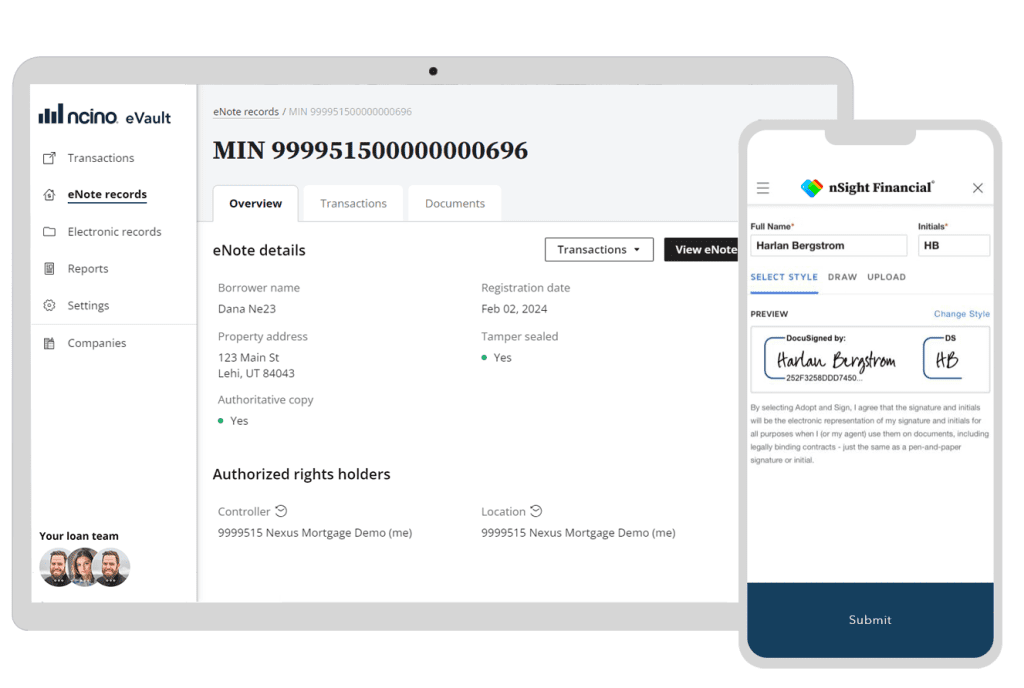

1. nCino's Mortgage Suite

- G2 Rating: 5 out of 5 stars

- Pricing: N/A

nCino is known for covering every stage of mortgage transactions. They offer digital solutions that loan officers can use to engage with referral partners, enhance the point of sale experience, and shorten the closing process.

You can use over 80 third-party integrations to introduce new functionalities into your digital experience without upending existing workflows. Financial institutions enjoy using nCino’s Mortage Suite because of how easy it is to sync processing and underwriting activities with loan origination software (LOS).

The platform serves established businesses like the Texas Tech Credit Union (TTCU), serving over 25,000 members. In a case study, a TTCU applications manager tells nCino’s Mortage Suite that 90% of mortgage channels come through channels other than their physical branches. They wanted a digital tool to centralize every step of the loan process to save time and reduce paperwork for staff and customers.

Key features:

