Procurement has become one of modern organizations’ most complex and critical functions. It’s about managing a web of interconnected source-to-pay workflows that touch nearly every department, from finance and legal to IT and operations. Teams are juggling everything from sourcing, supplier and vendor management, contract approvals, compliance, invoicing, and spend optimization, all while ensuring nothing breaks down the supply chain or delays delivery to customers.

To meet these demands, organizations require modern procurement software that can handle the depth and nuance of their unique procurement workflows. Most have highly customized systems with compliance requirements, approval hierarchies, and operational dependencies that are too complex for email threads and spreadsheets.

The market for procurement tools has exploded, with platforms like SAP Ariba, Coupa, GEP SMART, Jaggaer, and others offering everything from spend analysis and supplier risk management to automated workflows and contract intelligence. According to IMARC Group, the global procurement software market is expected to grow from $8.2 billion in 2024 to $17.5 billion by 2033, with a CAGR of 8.38%.

eProcurement technology is changing how companies approach procurement. Modern procurement software connects the dots across teams, surfaces real-time insights, improves vendor relationships, and drives more consistent, compliant outcomes.

In this guide, we’ll break down the different types of procurement software, explain why these tools matter, compare the top vendors, and walk through how to roll out and adopt a new procurement solution successfully.

What Is Procurement Software?

Procurement software (also known as procure-to-pay software) manages the procurement lifecycle, from sourcing suppliers to purchasing materials, managing inventory, generating purchase orders, overseeing bills and payments, and more. It enables organizations to identify inventory shortages before they impact their bottom line, gather data to help improve profitability and automate reminders about purchase orders or cancellations.

Procurement software is typically delivered through multiple products that provide tailored solutions to some regions of the procure-to-pay process, or as a more extensive software suite that offers modules that work together across the entire procure-to-pay process.

To be considered a procurement software, a product must offer the following features:

- Consolidate procurement-related data from multiple sources or applications.

- Define an organization’s procurement processes and manage all parts of the P2P operational lifecycle.

- Create and manage purchasing policies and approval workflows.

- Monitor finances and procurement-related transactions.

- Automated budget tracing and real-time procurement cost analysis.

- Create, manage, and inventory contracts.

- Automate and manage the request for proposal, request for information, and request for quote processes.

- Vendor and supplier sourcing, onboarding, and management.

- Identify procurement risks or potential fraud and maintain compliance with automated audits and regulatory checks.

- Custom reporting on all procurement-related processes.

Types of Procurement Software

Procurement software can be a package suite of applications designed to manage the entire source-to-pay process or can be broken into single applications designed for certain procurement process areas.

When selecting a procurement solution, it’s essential to understand your current procurement infrastructure and contextual needs. Otherwise, they risk purchasing duplicate solutions or incompatible applications

With that said, here are the most common and popular types of procurement software:

- Source-to-pay (S2P) software: Covers the entire source-to-pay process, from sourcing vendors to managing payments, providing an end-to-end solution.

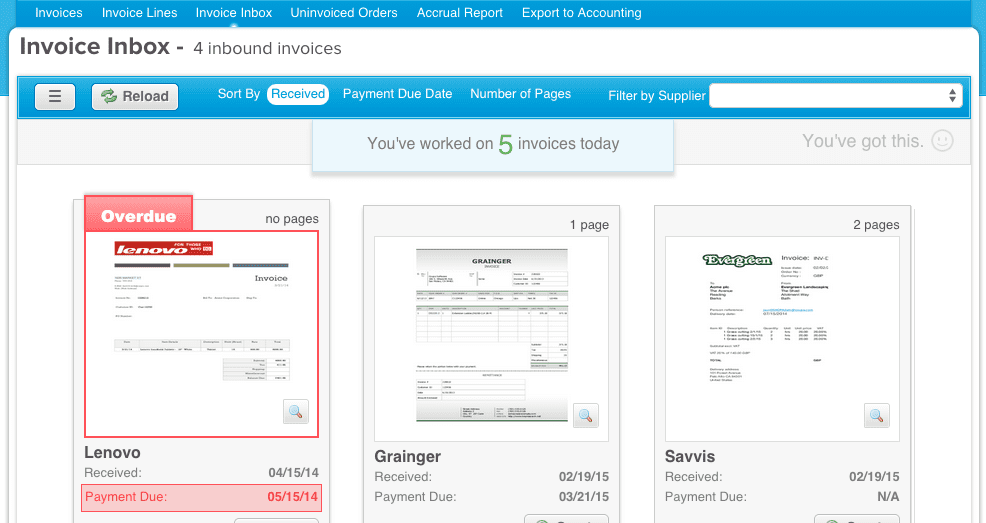

- Accounts payable and spend analysis software: Streamlines invoice processing and tracks organizational spending. It automates bill monitoring, schedules payments, and ensures on-time financial management.

- Contract lifecycle management software: Facilitates every stage of contract management, from creation and negotiation to execution and compliance tracking.

- Purchasing software: Automates purchasing activities, including requisitions, approvals, and order tracking, ensuring efficiency in procurement workflows.

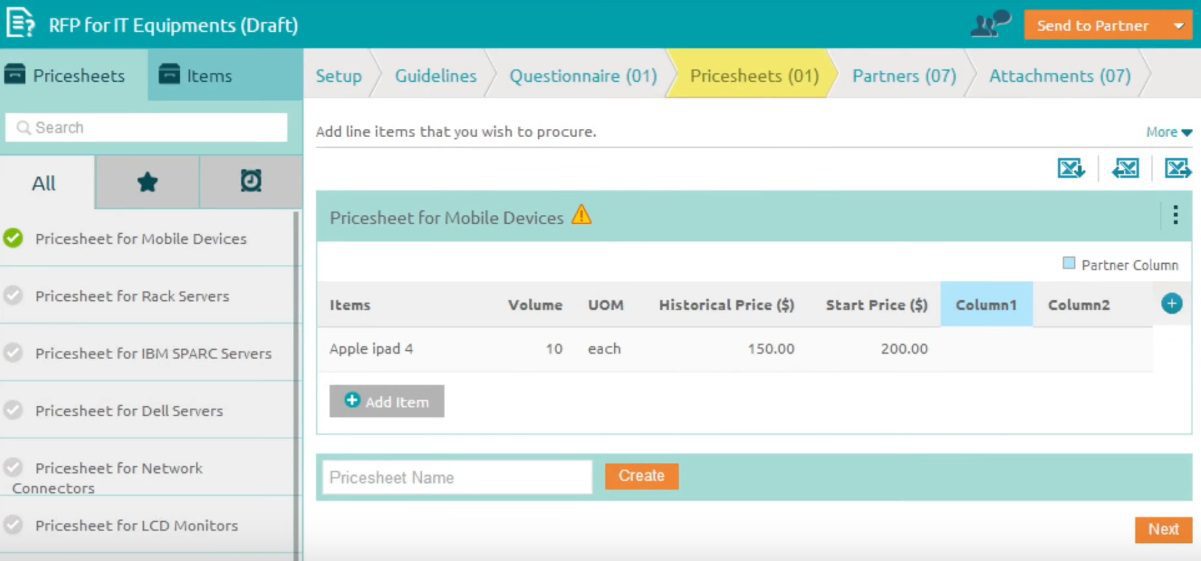

- RFP software: Simplifies the RFx process by helping professionals create requests, receive responses, and manage vendor bids. It leverages templates, automation, and AI to enhance efficiency.

