11 Best Life Insurance Policy Administration Systems (2024)

- September 30, 2022

The insurance industry has been considerably slow-paced in shifting towards technological innovation. That explains why many insurance companies still struggle with legacy banking systems with slow and flawed policy management workflows.

For insurers to adapt to the changes in the modern insurance landscape and embrace digital transformation, they need advanced policy administration systems (PAS).

A PAS tool can automate policy processes for greater efficiency, create customized products for every market, and handle the entire policy lifecycle on a single platform for complete transparency.

In this article, we’ve rounded up 10 of the best PAS solutions for you to consider. You’ll also find a list of features to look for in an ideal policy administration software.

11 Best Life Insurance Policy Administration Systems in 2024

- Applied Epic

- Oracle Insurance Policy Administration

- BindHQ

- EZLynx

- Insurity Sure Policy

- Equisoft Policy Administration System

- Accenture Life Insurance & Annuity Platform (ALIP)

- Life.io Empower

- Pega Policy Administration System

- BriteCore

- AgencySmart

What Is a Life Insurance Policy Administration System (PAS)?

A policy administration system (PAS) is a software designed to help insurers and companies track and manage insurance policies, pension products, and annuities. PAS performs various functions to effectively handle an insurance agent or company’s operations. These functions include accounting and finance, regulatory compliance, policy changes, premium submissions and withdrawals, and tracking claims.

How Digital Insurance Policy Administration Systems are Changing the Insurance Industry

Legacy banking systems put insurers on the backfoot with less adaptability and lower profitability. Conversely, policy administration systems plug right into the insurers’ business setup to boost operational efficiency, minimize losses, and increase the bottom line.

Here’s how digital insurance systems are shaping the insurance industry:

- Competitive advantage: Policy administration systems give insurers greater digital capabilities to meet the dynamic market demands. These systems can integrate into their existing workflows and offer them an edge over the competition.

- Differentiated customer experience: PAS tools simplify multiple policy management processes. It provides policy data access to both employers and employees, creating more transparency and less confusion. What’s more, these tools can reduce constant communication and hassle by digitizing all processes.

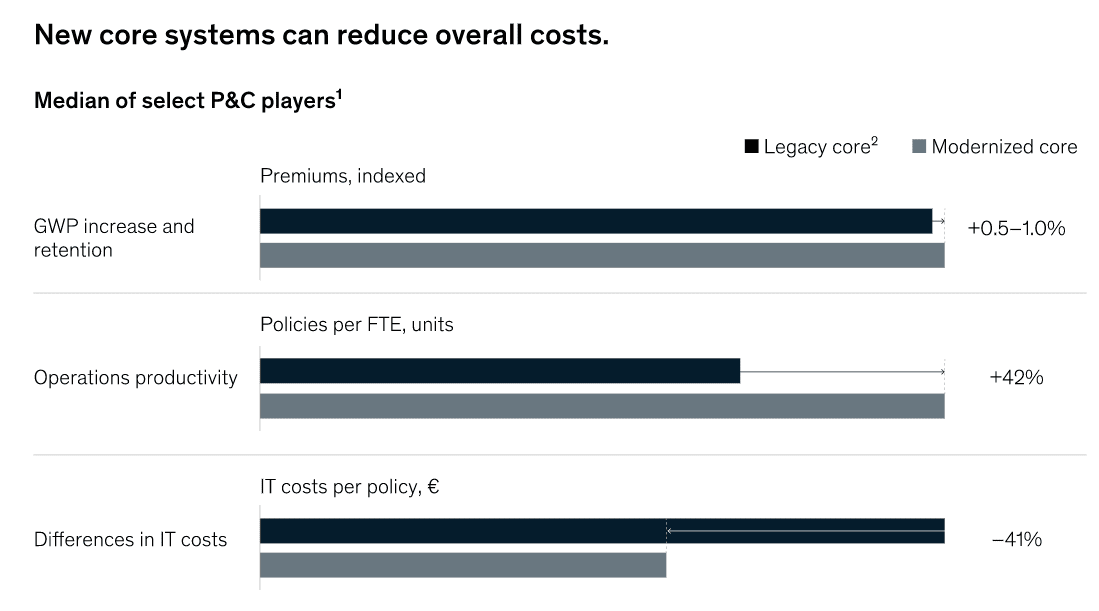

- Improved productivity: McKinsey’s Insurance 360° benchmark indicates that insurers with modern PAS software as part of their insurance agent training are significantly more productive than competitors with legacy IT systems. Digitizing the end-to-end policy management framework helps streamline relationships between insurance agents, employers, and other stakeholders.

- Greater scope for expansion: Insurance players are increasingly looking to expand globally. Fully-featured and adaptive PAS tools make it easy for them to go beyond the domestic market and adhere to country-specific regulations in a new region.

- Lower expenses: Digital insurance systems essentially create a better communication channel between policy and claims systems. So, insurers can compare clauses with claims more accurately to minimize these expenses on loss adjustments.

Source: McKinsey

5 Features of Life Insurance Policy Administration Software

With so many policy administration tools in the market, choosing the best one can be a tough call. A must-have checklist can help shortlist your options and pick the best tool.

So, here are five essential features to look for in a life insurance policy administration software:

1. Automating policy lifecycle

Managing a policy involves many steps, like underwriting, issuance, change requests, claim records, and cancellation. A policy administrative software automates these processes to create a systematic flow throughout a policy’s lifecycle.

2. Self-service options

Employees and policyholders want easy access to their policy details. A self-service option gives them a direct channel to find all these details without going through the agent. This option also saves a lot of work for the agents every time a policyholder requests information.

3. Ease of integration

One of the essential features to get the best ROI from a policy administration software is by integrating it into your policy management system. This way, you can create seamless processes for payments, reporting, analysis, and more. It’ll also give insurers better visibility into their entire pipeline.

4. Regulatory intelligence

Insurers must meet extensive regulation requirements in every state. A regulatory intelligence feature in the policy administration tool helps understand all regulatory requirements and reduces the processing time.

5. Accessible customer support

The quality and accessibility of the policy administration software’s customer support is another significant factor. You should always check how the support team functions and ask if they provide a dedicated point of contact for onboarding and query resolution.

11 Best Life Insurance Policy Administration Systems in 2024

Here are the best life insurance policy administration systems, with a brief overview of their functionality, key features, pricing, and rating.

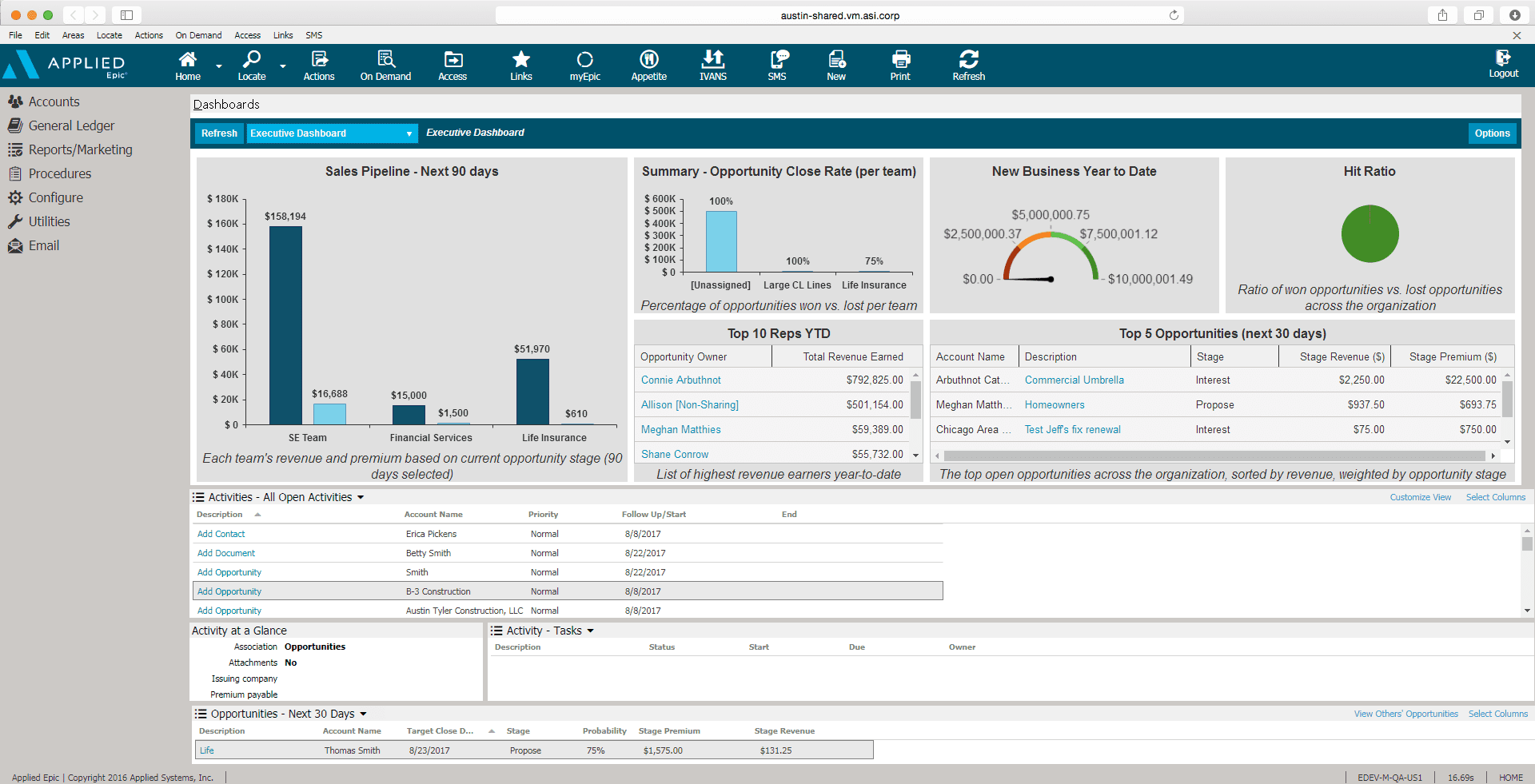

1. Applied Epic

Applied Epic is an integrated insurance management software with cloud-based functionality and robust automation capabilities. The tool allows you to integrate your entire policy management operations on a single platform and streamline customer relationships.