- Loan applications

- Mortgage calculators

- Customizable branding

- Document uploads

- Notifications and alerts

- Loan management dashboard

- e-Signatures

- Third-party integrations

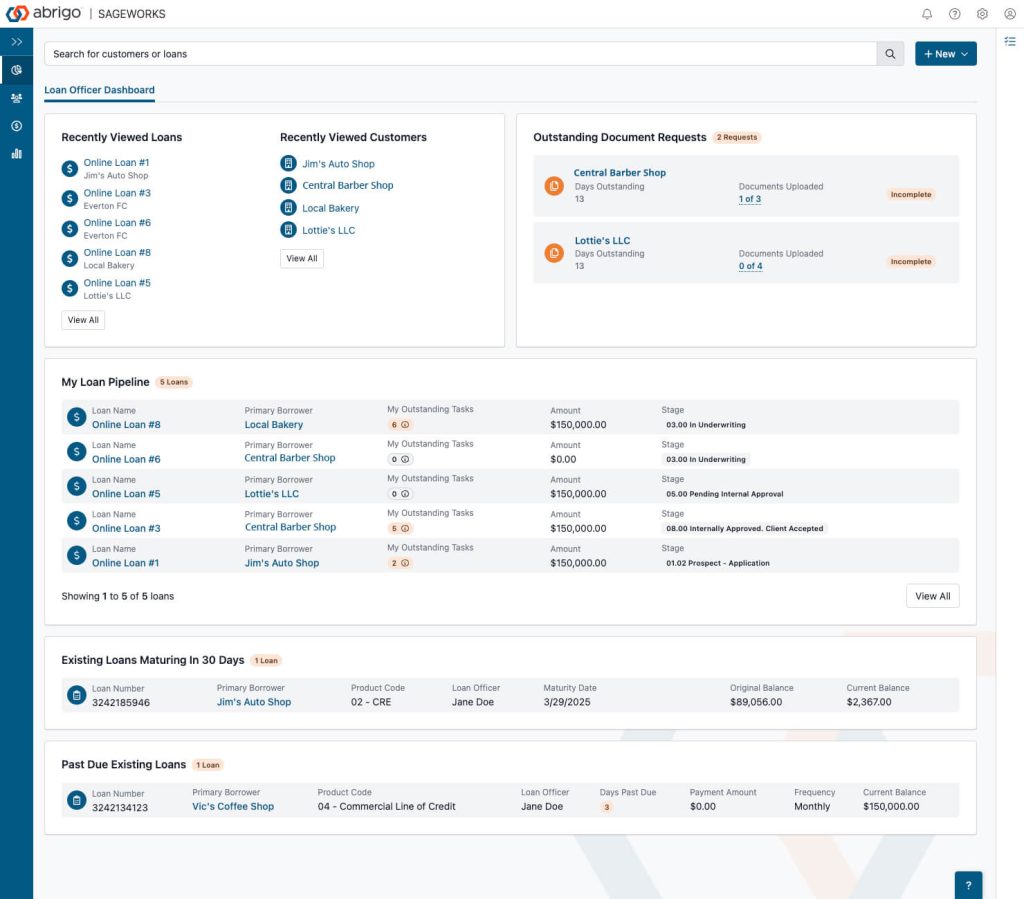

2. Abrigo Lending

- G2 Rating: N/A

- Pricing: N/A

Abrigo Lending is a lending software best for growing financial institutions that want to use automation to scale their loan portfolio. You can use the platform to accelerate loan processing by centralizing services for multiple loan types within a single web app, so you’re not working with fragmented systems to juggle business and personal loans. According to customers, what sets this solution apart from other feature-rich LOS is its shorter deployment cycle that lets teams get up and running with it quickly sets this solution apart from other feature-rich LOS.

Smaller banks and credit unions, like the 121 Financial Credit Union, find the most value in the platform’s ability to speed up loan applications by helping customers avoid filling in information their institution already has saved in the system.

Like many LOSs, integration capabilities are a big motivator for customers. Abrigo Lending can seamlessly communicate with core systems so members can verify existing information with a click of a button and complete their loan applications.

Key features:

- Loan applications

- Pre-built templates and workflows

- Client portal

- Document library

- Notifications and alerts

- Automated loan decisions

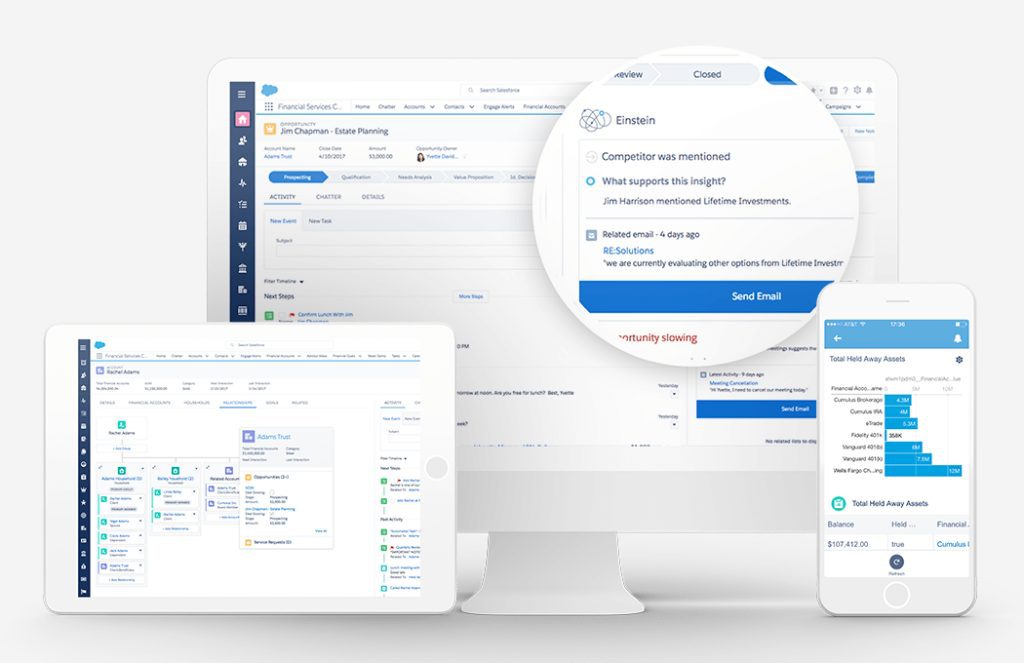

3. Salesforce Financial Services Cloud

- G2 Rating: 4.2 out of 5 stars

- Pricing: N/A

Financial services companies use Salesforce Financial Services Cloud because it is strong in collecting and storing client and prospect data from different conversations and touch points. The platform’s features allow you to automate the entire lending lifecycle and track key information every step of the way.

Like all Salesforce products, the platform allows you to build detailed reports that help you analyze the different layers of each relationship and easily spot areas for improvement. You can also benefit from AI-suggested predictions, scoring, and routing features.

From small institutions to large enterprise corporations, the platform helps customers improve the borrower experience by putting process transparency first.