- Spend management software: Provides tools to track, analyze, and optimize procurement-related expenses, improving cost control and budget oversight.

- Strategic sourcing software: Supports procurement teams in managing sourcing projects, collaborating with stakeholders, and executing category management strategies effectively.

- Vendor management software: Centralizes vendor onboarding, communication, performance tracking, and relationship management for streamlined operations.

- Warehousing software: Helps manage inventory by categorizing, organizing, and tracking goods in storage, ensuring smooth supply chain operations.

The Importance of Procurement Transformation

Procurement transformation is no longer optional for businesses aiming to stay competitive. It’s about more than just cutting costs—it’s about unlocking efficiency, improving relationships with suppliers, and building resilience in an unpredictable market.

Digital procurement systems are driving this shift, and the benefits speak for themselves. According to research, companies adopting these systems can cut procurement costs by up to 30% and boost operational efficiency by 40%.

Here’s why procurement transformation matters:

- Streamlining operations: By automating repetitive tasks and centralizing processes, procurement teams can focus on high-impact activities. This means faster approvals, smoother vendor management, and fewer delays.

- Saving money and controlling spend: Real-time insights into spending patterns help businesses identify savings opportunities, eliminate wasteful practices, and negotiate stronger supplier contracts.

- Strengthening supplier partnerships: Collaborative tools enhance transparency and communication, making it easier to build long-term, reliable supplier relationships.

- Mitigating risks: Digital procurement systems provide better visibility into contracts and spending, helping businesses spot and address compliance issues or potential disruptions before they escalate.

- Scaling with confidence: As businesses grow, modern procurement tools adapt to evolving needs, ensuring they remain agile and competitive.

Investing in procurement transformation isn’t just about keeping up—it’s about getting ahead. Analyst firms like Gartner and Forrester consistently highlight how organizations with advanced procurement systems achieve higher efficiency, better supplier management, and improved profitability. In an ever-changing business landscape, that edge can make all the difference.

12 Best Procurement Software in 2025

In this list, we’re introducing you to 12 popular procurement software tools to consider, including:

- SAP Ariba

- Coupa Procurement

- Team Procure

- Procurify

- GET SMART

- Precoro

- Netsuite Procurement

- Oracle Procurement Cloud

- Ivalua

- Jaggaer

- Zycus Source-to-Pay

- Kissflow

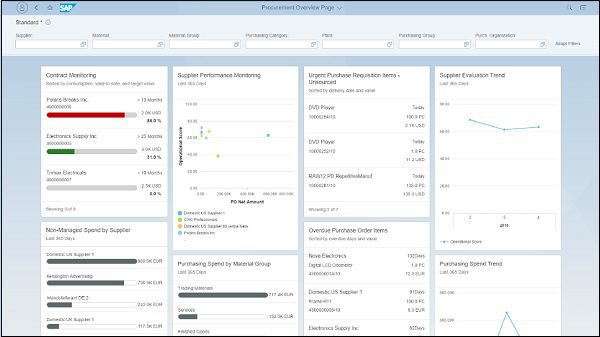

1. SAP Ariba

- G2 Rating: 4.1 out of 5 stars

- Pricing: Contact for pricing details

SAP Ariba is an advanced cloud-based procurement solution designed for both large and midsize organizations. Known for its seamless source-to-pay capabilities, it offers powerful tools to manage spending, optimize supply chain performance, and drive savings. SAP Ariba leverages AI and natural language processing to simplify procurement workflows, making it easier to find suppliers and optimize processes. It’s ideal for businesses looking to enhance collaboration, control costs, and digitize procurement.

Key features:

- Integration with SAP Business Network to foster stronger supplier relationships

- Deep analytics to track spending patterns and identify cost-saving opportunities

- Streamlined global compliance and vendor management in one unified platform

2. Coupa

- G2 Rating: 4.2 out of 5 stars

- Pricing: Contact for pricing details

Coupa delivers a user-centric procurement platform that offers full visibility into procurement processes, helping organizations maximize spending control and overall value. It’s known for its intuitive interface and customizable purchasing workflows, making it easy for teams to manage spend and supplier relations efficiently. Whether it’s streamlining contract management or enhancing compliance, Coupa empowers businesses to unlock greater procurement efficiency.

Key features:

- Comprehensive contract and catalog management, including approvals and punch-outs

- Simplified buying processes for goods and services, increasing procurement speed

- Inventory tracking to ensure optimal stock levels and avoid over-purchasing

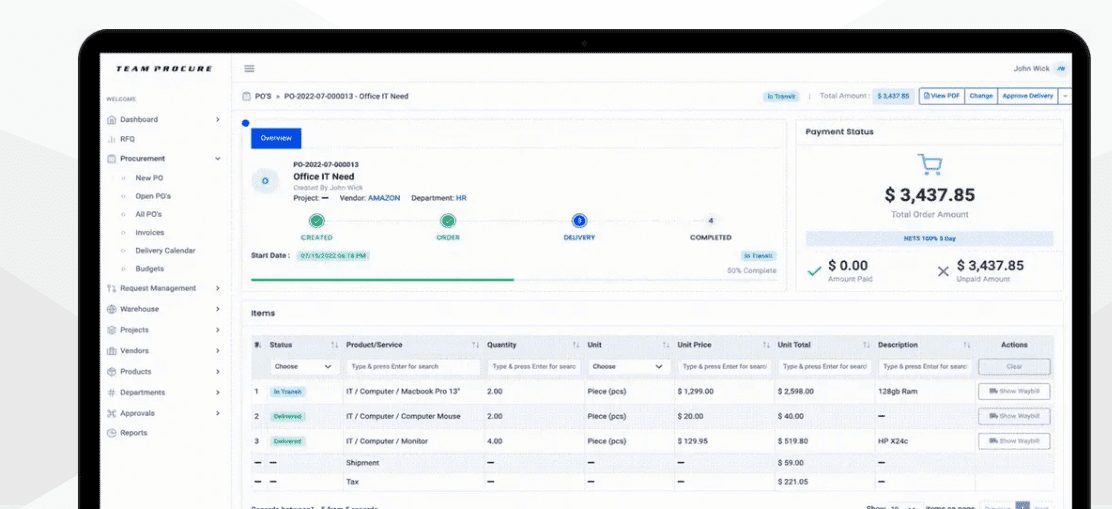

3. Team Procure

- G2 Rating: 5.0 out of 5 stars

- Pricing: Contact for pricing details

Team Procure is a rising star in the procurement space, offering an intuitive platform designed to fit businesses of all sizes. It helps organizations manage the full procurement lifecycle from purchase requests to supplier management, with customizable features tailored to each company’s unique needs. Team Procure is ideal for businesses seeking flexibility and seamless integration with existing systems.

Key features:

- Real-time management of RFQs and e-auction bids across multiple suppliers

- Customizable workflows for approvals and sign-offs, ensuring compliance

- Supplier performance tracking with built-in KPIs to ensure quality and consistency

4. Procurify

- G2 Rating: 4.6 out of 5 stars

- Pricing: Contact for pricing details

Procurify is a robust spend management platform that helps businesses maintain full visibility and control over purchasing activities. By automating workflows, managing vendors, and providing real-time budget insights, the tool ensures a smooth procurement process without sacrificing speed. Whether it’s managing approvals or optimizing team purchases, Procurify’s user-friendly interface empowers teams to make smarter purchasing decisions quickly.