With enough training resources and a prompt customer support team to understand the tool’s functionality, you can get the best out of the tool for your policy management needs. You get a comprehensive suite of features, including claims management, payment processing, reporting dashboard, invoicing and receipts, and contact management.

Key features

Easy to set up with a short learning curve and user-friendly interface

High customization options to use the product per your business needs

Full-fledged benefits management system organizations of all kinds

- G2 Review Rating: 4.5 out of 5 stars

- Price: Get a custom quote

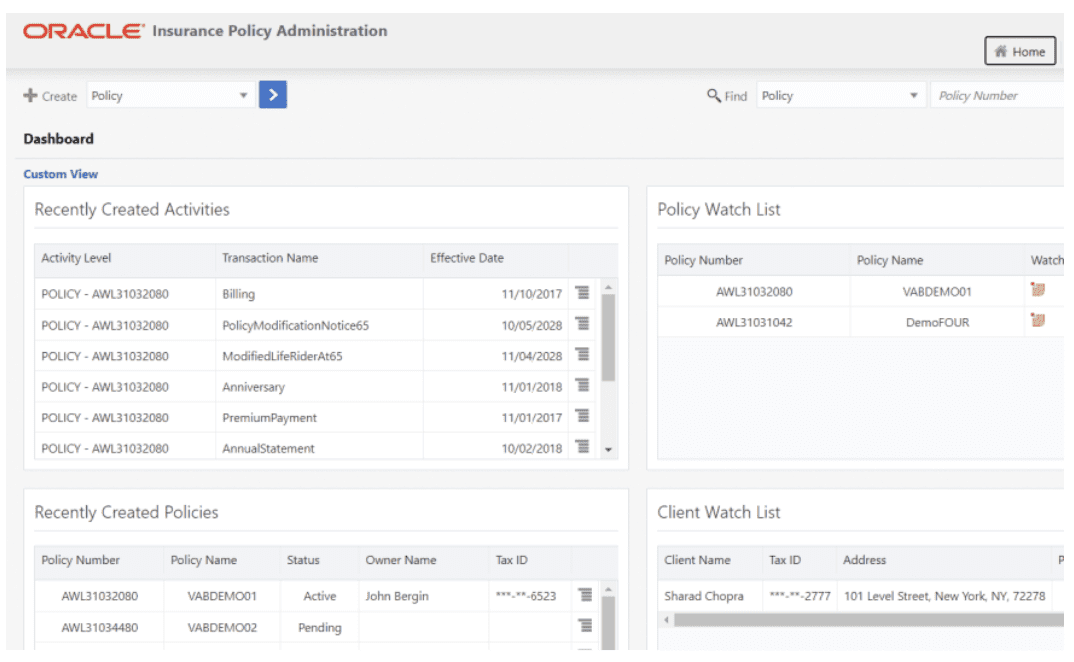

2. Oracle Insurance

Oracle Insurance is a highly-adaptive life insurance policy administration system with built-in capabilities for underwriting, issuance, processing, billing, collections, and claims. The tool is completely customizable, enabling businesses to adapt to the changing market and customer demands.

The product brings in automation from the beginning with the underwriting process. It also delivers a seamless customer experience by offering real-time access to policy data at any time. However, the interface can sometimes feel clunky, with occasional technical glitches.

Key features

- Reduces time to market with automated and improved business processes

- Easily configurable and modular platform for a multi-channel customer experience

- High-quality customer support from recognized industry experts

- G2 Review Rating: 3.9 out of 5 stars

- Price: Get a custom quote

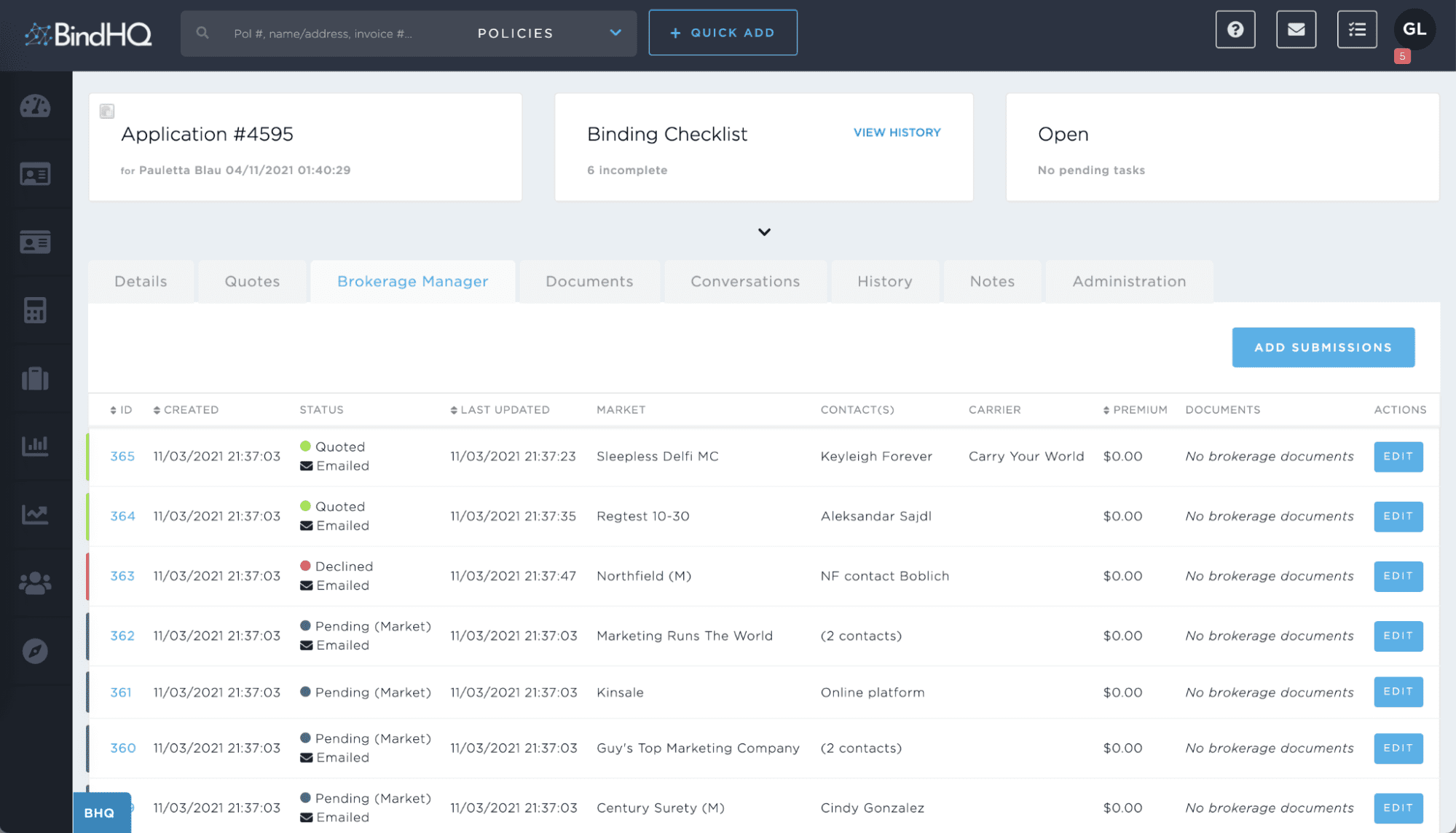

3. BindHQ

BindHQ is an insurance management system for specialty agencies and insurance businesses. This cloud-first, API-driven platform controls end-to-end management with policy administration, insurance accounting, and reporting and compliance.

You can easily integrate BindHQ’s API with third-party systems to build a robust and frictionless policy management setup. The team also offers consultative calls, business analysis, configuration services, and operating reviews to ensure the tool is integrated correctly and works smoothly.