Key features:

- Mortgage data models

- Document tracking and approvals

- Self-service options for borrowers

- Milestone tracker

- Guided loan applications

- Trigger notifications and alerts

- No code and low code automation

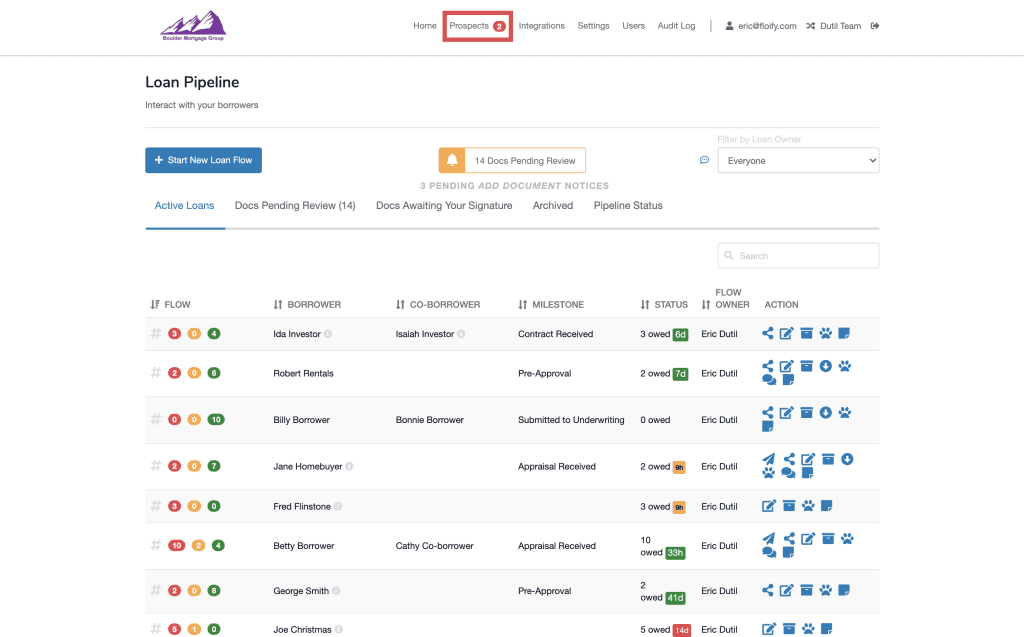

4. Floify

- G2 Rating: 4.8 out of 5 stars

- Pricing: Starts at $70/month

Loan officers say Floify stands out with its modern and user-friendly system for borrowers. The platform prioritizes clear and accessible design, equipping its online apps with multilingual options and following guidelines approved by the Americans with Disabilities Act.

Floify prioritizes good design with its thorough optimizations for mobile web browsers and iOS and Android apps. Their digital loan application process is just as responsive on mobile, so borrowers can follow along with application questions clearly without missing any important information.

The platform’s most popular functionalities are document collection workflows and interview-style loan application questions. Loan offices can easily jump in and out of Floify to add documents, approve documents, and communicate clearly with borrowers within the platform about why certain documents were rejected.

Floify customers include locally-owned mortgage brokers like Riverbank Finance and My Mortage. These businesses use the platform to provide borrowers with a clean and professional online app experience while saving their staff’s time collecting documents and managing mortgage disclosures.

Key features:

- Loan applications

- Client portal

- Document management

- E-signatures

- Customizable branding

- Mobile app experience

- Alerts and notifications

- API integrations

- Disclosure desk solution

5. SoFi

- G2 Rating: 4.9 out of 5 stars

- Pricing: N/A

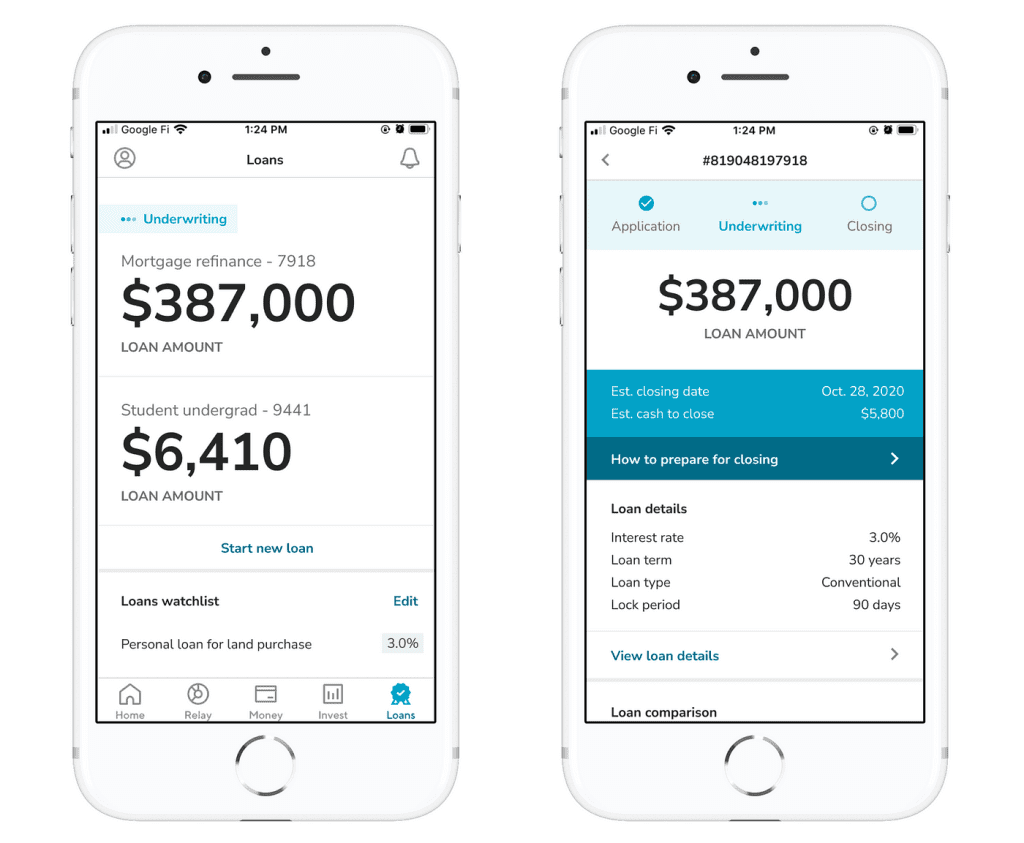

Unlike other loan software on this list, SoFi is a financial technology company that creates member-driven loan products. Built to help its members manage their financial future, it’s an all-in-one finance platform with features ranging from loan refinancing to banking and investing.

You can use a single app to access all these financial services — including its extensive suite of loan products. Loan management is done completely online. The app allows members to get pre-qualified for loans, submit applications, and get brand-new loans that meet their goals.

From students to first-time homebuyers, borrowers use SoFi because their products offer competitive rates, low down payment options, member perks, and access to multi-channel customer support.

Key features:

- 24/7 account monitoring

- Financial planning

- Member rate discounts

- Unemployment Protection Program

- Reward points

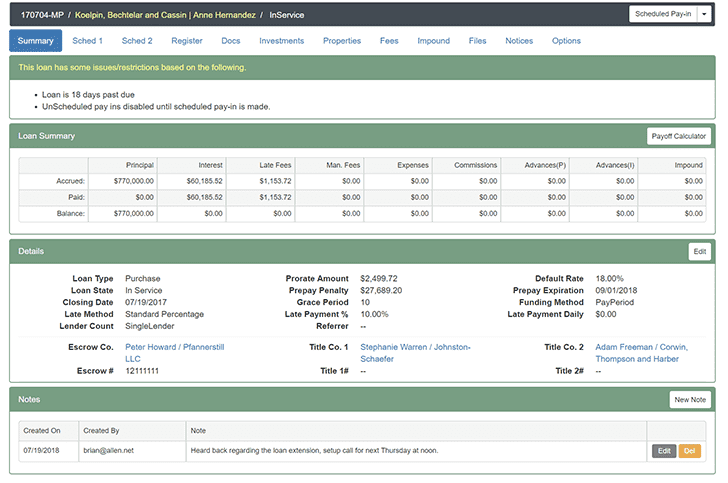

6. Bryt Software

- G2 Rating: N/A

- Pricing: Starts at $29/month

Bryt is a loan management software designed to give lenders unconventional flexibility and transparency, such as not having customers commit to contracts and displaying upfront pricing and implementation times for each subscription plan.

Customers from small and growing businesses find Bryt a suitable platform because of its ease of implementation, helpful onboarding process, and ability to communicate with support teams for platform customizations. You can get Bryt’s system up and running in as little as 30 minutes.

The software is designed with a modular concept. This allows lenders to build a solution by selecting the components that will add the most value to their business. Each subscription plan has a range of modules, but you can access more modules for an additional $30 monthly.

Key features:

- Custom document templates

- Private-labeled client portal

- Built-in payment collection

- Document management

- Asset and insurance tracking

- Compliance management

- API integrations

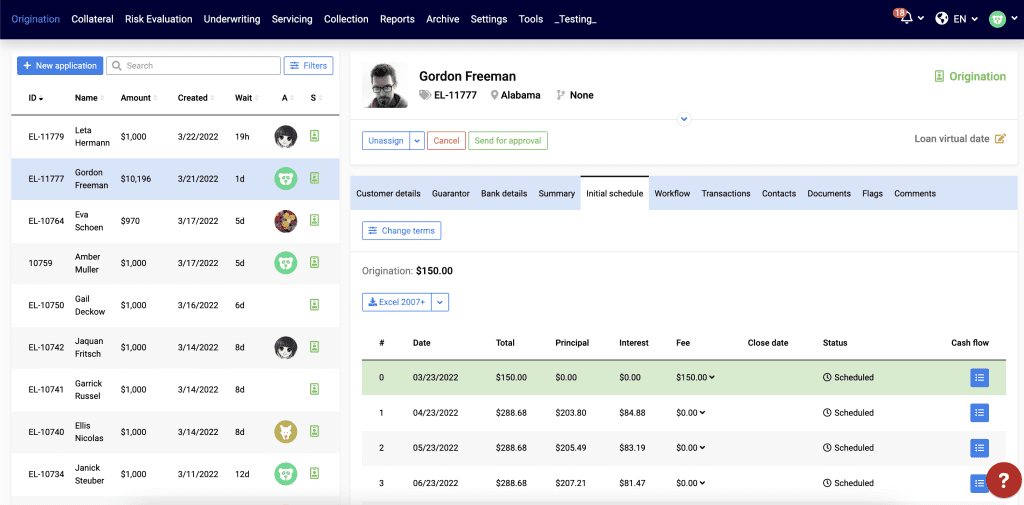

7. TurnKey Lender

- G2 Rating: 4.7 out of 5 stars

- Pricing: N/A

TurnKey Lender is an end-to-end loan management platform powered by AI. It’s best for companies that want to automate and accelerate decision-making throughout the lending process, like credit scoring, risk assessments, loan collection strategies, and more. You can use these intelligent tools to design robust workflows across their loan origination, loan servicing, and debt collection solutions.

Established corporations like H&R Block and AirAsia use the platform to support financial products and services. These customers use Turnkey Lender’s AI engine to seamlessly roll out large-scale digital transformation efforts through automated application collection, processing, and tracking.

Financial institutions enjoy how flexible of a solution it is for personalizing the loan application process and loan offers. Like Bryt, you can use different modules and 75+ pre-built integrations to enhance native solutions with advanced customer management tools.

Key features:

- AI-powered decision-making

- Client portal

- Bulk data import and export

- Document management

- Loan application workflows

- Alerts and notifications

- API integrations

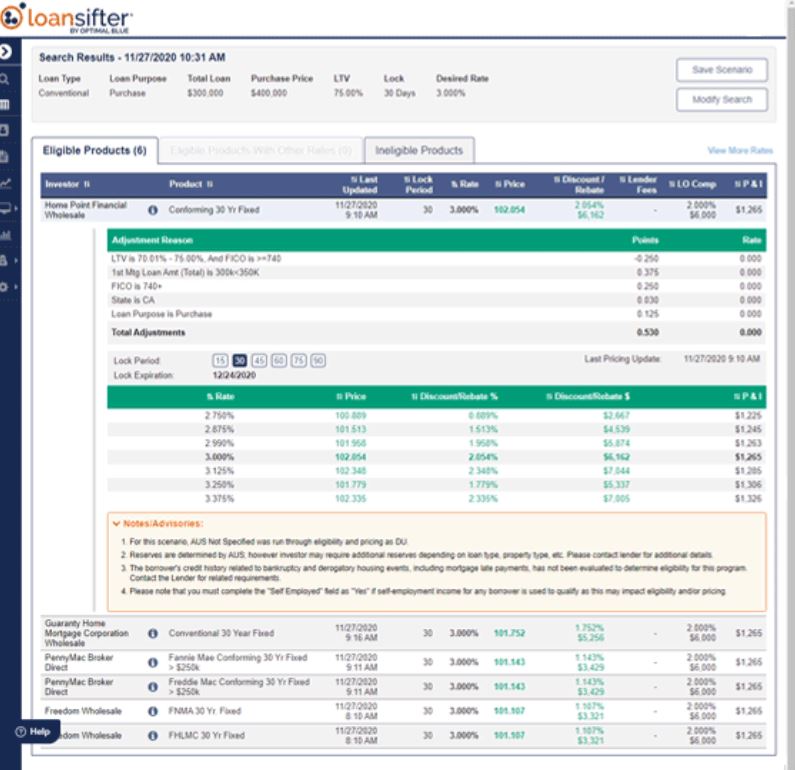

8. LoanSifter

- G2 Rating: 4.6 out of 5 stars

- Pricing: Starts at $79 a month

LoanSifter by Optimal Blue is recognized by mortgage brokers as a reliable solution for searching and comparing mortgage rates by hundreds of investors. Small to mid-market businesses often use this platform to win customer relationships by quickly providing clients with the best pricing options.

Customers can use LoanSifter’s extensive search capabilities to create new pricing quotes for clients in different scenarios. A typical workflow without the platform would include mortgage brokers using rate sheets to calculate the best pricing manually. This time-consuming process becomes even more inefficient when customers are on the line and want to know pricing options right away.

Beyond the agility to edit searches and pull up pricing immediately, mortgage brokers also find LoanSifter valuable because the search results include essential information like a lender’s product matrix and guidelines.