Key features:

- Automated purchasing workflows to reduce administrative overhead

- Vendor management tools to guide smarter buying decisions

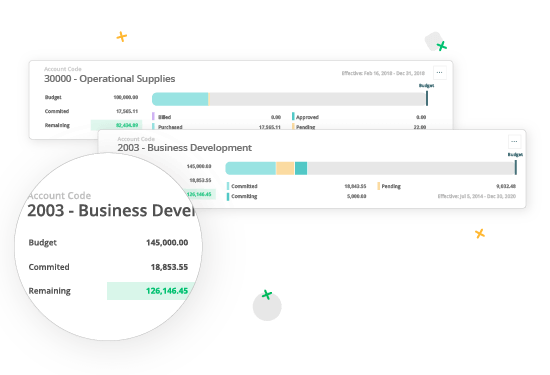

- Real-time budget insights to prevent overspending

5. GEP SMART

- G2 Rating: 4.4 out of 5 stars

- Pricing: Contact for pricing details

GEP SMART is a powerful AI-driven source-to-pay (S2P) platform designed to help organizations streamline procurement while gaining deeper insights into spending patterns. This comprehensive solution combines spend analysis, supplier management, and contract management to deliver end-to-end control over procurement. Its AI-powered tools enhance decision-making and optimize cost management, making it ideal for large enterprises looking to digitalize their procurement processes.

Key features:

- AI-driven insights that help identify savings and drive smarter sourcing decisions

- Seamless integration with existing procurement workflows for greater efficiency

- End-to-end supplier and contract management for full procurement visibility

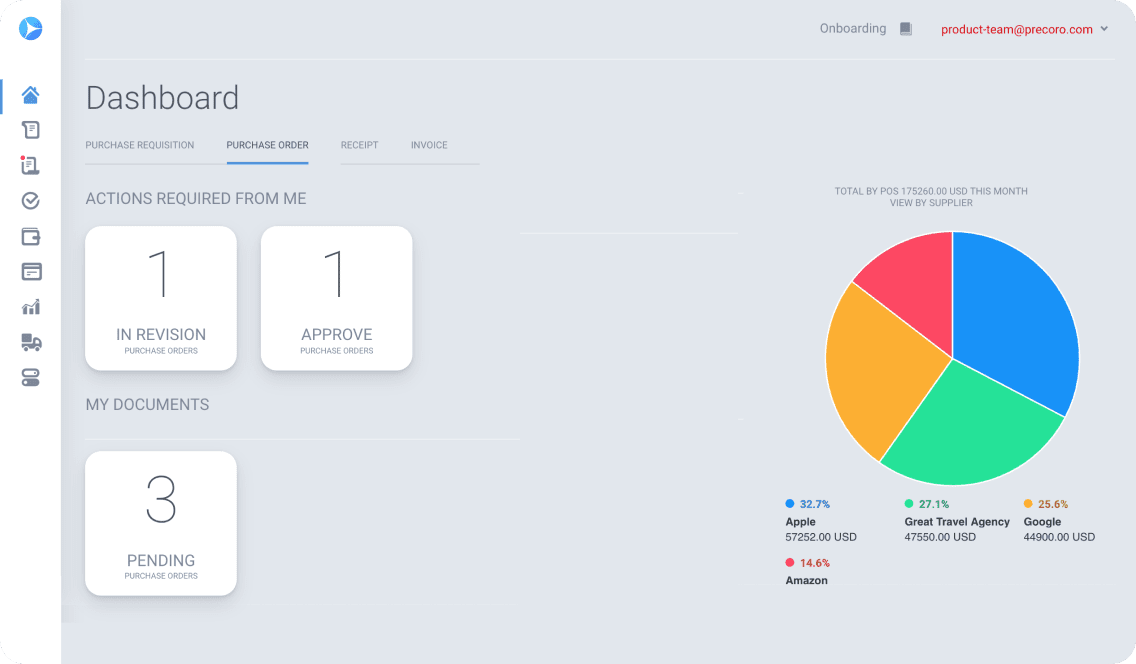

6. Precoro

- G2 Rating: 4.7 out of 5 stars

- Pricing: Packages starting at $499/month

Precoro is designed for teams looking to automate and simplify procurement. This all-in-one platform enables businesses to streamline purchase order creation, approval workflows, and budgeting processes. With its mobile app and robust reporting features, Precoro ensures procurement teams can make real-time decisions, while reducing manual errors and optimizing costs.

Key features:

- Real-time purchase order creation and approval from anywhere with the mobile app

- Customizable reporting options with over 120 fields for detailed insights

- Smart notifications to ensure timely approvals and spending control

Precoro is procurement software that helps eliminate manual errors, reduce expenses, and save time. Teams can use Precoro to generate purchase orders, approve process steps, and generate reports. Precoro can also manage budgets, track inventory, and integrate with the tools you’re already using.

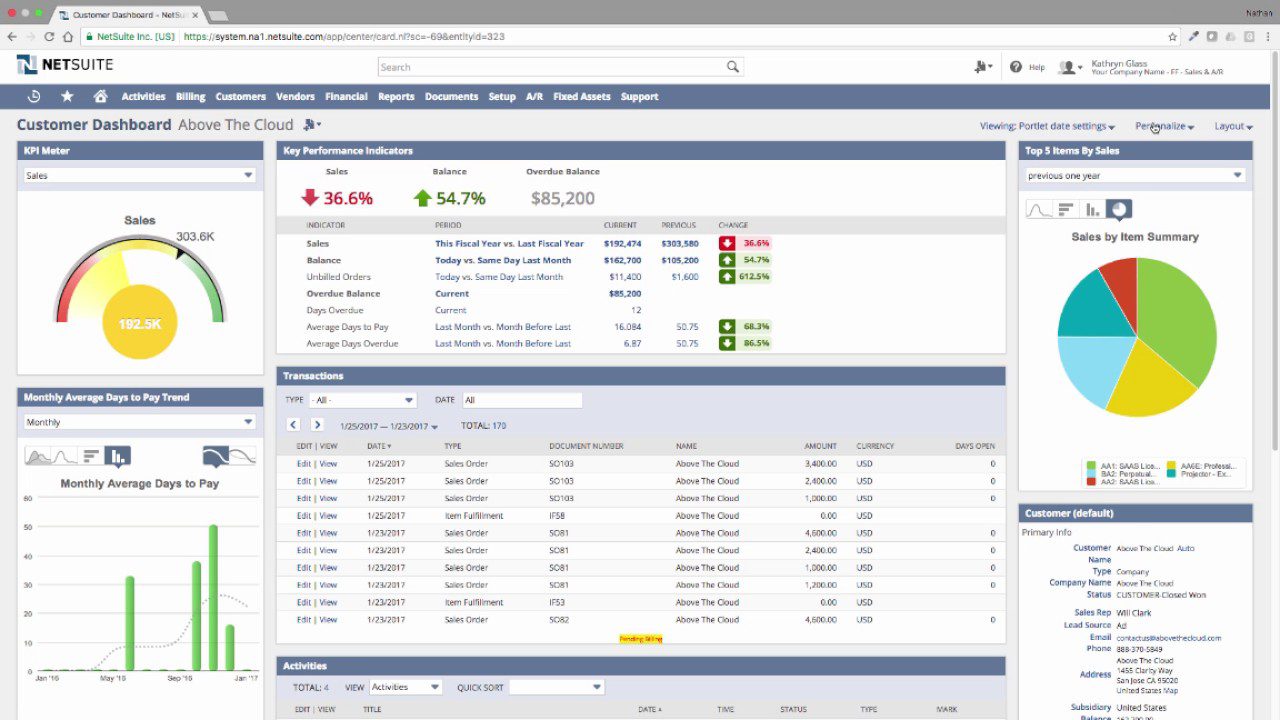

7. Netsuite Procurement

- G2 Rating: No ratings available

- Pricing: Contact for pricing details

Netsuite Procurement simplifies vendor and inventory management, making it easier for teams to track purchases and optimize procurement operations. As part of the Oracle suite, it provides seamless integration with financial and operational tools, ensuring a unified experience across departments. It’s perfect for businesses looking for a comprehensive, scalable solution for procurement and spend management.