Key features

- Better and faster underwriting process with comparisons of multiple business lines

- Maximize cost savings with integrated operations, from accounting and taxation to compliance and reporting

- On-demand support available in several formats along with expert insights

- G2 Review Rating: 4.7 out of 5 stars

- Price: BindHQ Light at $275/month, BindHQ Pro at $325/month, Enterprise at $450/month—all billed annually

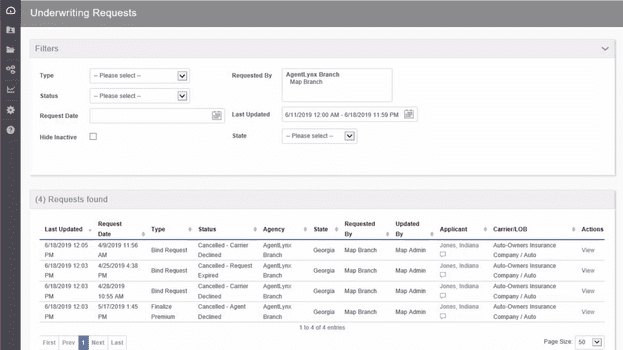

4. EZLynx

EZLynx is a full-fledged insurance agency software with a range of tools to streamline your policy management program. You can use a combination of tools, like insurance automation, comparative rater, lead management, and retention management.

Its built-in rating engine brings real-time rates for different policies directly to the customers, liaising between brokers and policyholders.

Key features

- Automated lead capture, tracking, follow-ups, and conversions to drive profitability

- User-friendly client servicing and operations management tool for agencies

- Integrated marketing function with communication center to reach prospective clients and convert them