Key features:

- Access to rates from over 100 investors

- Side-by-side price comparisons

- Configurable searches

- Client data management

- Integrations with LOS

- Custom API integrations

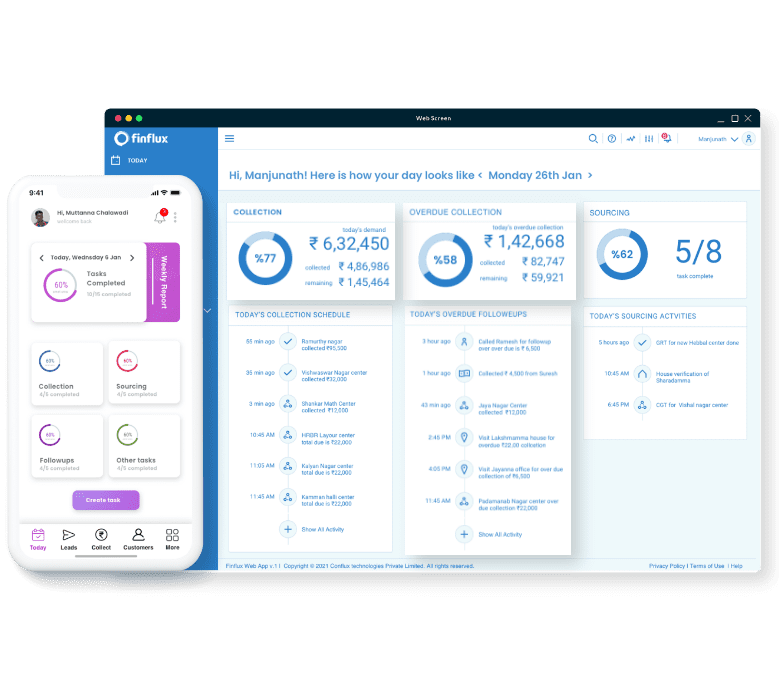

9. Finflux

- G2 Rating: 4.6 out of 5 stars

- Pricing: N/A

Finflux is a cloud-based platform that serves more than four million borrowers. Its emphasis on user experience allows lenders to personalize lending products for their targeted customer base.

Financial institutions can plug and play different integrations into the platform’s solution architecture to build reporting dashboards, set up a co-lending model, and offer different repayment options.

The platform sets itself apart with its mobile application, giving borrowers a comprehensive dashboard to view and manage their loans. Customers can use the app to upload documents, have a comprehensive view of loan pipelines, send payment reminders, and more.

Key features:

- Flexible loan products

- Reporting dashboard

- API integrations

- Automated workflows and events

- Notifications and alerts

- Borrower dashboard with loan information

Features of Loan Software

Selecting the right loan software is essential for enhancing the efficiency and effectiveness of your lending operations. The ideal loan software not only streamlines the application and disbursement process, but also ensures strong risk management and superior customer experience.

Below are key features that lenders should prioritize when choosing their loan software solutions:

- Automated loan decisioning

- Comprehensive loan servicing

- Risk management and compliance

- Flexible and customizable workflows

- Advanced analytics and reporting

- Customer relationship management (CRM)

- Mobile and online access

1. Automated loan decisioning

Automated loan decisioning speeds up the process of approving or rejecting loan applications. This feature uses algorithms and data analysis to quickly assess a borrower’s creditworthiness. By leveraging historical data, predictive models, and machine learning, this system can reduce manual errors and bias in decision-making.

The primary benefit for lenders is the drastic reduction in processing time. This efficiency allows them to serve more customers without compromising the quality of their risk assessment. Automated decisioning can also be improved over time as more data becomes available, ensuring the system continues to be accurate and reliable.

2. Comprehensive loan servicing

Loan servicing is the backbone of any lending operation, encompassing everything from issuing loans to processing payments and managing borrower communications. Top-notch loan software will offer comprehensive tools to handle all these tasks seamlessly. This includes automated payment reminders, easy tracking of payment histories, and efficient management of defaulters and collections.

The software should also support various payment methods and schedules, offering flexibility to both lenders and borrowers. Clear and intuitive interfaces also ensure that customer service representatives can manage accounts effectively, which enhances the overall borrower experience.

3. Risk management and compliance

Effective risk management is essential for any lender to maintain profitability and regulatory compliance. Loan software should include robust tools for analyzing and mitigating risks associated with lending. This includes features like credit scoring, collateral management, and exposure analysis. The software should also be adaptable to various regulatory requirements to ensure that lenders stay compliant.

With dynamic reporting capabilities, lenders can monitor their risk levels in real time, making informed decisions to adjust their strategies as market conditions change. Automated alerts can notify lenders of potential issues before they become problematic, enabling proactive risk management.

4. Flexible and customizable workflows

No two lending operations are exactly the same, and loan software needs to reflect this reality. The software should offer flexible and customizable workflows that can be adjusted to match each lender’s specific processes and needs. This means being able to configure stages of the loan cycle, from application to final repayment, according to bespoke requirements.

Whatfix can enhance this feature by providing in-app guidance and support, helping users navigate complex workflows and customize them without needing extensive technical knowledge. This adaptability ensures that lenders can optimize their operations and improve efficiency across different loan products and services.

5. Advanced analytics and reporting

Data is a critical asset for any lender, and advanced analytics and reporting features turn this data into actionable insights. Loan software should offer comprehensive reporting tools that allow lenders to analyze performance, track key metrics, and identify trends in their loan portfolios.

These analytics can help lenders understand borrower behaviors, predict future trends, and make data-driven decisions to improve their services. Features like dashboards, visual analytics, and automated report generation make it easy for lenders to access and interpret their data, improving strategic planning and operational efficiency.

6. Customer relationship management (CRM)

Integrating CRM functionalities into loan software allows lenders to maintain and improve their relationships with borrowers. This enables lenders to manage leads, track borrower interactions, and deliver personalized service. By having all borrower information and communication logs in one place, lenders can provide more consistent and responsive service.