Key features:

- Real-time visibility into vendor performance and spending

- Streamlined procurement workflows with automated purchase approvals

- Integration with Oracle and Netsuite products for greater operational efficiency

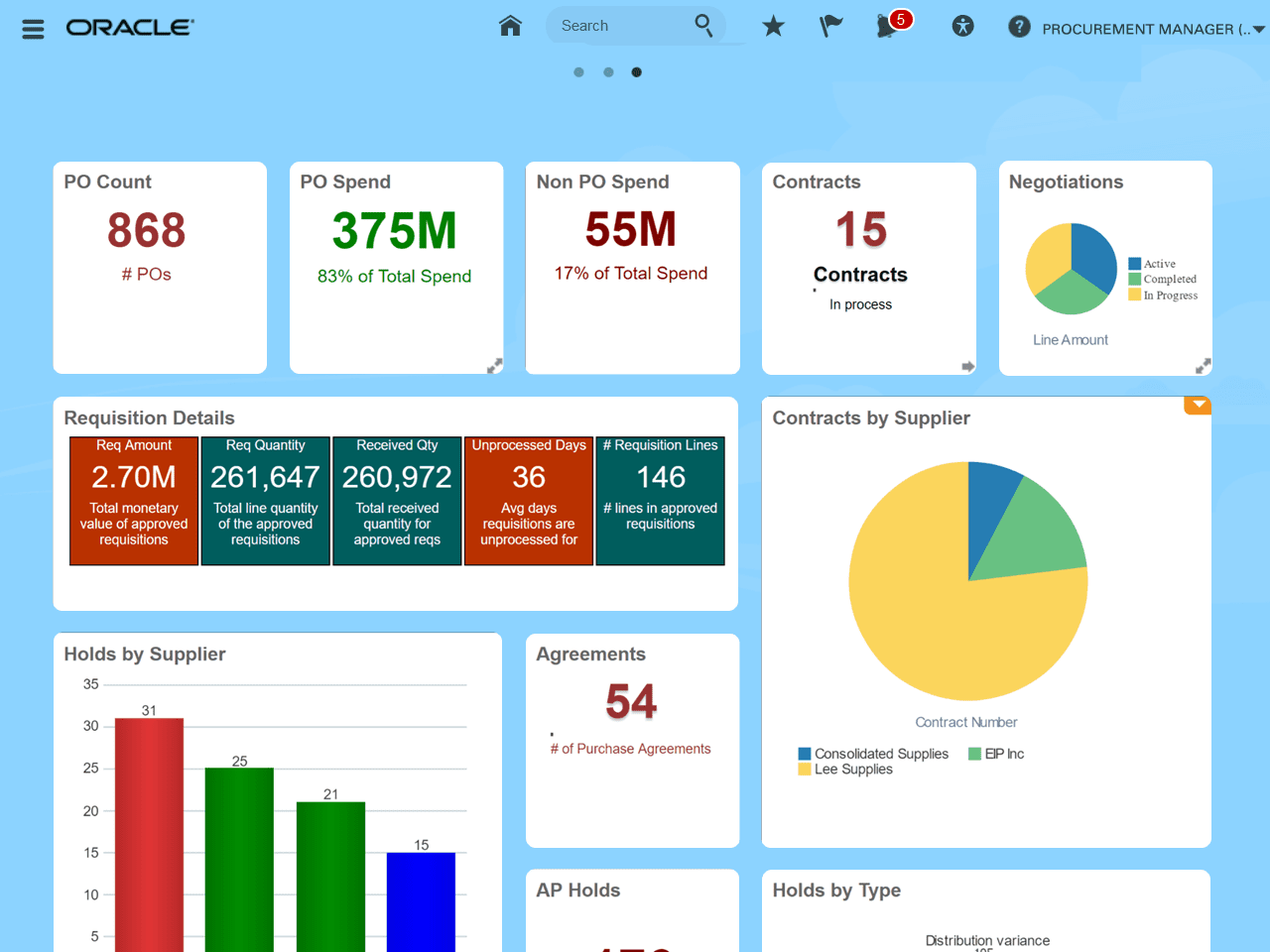

8. Oracle Procurement Cloud

- G2 Rating: 4.2 out of 5 stars

- Pricing: Starts at $650/user/month

Oracle Fusion Cloud is a comprehensive procurement suite that offers everything from strategic sourcing to supplier management. Designed for large enterprises, this platform streamlines procurement tasks and enhances supplier collaboration. By leveraging AI and analytics, Oracle Fusion Cloud drives spend optimization, reduces risks, and ensures compliance across complex procurement processes.

Key features:

- AI-powered features that enhance productivity and identify new savings opportunities

- End-to-end contract lifecycle management for full procurement transparency

- Built-in analytics to track procurement performance and optimize supplier relationships