- G2 Review Rating: 4.0 out of 5 stars

- Price: Get a custom quote

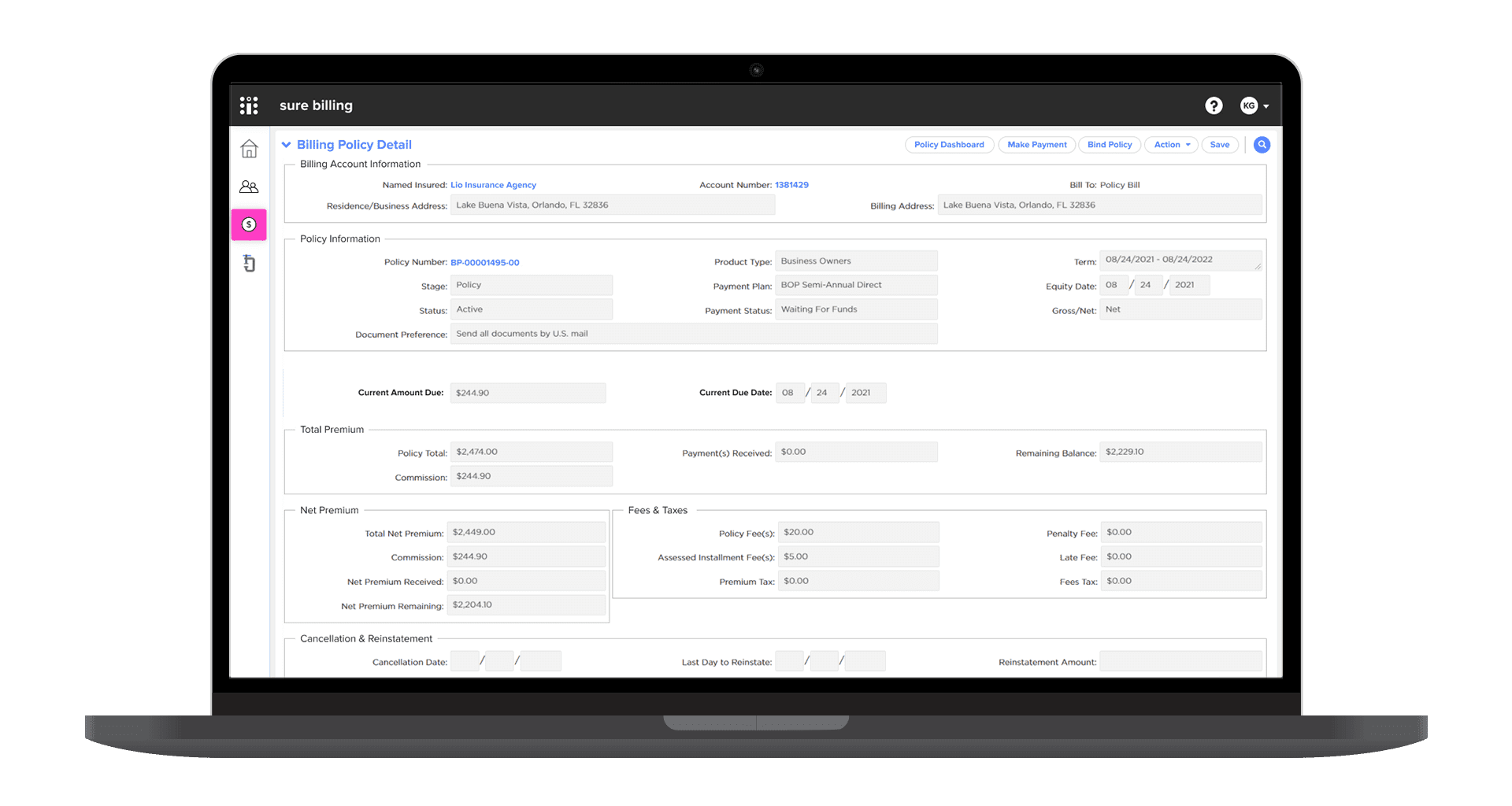

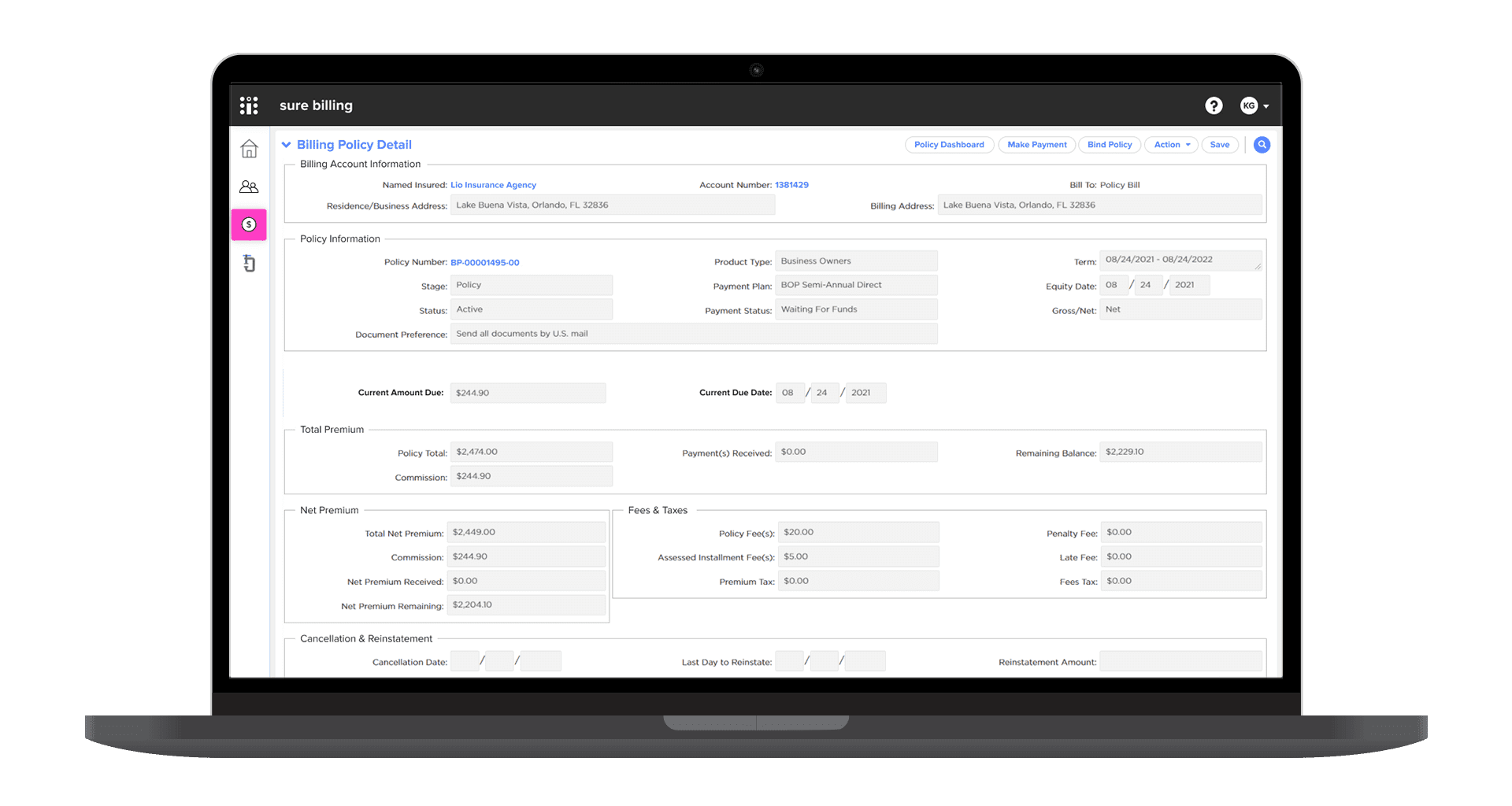

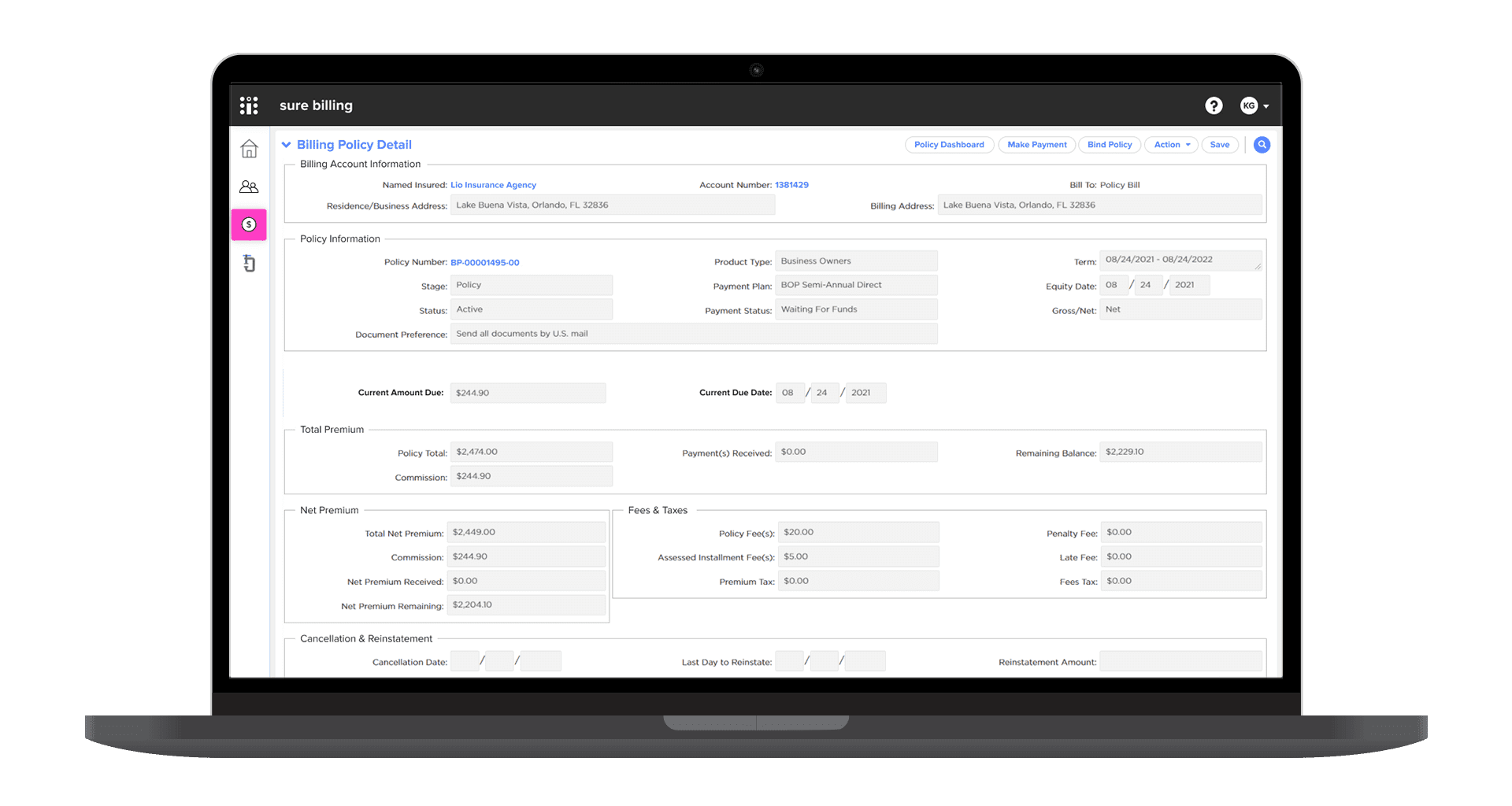

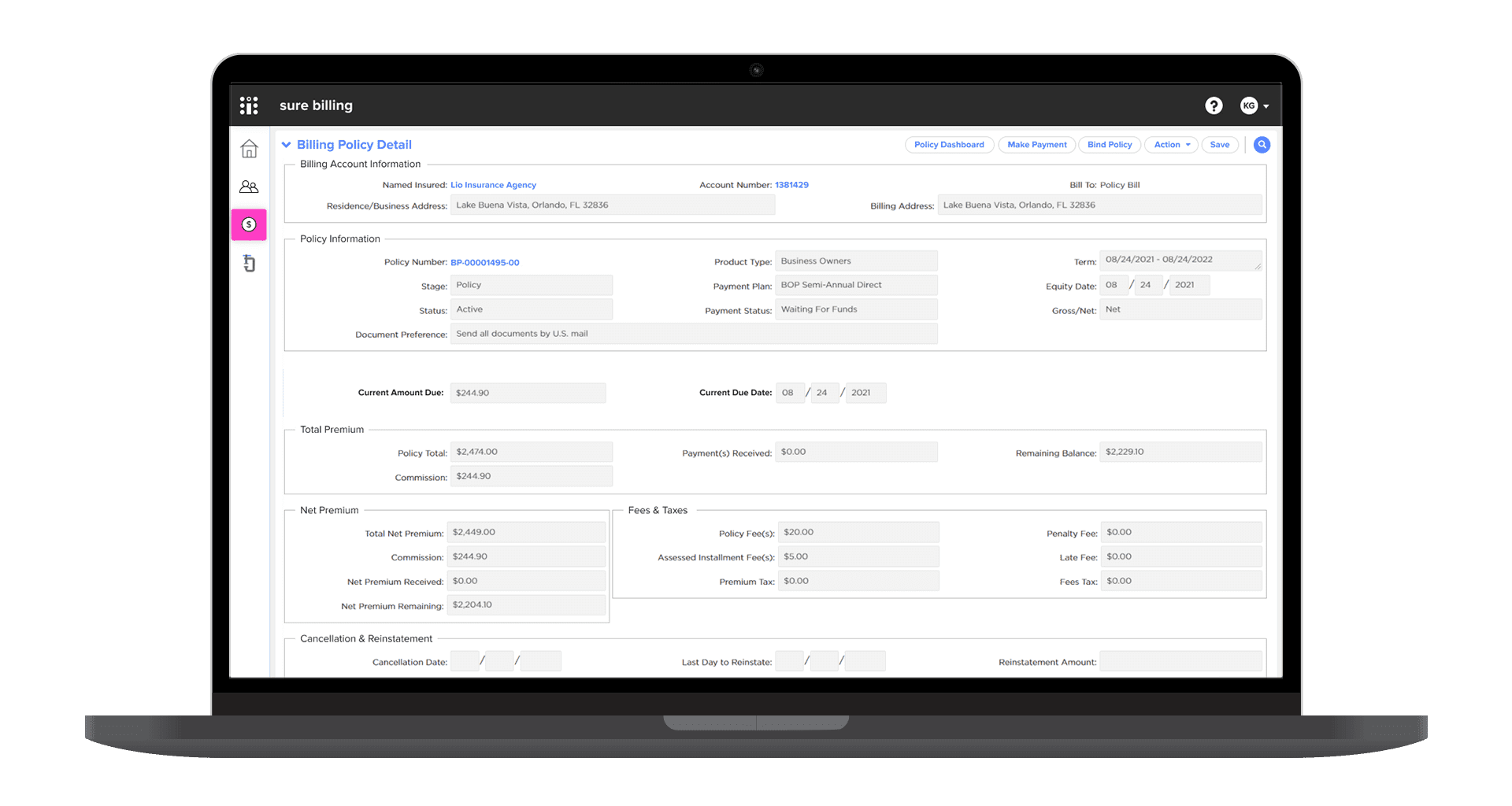

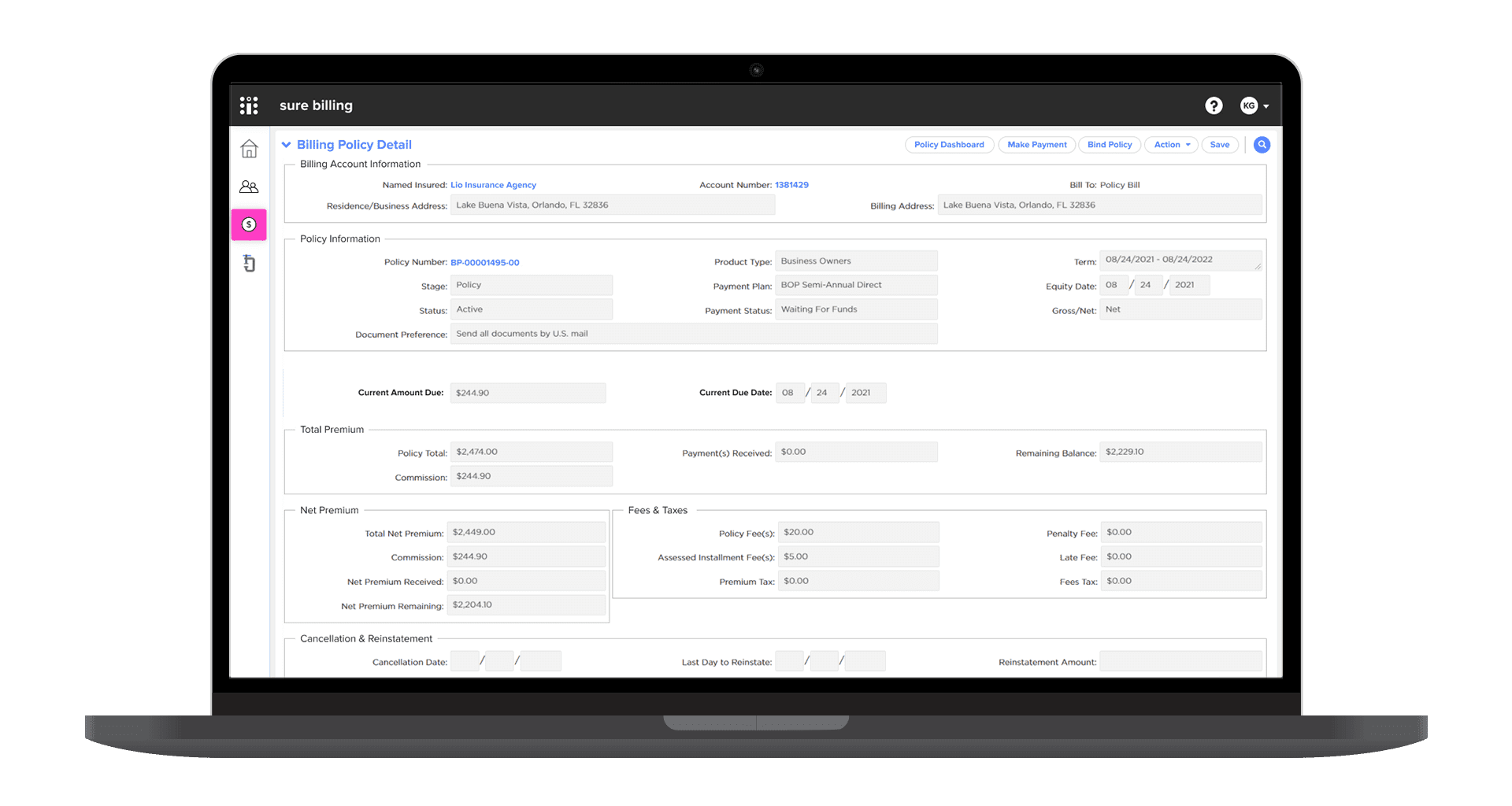

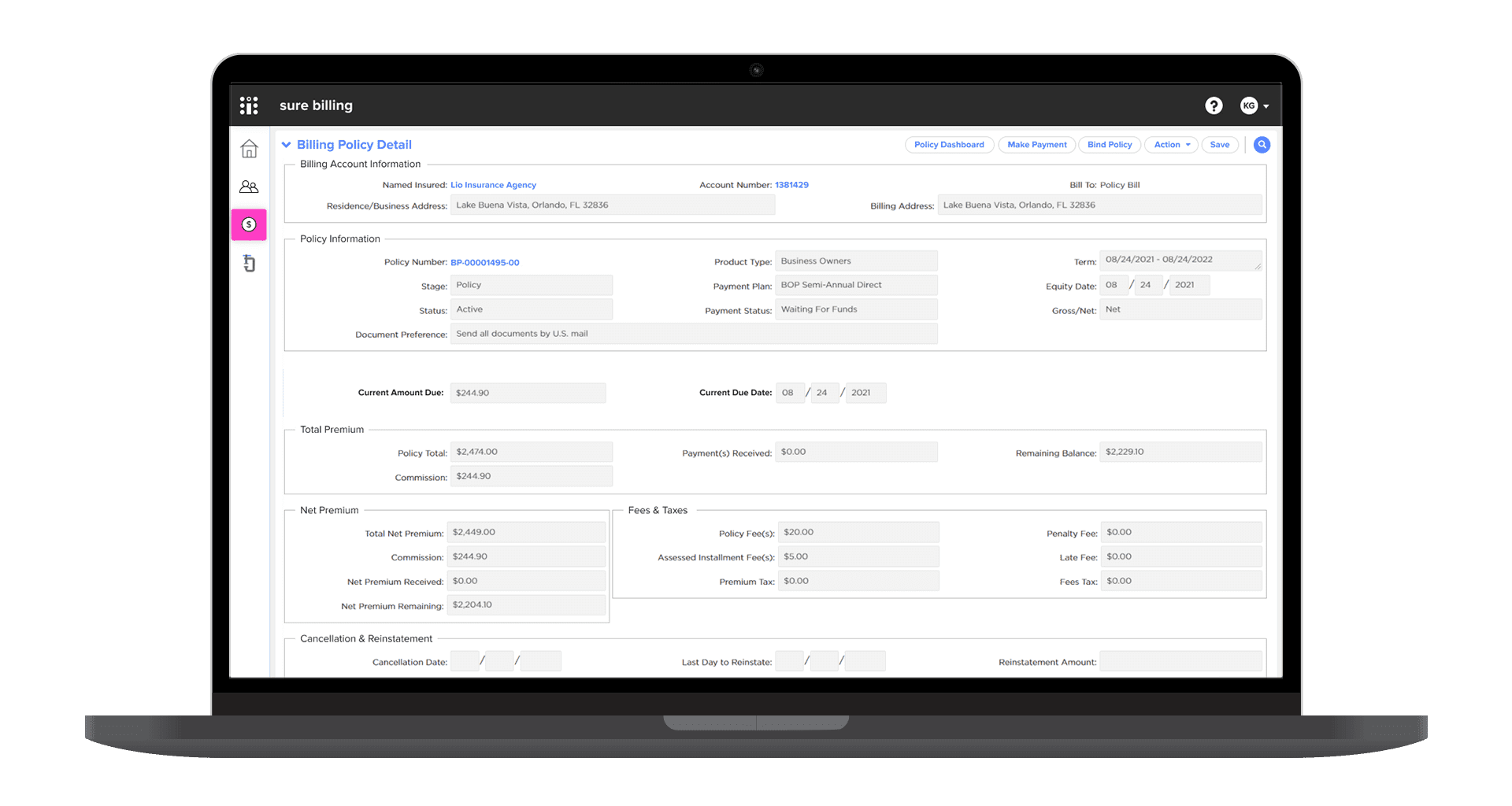

5. Insurity Sure Policy

Insurity Sure Policy is a cloud-native policy administration software with easy configurations to customize your policy management program for newer markets. The tool also minimizes time in the underwriting process with more predictable business outcomes.

It’s a scalable solution with ready-to-use APIs to integrate into your policy setup. Its highly-rated regulatory support is an added advantage.

Key features

- Robust and holistic reporting function to give users a high-level overview of their program

- Speed up the product launch process with easy configuration capabilities

- In-depth analytics to track all data and performance against the suitable KPIs

- G2 Review Rating: 3.0 out of 5 stars

- Price: Get a custom quote

5. Insurity Sure Policy