Effective CRM features can help lenders increase borrower retention and boost satisfaction by making it easier to address issues and by offering tailored services and promotions. Whatfix can further enhance the usability of CRM features by providing real-time assistance and training within the software.

7. Mobile and online access

Borrowers expect to be able to access their loan information and perform transactions from anywhere, any time. Because of this, loan software must provide mobile and online access, including mobile apps and web portals where borrowers can apply for loans, make payments, and communicate with lenders.

For lenders, offering a mobile-friendly platform is not just about convenience- it’s necessary for reaching a broader audience. This accessibility also enables lenders to streamline their operations and provide faster responses to borrower inquiries, improving the overall customer experience.

Benefits of Loan Servicing Software

Today, traditional lenders are competing with financial technology companies for end-to-end loan management. What sets them apart are speed and simplicity.

In a world where we can open bank accounts, conduct peer-to-peer transfers, and use our credit cards right through our phones, it’s clear that complex, drawn-out banking processes aren’t going to cut it. Bank customers and borrowers expect to engage with lenders whenever they need it, but only 7% of banks handle the entire loan process online.

If you’re still iffy about loan servicing software and what it can do for your business, here are a few benefits that might change your mind:

- Minimizes risks

- Saves time

- Reduces calculation errors

- Improved data security

- Better customer experience

- Enhanced reporting and analytics

- Streamlined communication with borrowers

- Improved regulatory compliance

- Scalability for growing operations

- Automation of repetitive tasks

1. Minimizes risks

From compliance management to debt collection, loan servicing software can help your team track activities, payments, and documents all in one place. With a holistic view of each client’s account, you can avoid missing deadlines and proactively remind borrowers about documents and payments to submit.

Automated workflows and AI-driven tools can also help your loan officers personalize the borrower experience with upfront payment schedules and credit risk modeling so that customers can prevent bad debt.

2. Saves time

Customers choose to use fintech leaders because they can shorten the processing time by almost ten days.

When borrower information is streamlined and synchronized with core systems, you can streamline pre-qualification, loan applications, document collection, compliance checks, and approval processes within a single seamless workflow. Your loan officers can save days worth of work by removing the need to pull borrower information from different sources, manually review documents, and generate reports from scratch.

3. Reduces calculation errors

With loan software, you can use pre-determined rules and steps to avoid operational mishaps during transactions. You can ensure consistency in your approach while having the flexibility to configure elements so calculations best reflect specific borrower accounts and situations. Without automation, loan officers are more likely to face variability due to missing or incorrect information, workplace distractions, or heavy workloads.

4. Improved data security

Your client data is more protected with enterprise-grade cloud security than it would be by leaving a paper trail. Loan software allows you to put robust security measures in place, like biometric identification and two-factor authentication, to log into accounts and dashboards. You can also set up alerts and triggers that inform loan officers and borrowers of suspicious activity, like attempted logins in unfamiliar places or locking accounts because of multiple failed logins.

5. Better customer experience

Whether it’s applications, document submissions, or payments, the entire loan process can be overwhelming for borrowers- especially if it’s their first time taking a loan or if they’ve had bad experiences with financial management. A digital experience gives your team the power to curate engaging user interfaces that help borrowers cut through the noise and prioritize the most relevant information.

You can implement guided walkthroughs, summarize complex information, and add visual cues to ease borrower anxiety. With mobile applications and responsive design for multiple devices, you can also optimize communication methods to meet customers wherever they are.

6. Enhanced reporting and analytics

Loan servicing software provides advanced reporting and analytics features that empower lenders with actionable insights and comprehensive data overviews. These features enable lenders to monitor loan performance, track key metrics, and identify trends in real time. With enhanced analytics, you can make data-driven decisions that improve your lending strategies and anticipate market changes more effectively.

For instance, customizable dashboards allow you to focus on the metrics that matter most, from delinquency rates to loan originations. Predictive analytics can forecast future trends based on historical data, helping your team to proactively manage risk and adjust lending policies before issues arise. This level of analysis not only supports more strategic decision-making, but also enhances transparency and accountability within your organization.

7. Streamlined communication with borrowers

Effective communication is key to maintaining strong relationships with borrowers, and loan servicing software significantly enhances this aspect. The software automates and organizes borrower communications, ensuring that messages are timely, relevant, and consistent. Whether it’s payment reminders, account updates, or promotional offers, the software ensures that all communications are personalized and delivered across the borrower’s preferred channels.

This benefit extends to providing a centralized communication hub where borrowers can view their loan history, ask questions, and receive support all in one place. This approach reduces misunderstandings and improves borrower satisfaction by making the communication process straightforward and accessible.

8. Improved regulatory compliance

Staying compliant with the ever-changing regulatory environment is a major priority for lenders, but loan servicing software helps simplify this task. The software is regularly updated to reflect the latest regulatory requirements, helping you avoid costly penalties and legal issues. It automates compliance-related tasks like reporting, document retention, and audit trails, ensuring you meet all regulatory obligations without manual oversight.