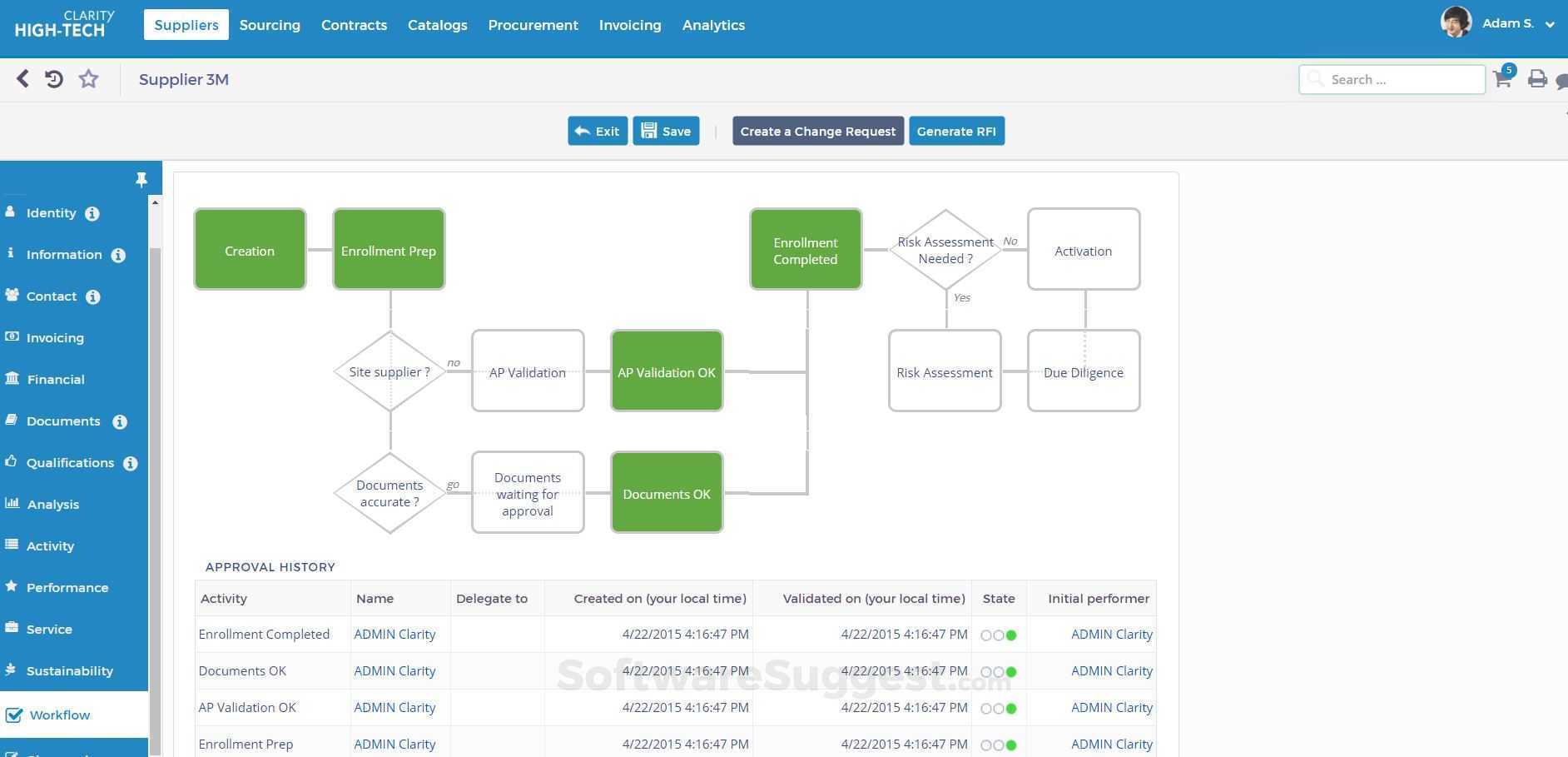

9. Ivalua

- G2 Rating: 4.3 out of 5 stars

- Pricing: Contact for pricing details

Ivalua provides a unified source-to-pay platform with tools designed to improve supplier collaboration, enhance compliance, and reduce procurement costs. By leveraging automation, Ivalua helps teams streamline purchasing processes, ensure data accuracy, and gain insights that drive better decision-making. It’s ideal for organizations looking to improve procurement efficiency and maximize ROI.

Key features:

- Comprehensive spend visibility across the S2P lifecycle to optimize purchasing decisions

- Seamless collaboration tools that ensure secure supplier engagement

- AI-powered insights to maximize procurement ROI and reduce operational risks

10. Jaggaer

- G2 Rating: 4.4 out of 5 stars

- Pricing: Contact for pricing details

Jaggaer offers a highly flexible procurement platform that covers everything from supplier management to sourcing, contract management, and invoicing. With its “autonomous commerce” approach, Jaggaer allows businesses to build customized digital procurement solutions that match their specific needs, all while streamlining workflows and improving operational efficiency.

Key features:

- Optimized contract compliance and guided buying experiences

- Modular solutions that integrate with existing procurement and finance systems

- Real-time inventory management to reduce redundant purchases and improve efficiency

11. Zycus Source-to-Pay

- G2 Rating: 3.6 out of 5 stars

- Pricing: Contact for pricing details

Zycus combines advanced AI with a robust S2P platform to help businesses optimize procurement processes, reduce risks, and increase efficiency. With a focus on supplier management, spend analysis, and project tracking, Zycus provides the insights and tools necessary to drive smarter procurement decisions across the organization.

Key features:

- AI-powered spend analysis to unlock potential savings

- Supplier risk management and performance assessment tools

- Seamless collaboration through a built-in supplier network

12. Kissflow

- G2 Rating: 4.3 out of 5 stars

- Pricing: Contact for pricing details

Kissflow offers a flexible procurement solution that simplifies the procurement process while providing complete control over purchasing workflows. It’s designed to streamline approval processes, improve budget management, and ensure seamless integration with other business tools. It’s ideal for businesses looking for a straightforward solution with powerful automation capabilities.

Key features:

- Three-way matching of invoices, goods receipts, and purchase orders

- Customizable budget management rules to prevent overspending

- Drag-and-drop workflow customization for easy process design

Barriers to E-Procurement Implementation

No matter how advanced the new digital procurement solution is, your implementation will face challenges. Moving your entire procurement operation online can sound like a daunting endeavor, but there are some great ways for managers to break down common barriers to digital procurement implementation.

1. Preference for legacy systems

Once employees are used to doing their jobs in a certain way, it can be very difficult for them to break free of old habits—even when the impending change is making their lives easier. It’s important to make room for this sentiment when planning the rollout of your new system. Set realistic timelines for all updates and communicate the importance and benefits of the new system to enable effective change management within the company.

2. Organized data

Digital procurement systems consolidate siloed tools like emails, spreadsheets, chats, etc., and offer the ability to manage the entire vendor lifecycle from a single interface. The data on all vendor interactions end up in a centralized repository, making it easy to access vendor details anytime and create visual performance reports.

3. Expense of new technology

When shifting from doing things ‘the old-fashioned way’ to doing them entirely online, the price tag of your new digital procurement software is likely to shock managers. This makes sense – it’s probably a big jump. You can reassure them that this jump in cost will be offset significantly by the savings and opportunities it will bring.

4. On-demand performance support

Post-implementation, end-users will require support in the flow of work. Simple onboarding and training won’t suffice, and organizations need to provide detailed support for employees at the moment of need to ensure preferred vendors are selected, procurement workflow governance is met, and compliance is met.No matter how advanced the new digital procurement solution is, your implementation will face challenges. Moving your entire procurement operation online can sound like a daunting endeavor, but there are some great ways for managers to break down common barriers to digital procurement implementation.