Insurity Sure Policy is a cloud-native policy administration software with easy configurations to customize your policy management program for newer markets. The tool also minimizes time in the underwriting process with more predictable business outcomes.

It’s a scalable solution with ready-to-use APIs to integrate into your policy setup. Its highly-rated regulatory support is an added advantage.

Key features

- Robust and holistic reporting function to give users a high-level overview of their program

- Speed up the product launch process with easy configuration capabilities

- In-depth analytics to track all data and performance against the suitable KPIs

- G2 Review Rating: 3.0 out of 5 stars

- Price: Get a custom quote

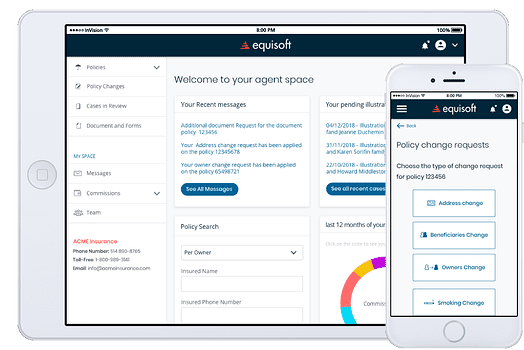

6. Equisoft

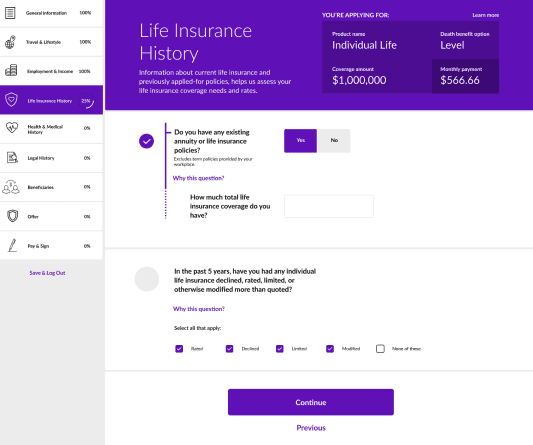

Equisoft Policy Administration System is a plug-and-play PAS implementation tool. It comes with built-in annuity and final expense insurance products. So, you don’t have to configure and customize anything to launch in a new market.

The tool also offers a user-friendly interface for employers and employees to manage their policy programs. Its hassle-free cloud-first functionality means your team can do more with the product without relying on cloud architects’ technical expertise.