For example, loan software can automatically apply new interest rate caps, adjust loan terms according to state laws, and generate required compliance reports for regulators.

9. Scalability for growing operations

As your lending operations grow, you need software that can scale with your business. Loan servicing software is designed to support growth, allowing you to manage a larger volume of loans and clients without a drop in performance or user experience. This scalability ensures that you can expand your lending portfolio while maintaining high levels of efficiency and service.

The software can dynamically allocate resources based on demand, manage increased data volumes, and support additional users without significant upgrades. This means you can grow your business and enter new markets with confidence, knowing that your loan servicing platform will support this growth every step of the way.

10. Automation of repetitive tasks

Loan servicing software automates many repetitive tasks associated with managing loans, like calculating interest, generating statements, and updating account balances. This automation reduces the likelihood of human error and frees up your team to focus on more strategic activities that add value to your business.

For example, the software can automatically process payments and apply them to the borrower’s account, adjust interest rates based on predefined rules, and send out end-of-year tax statements. This level of automation not only improves operational efficiency, but also enhances accuracy and consistency across your loan portfolio.

Common Loan Software Challenges

While loan software can significantly enhance the lending process, lenders often encounter several challenges when adopting these technologies. Understanding and addressing these obstacles is crucial for optimizing the use of loan software.

Below, we explore common issues and provide practical solutions:

- Integration with existing systems

- User adoption and training

- Maintaining data security and privacy

- Customizing features to specific needs

- Handling regulatory compliance

- Scalability concerns

1. Integration with existing systems

A major hurdle for many lenders is the seamless integration of new loan software with their existing systems, like CRM tools, legacy banking systems, or other financial software. Integration issues can lead to data silos, disrupted workflows, and an increased risk of errors. Without smooth integration, the full potential of loan software cannot be realized, which affects overall operational efficiency.

To address this, lenders should seek loan software that offers flexible APIs and customization options to facilitate integration. Whatfix can significantly reduce the learning curve and minimize disruptions during this phase by providing contextual guidance and support, helping users navigate the new software and understand how to link it with existing systems.

2. User adoption and training

Another challenge is ensuring that all team members can effectively use the new loan software. The transition from traditional methods to a digital platform can be difficult for some, leading to resistance to change or underutilization of the software. This diminishes the technology’s benefits and delays the return on investment.

Comprehensive training programs and ongoing support are essential for overcoming this challenge. Whatfix enhances this process by offering in-app guidance and interactive walkthroughs tailored to each user’s role and familiarity with the software. This personalized approach helps accelerate adoption and ensures that everyone can leverage the full capabilities of the loan software.

3. Maintaining data security and privacy

With the increasing amount of sensitive data being processed, maintaining data security and privacy has become a critical concern for lenders using loan software. Any breach can lead to significant financial losses and damage to the lender’s reputation. Ensuring the confidentiality, integrity, and availability of borrower data is a non-negotiable requirement.

Lenders should prioritize loan software that adheres to the highest security standards, including end-to-end encryption and robust access controls. Whatfix can help reinforce these practices by guiding users through secure procedures and alerting them to security features within the software. Regular training updates provided through Whatfix can also keep lenders informed about new security protocols and best practices.

4. Customizing features to specific needs

No two lenders are exactly alike, and a one-size-fits-all approach to loan software can be limiting. Lenders often need to customize the software to fit their unique processes and loan products. Without this flexibility, lenders may not be able to optimize their operations or might need to make compromises that could affect their service quality.

Highly customizable loan software should allow lenders to modify workflows, forms, and rules to fit their specific needs. Whatfix assists in this customization by providing step-by-step guidance on how to adjust settings and features within the software, making it easier for users to tailor the platform to their exact requirements without extensive technical support.

5. Handling regulatory compliance

The lending industry is heavily regulated, and keeping up with changing laws and standards can be daunting for lenders. Loan software must be able to adapt quickly to new regulatory requirements to avoid compliance risks, which can be costly and damaging to the lender’s credibility.

Lenders should ensure that their loan software provider regularly updates the platform to reflect the latest regulatory changes. Whatfix can help lenders stay compliant by offering real-time updates and training on new regulations and how they affect the software’s use. This proactive approach ensures that lenders are always ahead of compliance issues.

6. Scalability concerns

As lending operations grow, lenders need loan software that can scale with their expanding needs. Limited scalability can hinder growth, forcing lenders to invest in new solutions prematurely. It’s crucial that the software can handle an increasing number of loans, users, and data without performance degradation.

Choosing scalable loan software is key for lenders planning to grow their operations. The software should be able to handle a growing load without compromising speed or user experience. Whatfix can support scalability by enabling users to easily explore and utilize additional features and modules of the software as their needs evolve, ensuring a smooth scaling process.

Loan products are feature-rich. They can present loan officers and borrowers with a ton of information that can be easy to miss without the right guidance.

Whatfix lets you build engaging customer and employee onboarding and adoption workflows, including in-app content, self-service support channels, and pop-ups.

You can use behavioral analytics to nudge your audience with the right next steps and empower them with information at the most critical points of their user journey.

Learn more about how Whatfix can support your digital banking transformation and loan software implementation today.

Thank you for subscribing!