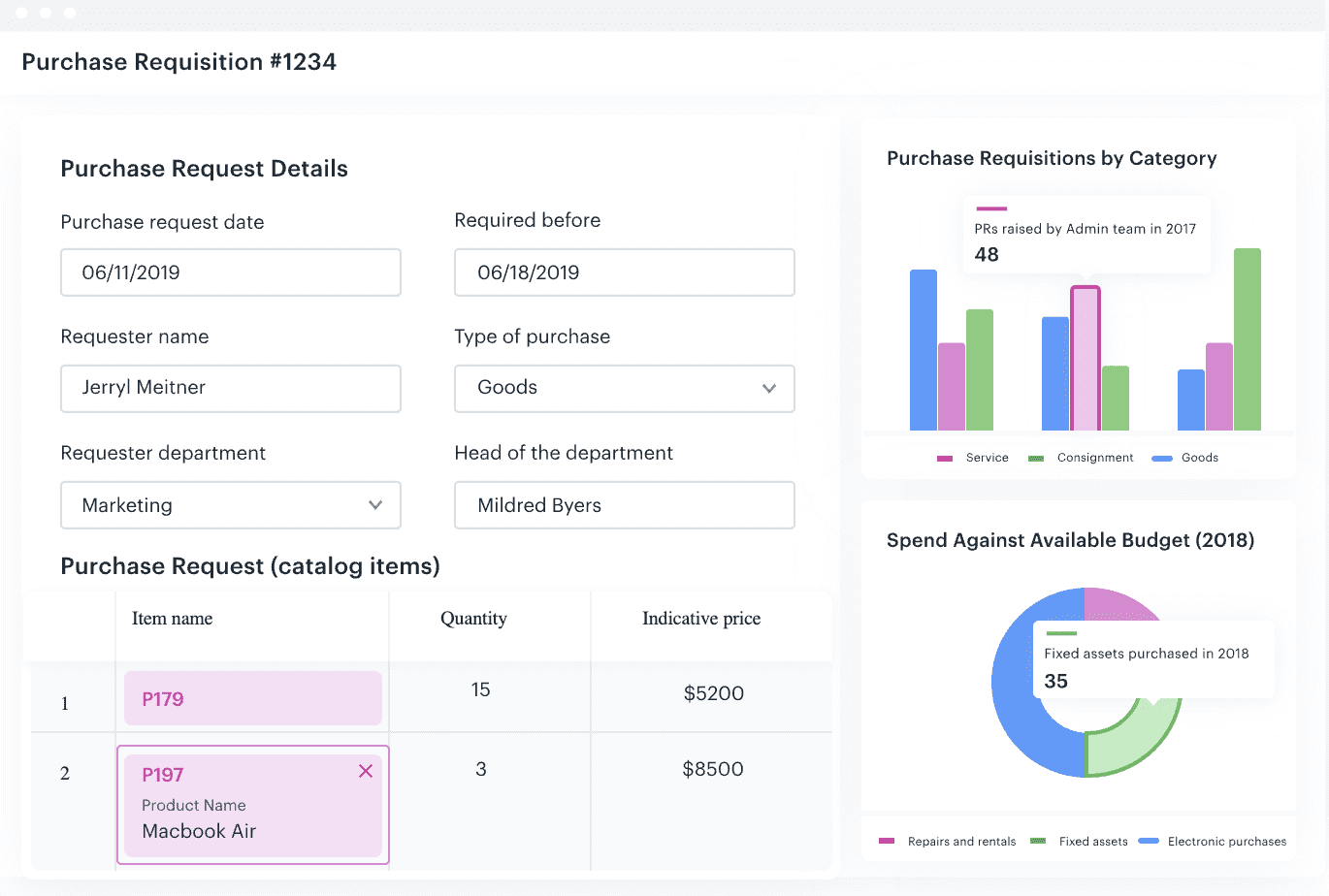

What to Consider Before Purchasing a Procurement Software

S2P and procurement software are mission-critical to many organizations’ day-to-day operations. Before starting the procurement software buying process, IT teams and supply chain application owners must understand their procurement application needs, current S2P infrastructure, and current procurement challenges.

Here are a few “before you buy” considerations to remember before starting your procurement software purchasing process:

- Current S2P application stack: What procurement application do you currently use? Inventory all applications used in your procurement process to ensure that any new solution doesn’t have duplicate features and will integrate with these tools.

- S2P suite or individualized “best-of-breed” application: What are your contextual procurement needs? Do you need a solution to manage the entire S2P process, or just certain parts of it? This will help guide you on the type of application you need.

- Communication and collaboration features: Keeping relevant conversations about procurement decisions or contracts in your software can ensure everyone has the information they need to make appropriate decisions.

- Budget insights: When purchasing new materials, you need to monitor your budget. A tool with insights into your budget will make it easier to identify when you’re at risk of spending too much.

- Automation: Automation tools drive productivity and efficiency. Procurement software with automation tools can help you improve accuracy, reduce errors, and keep processes running smoothly.

- Implementation and adoption strategy: While procurement software vendors will promise quick ROI, the reality is that without a change and onboarding strategy built around the people using this new technology (employees, suppliers, vendors), your end-users will fail to find value in the tool with low digital procurement adoption.

How to Drive E-Procurement Adoption

Despite the digital transformation challenges, your change management team can overcome these barriers to digital procurement adoption with a few tactical strategies.

1. Create a cross-department change team

While the procurement team might be most likely to use your e-procurement software, this change in operations will have a company-wide effect. Building a team of inter-department employees to develop a rollout plan will ensure that your implementation plan covers every base and satisfies the needs of various team members.

2. Create personalized onboarding and training based on role

Employees in different roles will use your new procurement software differently depending on their role responsibilities and tasks. This means the onboarding process must cater training directly to the needs of team members in different positions.

While this may initially mean a bit of extra work, knowing that your employees are well-equipped to take full advantage of your e-procurement solution will ease anxieties and result in a higher overall return on investment with high overall software adoption.