Key features

- Easy to set up and implement without the need for developers’ assistance

- Seamlessly manage business processes and outcomes with its complete suite of features

- Third-party integrations available for all major insurance services

- G2 Review Rating: NA

- Price: Get a custom quote

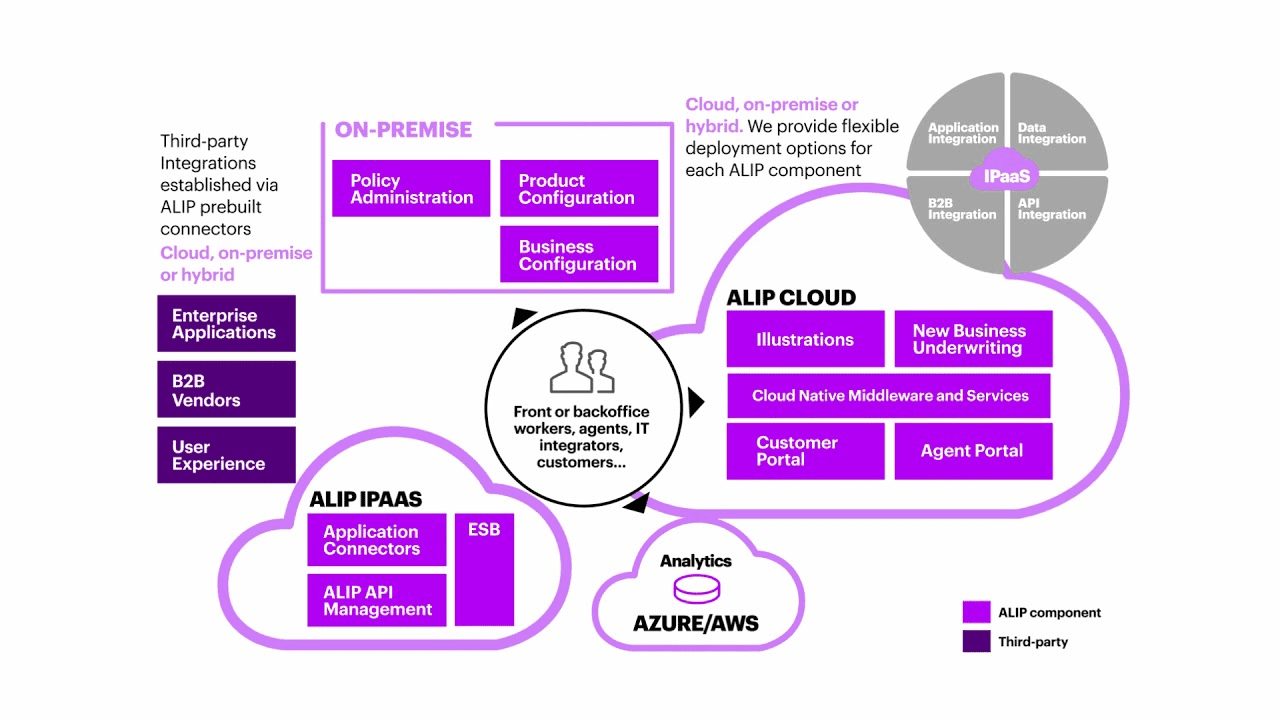

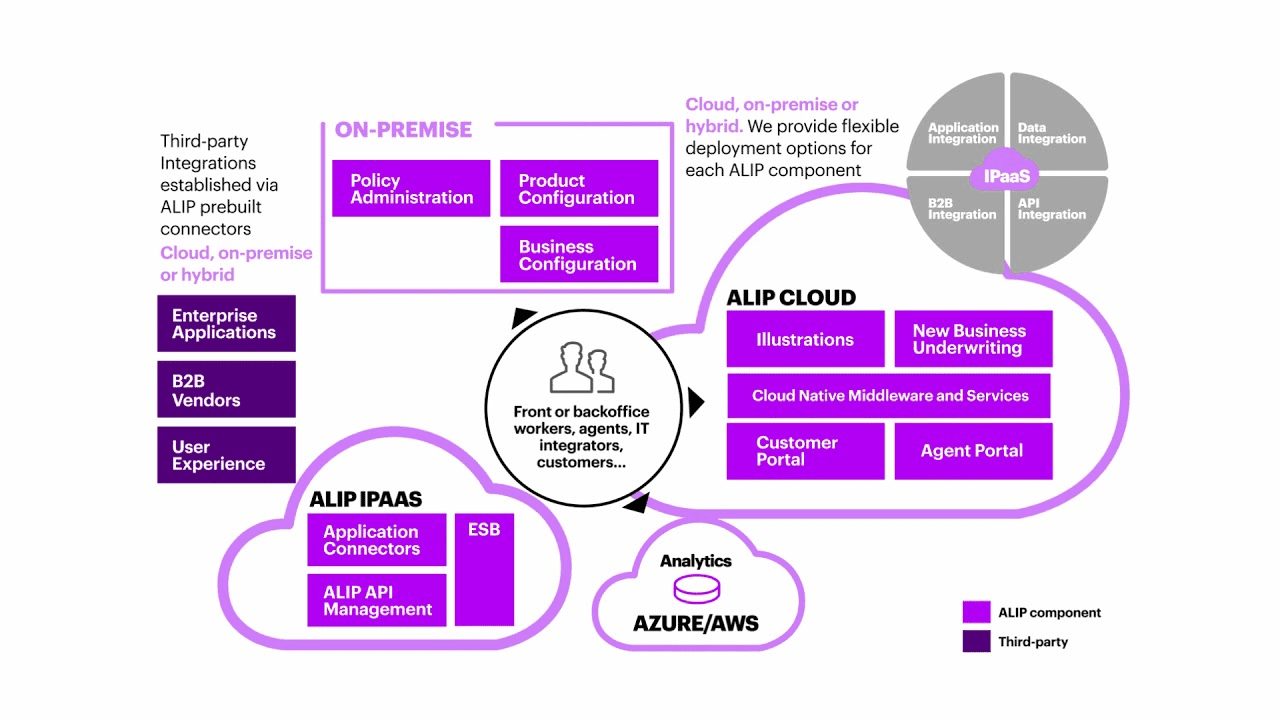

7. Accenture Life Insurance & Annuity Platform (ALIP)

Accenture’s ALIP is a robust life insurance policy management system with tailored products designed for insurers’ specific operational needs. This feature-rich policy management solution allows you to develop a custom product independently and configure it with existing products.

The tool’s intuitive interface and integrated testing functionality make it a top choice for many insurance players. As a bonus, you also get a prebuilt library of business rules and workflows.

Key features

- Complete policy lifecycle management with automated underwriting

- Cloud flexibility to bring more agility into your operations and achieve desired outcomes

- Advanced policy processing features, such as claims, payout, transaction management, accounting, regulatory management, and more

- G2 Review Rating: 3.5 out of 5 stars

- Price: Get a custom quote

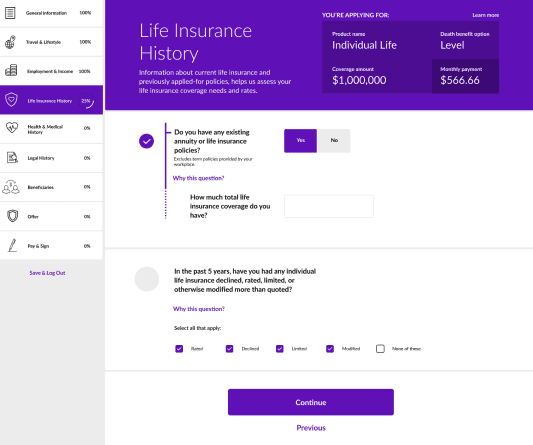

8. Life.io Empower

Life.io Empower is a self-service policy management tool with greater control available to policy owners. Users can review their policy details and manage or update account details 24×7.

As a part of Life.io’s enterprise solutions, Empower gives customers complete ownership of their policies. This enables insurance agencies and brokers to deliver a differentiated customer experience and offer more transparency.

Key features

- Complete access to policy information with the flexibility to update these details with a self-service portal

- Freedom to contact policy advisor or agent whenever needed

- Set up automatic payments and reminders and withdraw funds directly from the platform