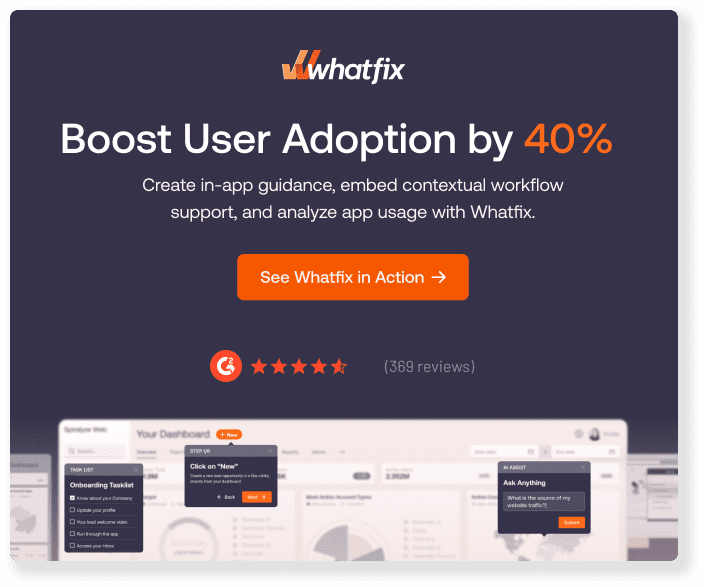

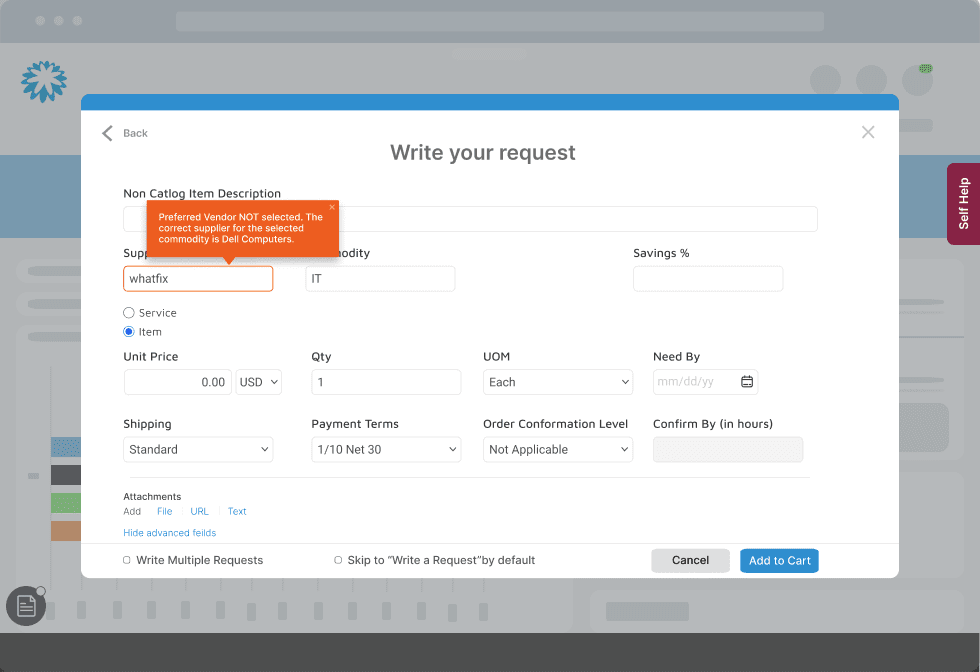

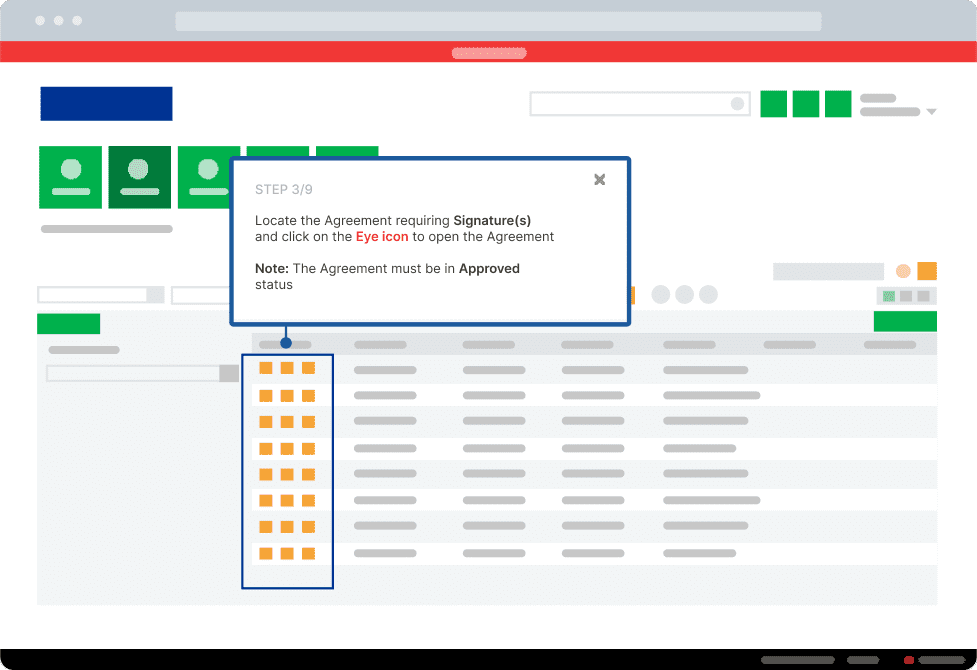

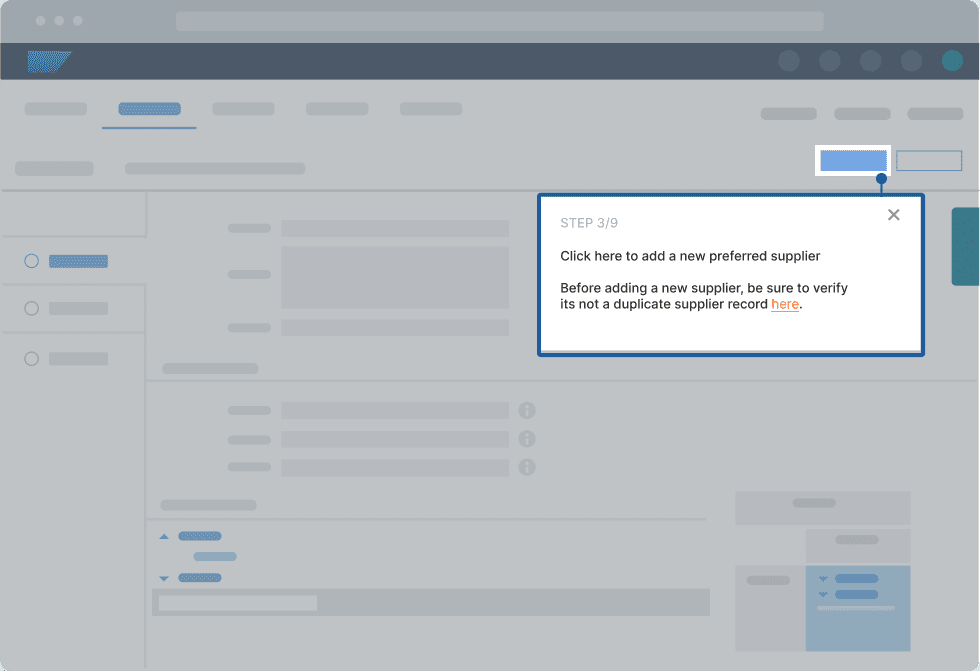

A digital adoption platform (DAP) like Whatfix can significantly speed up the time it takes for users to become proficient with a new S2P application. It achieves this by providing in-app guided training experiences. With Whatfix, new users receive support through features such as Tours, Task Lists, Flows, Smart Tips, and other in-app guidance, all designed to assist employees seamlessly while they work.

3. Invest in a DAP for in-app guidance

When implementing a new e-procurement solution, it will be critical to provide necessary training and support as employees get used to doing their jobs in a completely new way. Investing in a DAP like Whatfix will improve the outcome of your digital procurement implementation by providing easy-to-use tools for in-app support.

A DAP provides L&D, IT teams, and S2P application owners with the tools to create in-app guidance and on-demand help content with a no-code editor that lays directly on your S2P and procurement applications.

With Whatfix, enable your procurement end-users with:

- Tours and Task Lists to accelerate time-to-proficiency for new procurement team members.

- Flows to guide users through complex workflows or infrequently done tasks.

- Pop-Ups to alert employees of procurement process changes, regulatory laws, company news, or upcoming deadlines.