- G2 Review Rating: NA

- Price: Get a custom quote

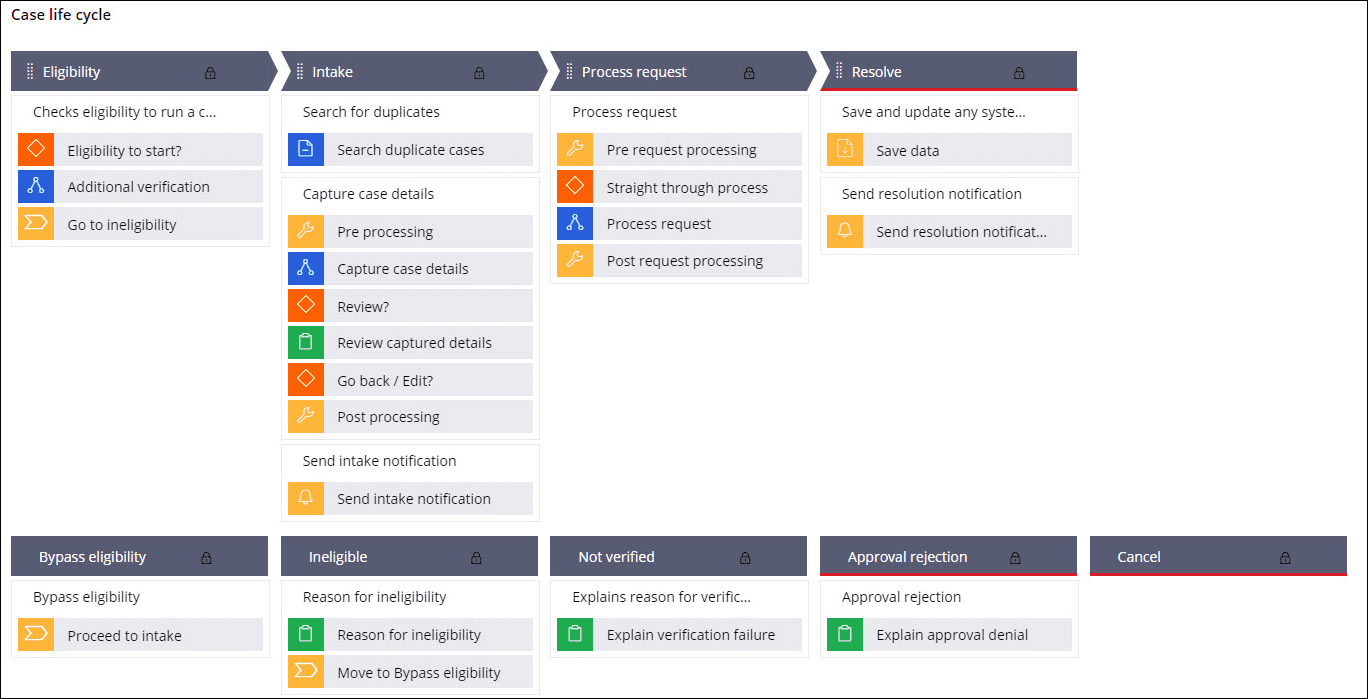

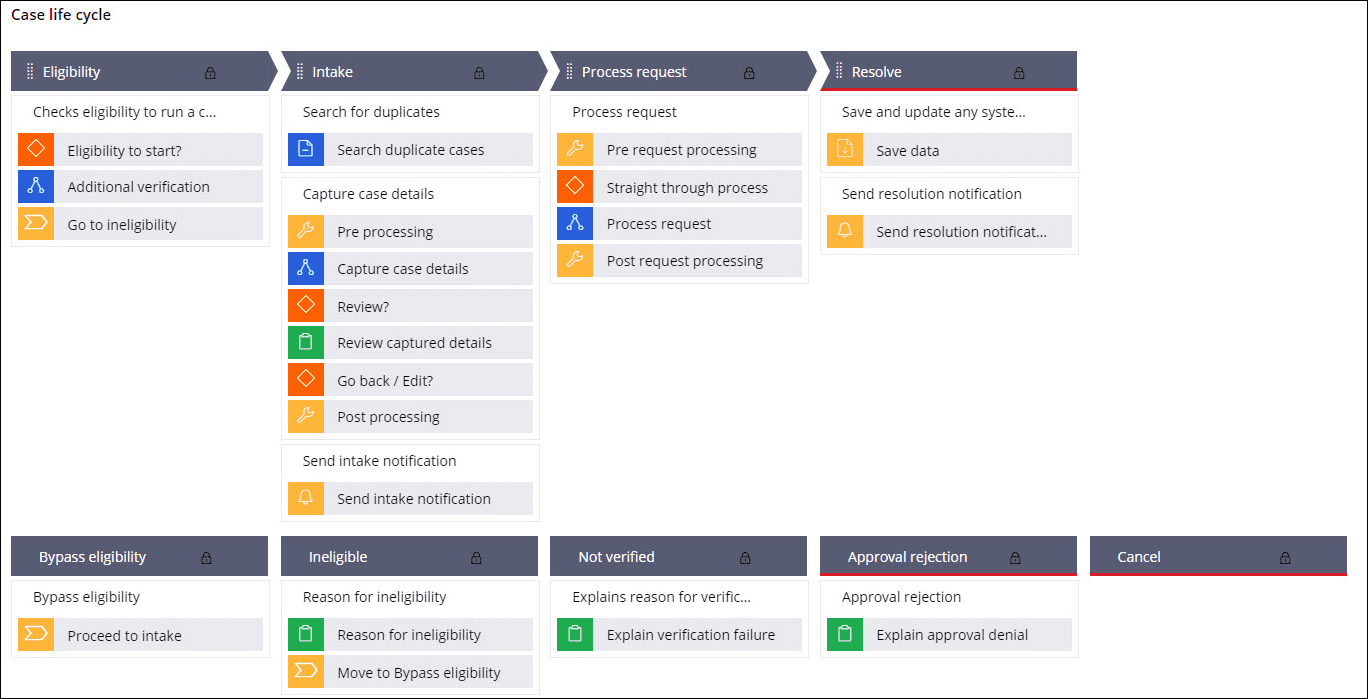

9. Pega Policy Administration System

Pega Policy Administration System is a highly adaptive and low-code development platform for insurers and agencies. The platform uses AI-powered workflow automation to build a powerful policy management system.

Its insurance product configurator minimizes the time to market and accelerates product launches in new markets. What’s more, companies can also reconfigure their systems to incorporate customer feedback and make the setup more intuitive.

Key features

- Greater connectivity and seamless communication across channels and distribution lines

- Better cost control and reduced inefficiencies due to a highly synced workflow

- Easy configurations for the smallest of changes without the need for programming