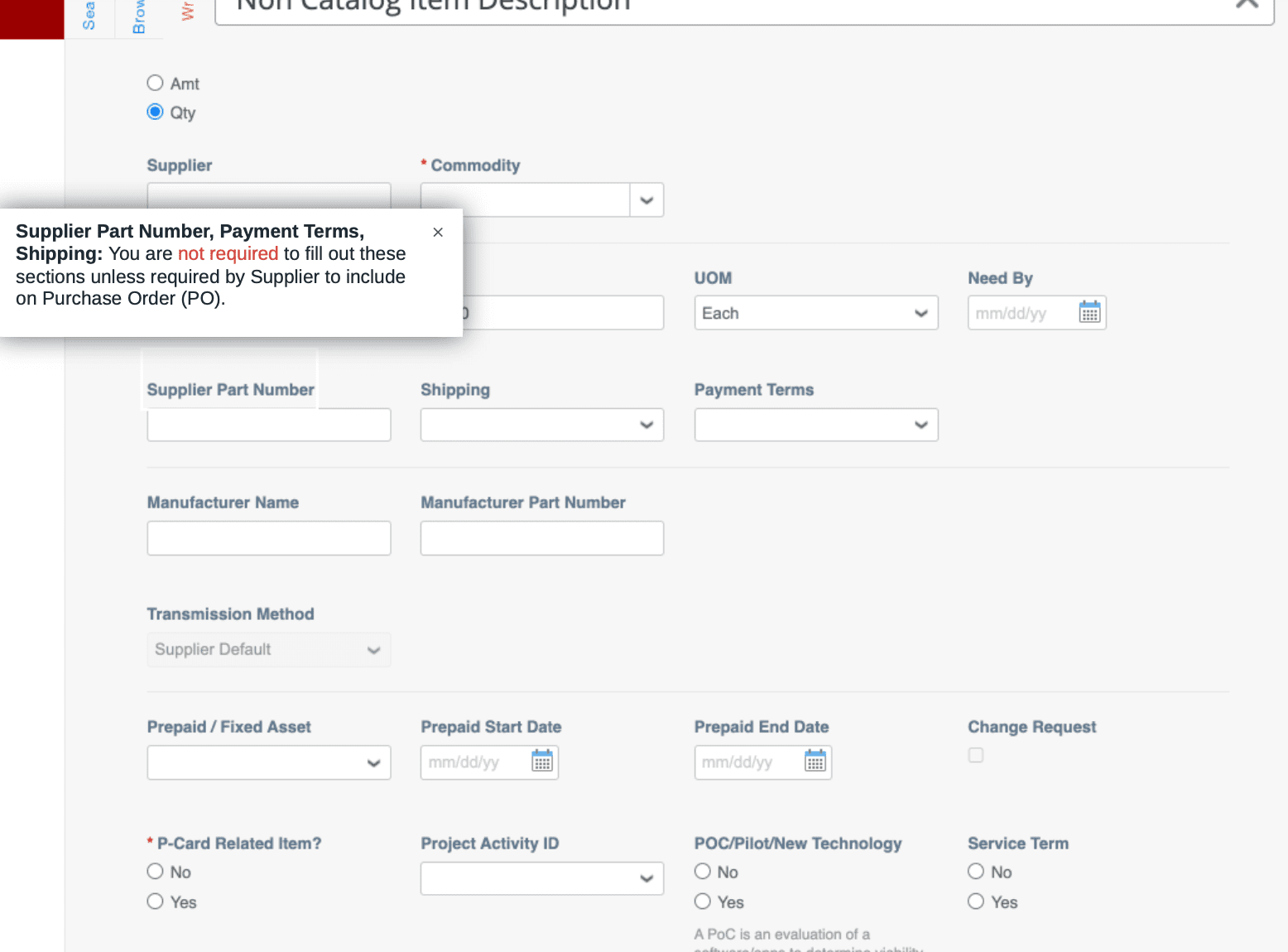

- Smart Tips to nudge end-users to take a specific action or provide additional information at critical steps in your S2P process.

4. Provide your employees with real-time performance support

Learning how to use new software can be difficult, especially for employees who have been around for many years. To boost digital procurement adoption, it’s important to provide your employees with avenues for real-time support to make them feel secure, appreciated, and supported to work their way through the new system.

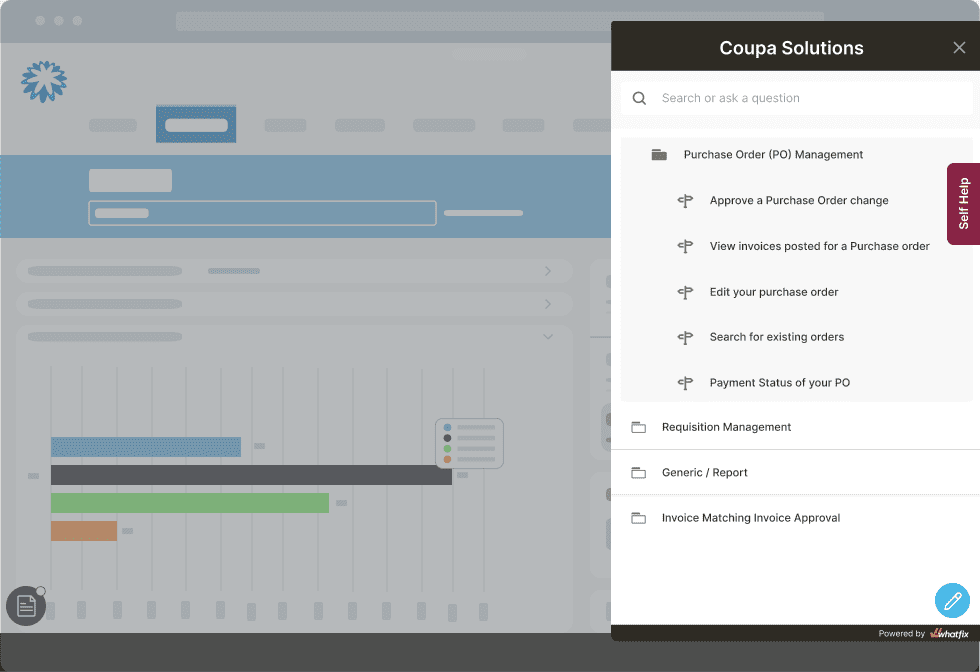

With a tool like Whatfix, teams can embed a self-help knowledge base directly into their procurement applications, allowing end-users to find help content and answers to common challenges and process questions.

When using an S2P or digital procurement tool, employees must correctly input data and adhere to proper workflows to keep their data clean and to achieve ROI from their procurement system. With Whatfix, procurement leaders can create smart tips that remind end-users of mandatory fields they must update for orders, suppliers, and vendors.

5. Keep employees updated on digital procurement implementation projects

It can be frustrating for employees to feel like they’re being dragged around as big changes are happening. Keeping team members in the loop as your e-procurement implementation project evolves could make all the difference in how they approach the change.

Regularly communicate with employees affected by the change and ensure they have a clear avenue for support if they encounter any issues during implementation.

6. Ask employees for feedback on the implementation

The best way to ensure your implementation plan works is to solicit regular feedback on training efforts and their feelings about the digital procurement software itself. Addressing any issues that arise here will be critical to successfully implementing and driving digital procurement adoption.

With Whatfix, organizations can gather end-user feedback from employees, suppliers, and vendors directly in their S2P and procurement applications and digital processes to understand and improve adoption, onboarding, and end-user support.

7. Track application onboarding, process governance, and overall e-procurement adoption with analytics

In addition to asking for direct feedback, getting quantitative data that shows how the implementation is going is greatly helpful in ensuring success. Employing a digital adoption platform can help here by providing data analytics to clearly show user engagement with the new system and their adoption progress. Seeing where team members are getting stuck while handling the new software helps modify the training flows to make the adoption plan as successful as possible.

With a DAP like Whatfix, organizations can capture user events to understand user adoption and understand:

- How employees are engaging with new procurement applications.

- What features or processes are not being adopted.

- What help content and in-app guidance are working, what needs to be improved, and what new content should be created.

- Where users are struggling (i.e., identify friction points.)

- How long it takes employees to become productive with new digital procurement processes.

Procurement Software Clicks Better With Whatfix

Procurement software is complex, and enterprises must build customized processes and workflows that help them achieve e-procurement objectives and goals.

Finding ROI from your procurement software investment depends on how well you prepare and support your procurement software end-users—i.e., the employees, suppliers, and vendors using the platform.

With a digital adoption platform (DAP) like Whatfix, organizations can enable end-users with contextual, in-app guided experiences and self-help support to unlock the true potential of procurement applications and digital processes.

With Whatfix, enable your procurement end-users by:

- Guiding users through the procurement system’s features, tasks, and processes with interactive flows, tours, and task lists.

- Alerting and nudging users with in-app smart tips, beacons, and field validations.

- Providing users with Self Help, which crawls your organization’s knowledge and documentation and curates it into a searchable, embedded self-help wiki that serves as a help center for your end-users.

Take it a step further with Whatfix Mirror and create replicate sandbox environments of your enterprise applications to provide hands-on training in an interactive, risk-free training environment – perfect for new hires, change training, upskilling, and testing new workflows.

Whatfix for procurement and S2P applications puts the information and context your employees need right within the application, guiding them precisely when they need it most. Automate your processes and boost employee productivity while ensuring you get the most out of your new procurement software investment.