- G2 Review Rating: 4.2 out of 5 stars

- Price: Get a custom quote

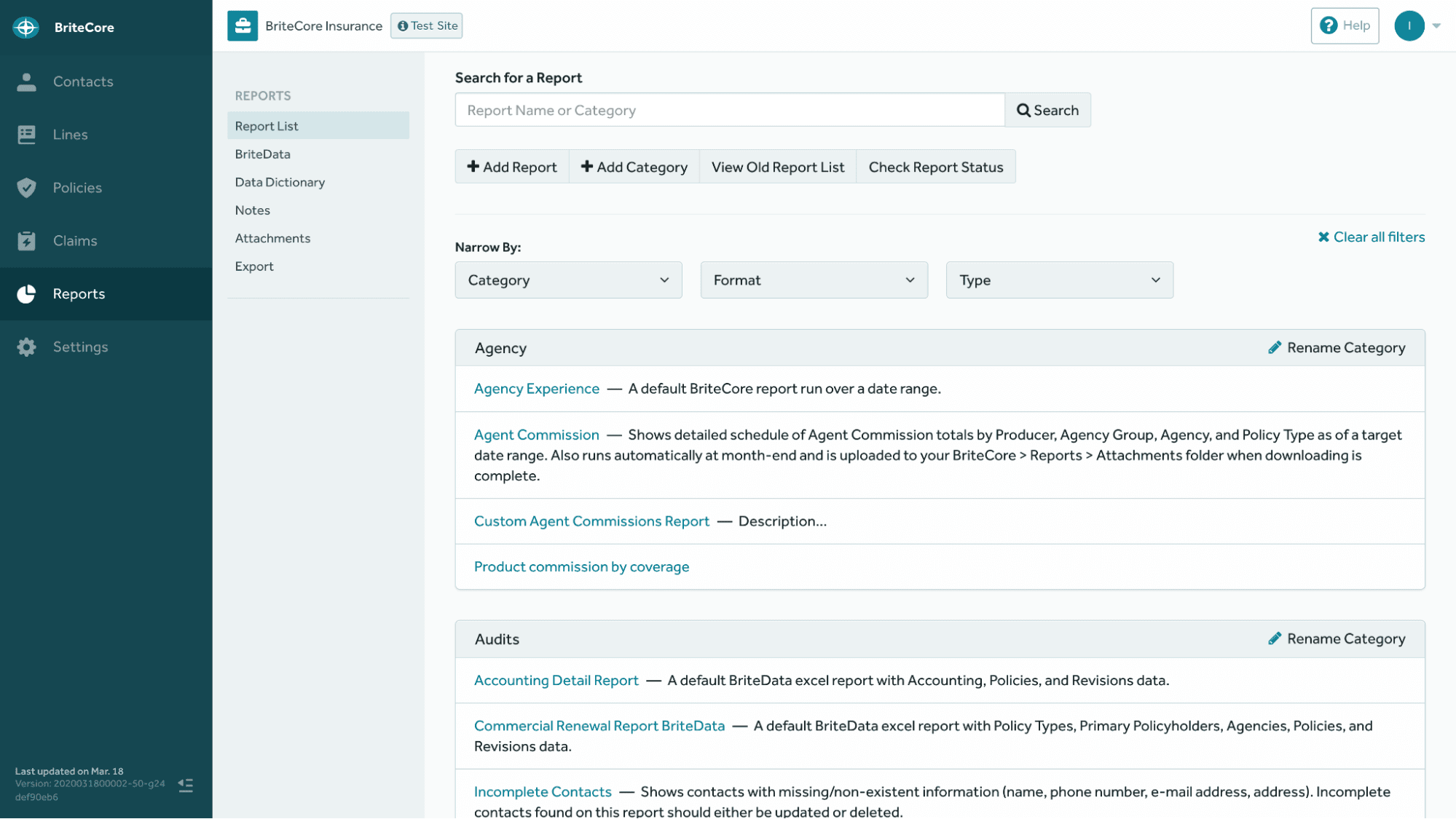

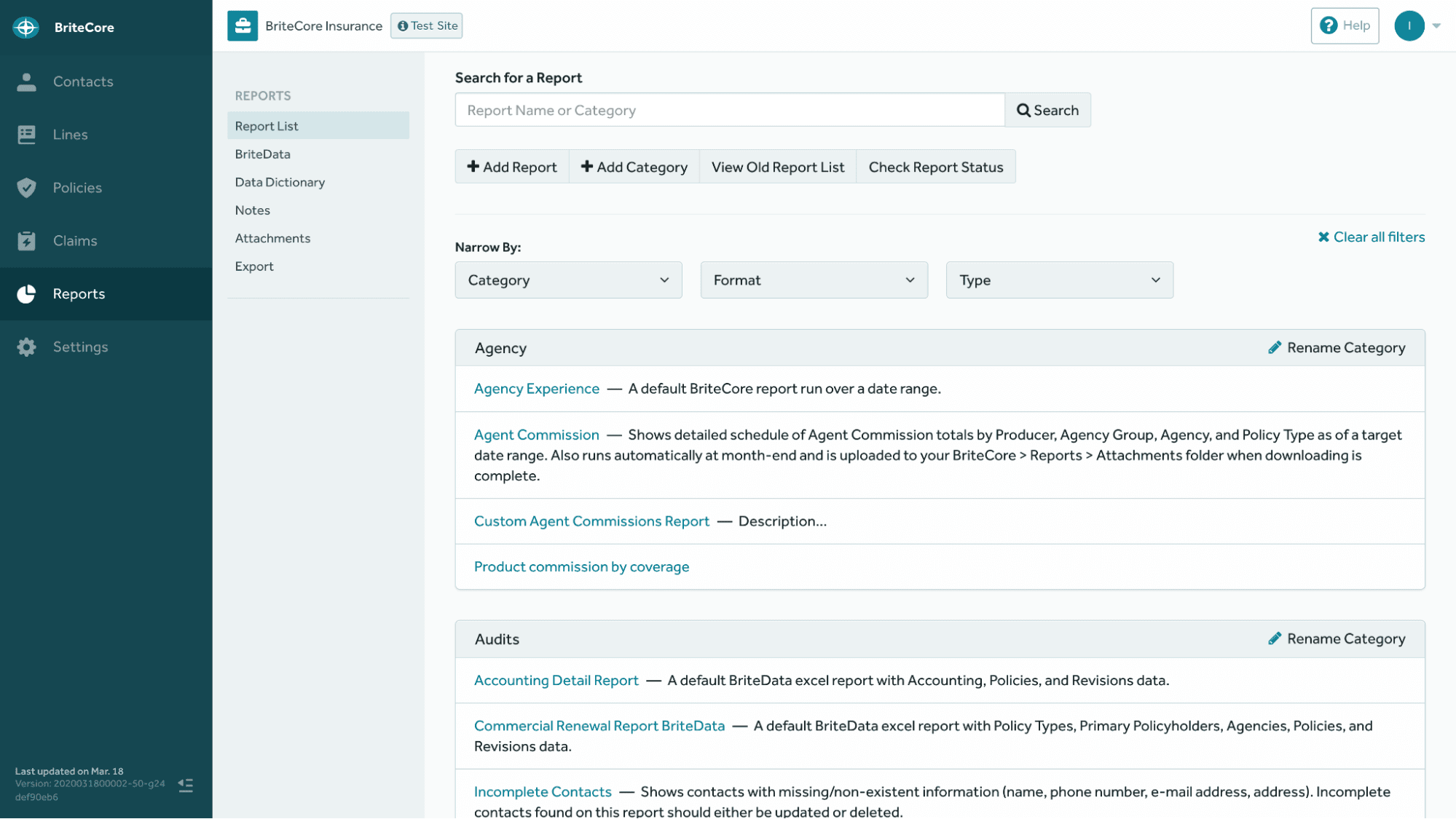

20. BriteCore

BriteCore offers a suite of tools for insurers to embrace digital transformation and boost their business models. BritePolicies is a full-fledged policy management tool within this suite of tools designed to manage the entire policy lifecycle.

Its flexible workflows, faster response time, intuitive interface, and automation capabilities make it an ideal choice for many businesses. The software also supports policies from multiple lines of business.

Key features

- Cloud-native solution with advanced functions for underwriting, quoting, content management, data warehousing, claims management, and more

- Easier access to information and enhanced customer experience

- Continuous updates on the platform for greater security and durability

- G2 Review Rating: 4.0 out of 5 stars

- Price: Get a custom quote

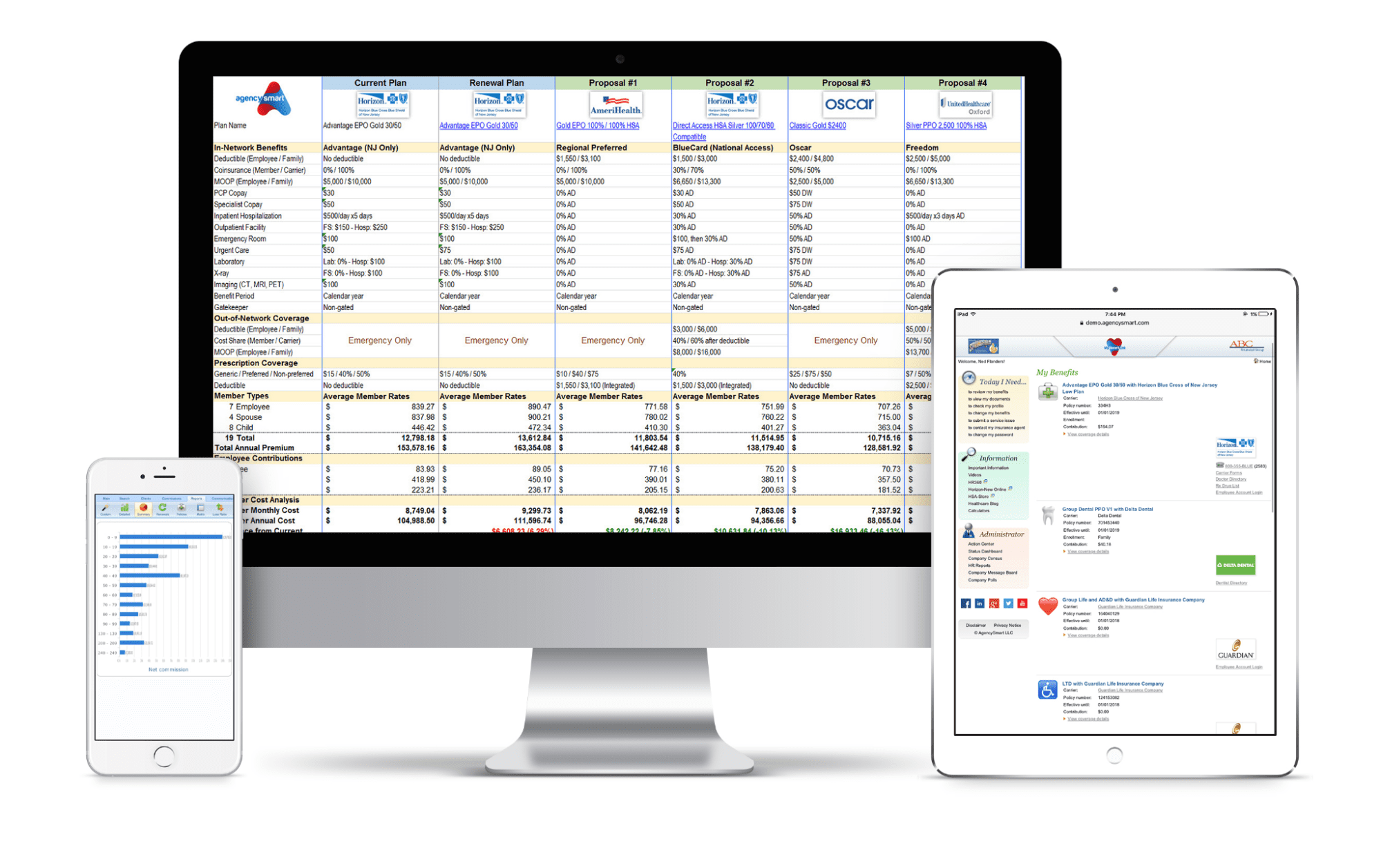

11. AgencySmart

AgencySmart is an all-in-one, cloud-first policy management solution for insurers, retailers, employers, and financial service providers. The PAS tool solves the challenge of using multiple platforms and systems to manage the policy administration program.

You can handle every aspect of the policy processing framework—from pre-sale and underwriting to premium collections and renewal. Besides, all the policy records are easily accessible to the customers.

Key features

- Improved productivity with less time spent on complexities of generating quotes, processing policies, and other processes

- Integrated management system to log, track, modify, and store all policy records

- Eliminate the scope of human error in data entry with a single database and automated data entry

- G2 Review Rating: 4.8 out of 5 stars

- Price: Basic Quoting at $49, CRM with Commissions at $75, Full Access at $99, Enterprise & GA at custom pricing

Finding the best insurance policy administration system is just the first step. You also need to prepare your team to use it effectively and get the best of its functionality. This is where digital adoption platforms like Whatfix can help.

Whatfix drives digital adoption of your life insurance applications with contextual support.

In-app guidance & just-in-time support for customer service reps, agents, claims adjusters, and underwriters reduces time to proficiency and enhances productivity. You can also increase processing rate with automated form completion features and provide self-service support to deliver a frictionless customer experience.

Learn more about embracing digital transformation for your insurance business today!

Thank you for subscribing!