What Is an Insurance Chatbot? (+Use Cases, Examples)

Seeking to automate repeatable processes in your insurance business, you must have heard of insurance chatbots.

Insurance chatbots have a range of use cases, from lead generation to customer service. They take the burden off your agents and create an excellent customer experience for your policyholders. You can either implement one in your strategy and enjoy its benefits or watch your competitors adopt new technologies and win your customers.

Below you’ll find everything you need to set up an insurance chatbot and take your first steps into digital transformation.

What Is An Insurance Chatbot?

An insurance chatbot is a virtual assistant solution that facilitates communication between an insurance company and its customers. Chatbots can be AI-powered or rule-based.

- Rule-based insurance chatbots can start conversations, offer support, and process requests based on pre-defined rules. An agent creates workflows to map out the most common scenarios, and a bot follows them when answering standard user questions. Rule-based chatbots can resolve simple issues, but they don’t provide you with all the opportunities AI chatbots do.

- AI-driven insurance chatbots are virtual assistants trained to simulate human-like conversations and process requests independently. AI chatbots can be helpful in a lot more scenarios than rule-based chatbots. They understand user intent and reply to queries that haven’t been pre-defined.

Before they can adequately perform their functions, AI chatbots should be trained. A bot should learn the keywords and their synonyms, recognize frequently asked questions (FAQs) and understand the customer’s intent. The good thing is that the initial training process doesn’t take long, and you can start using your chatbot almost immediately.

In combination with powerful insurance technology, AI chatbots facilitate underwriting, customer support, fraud detection, and various other insurance operations.

Benefits Of Insurance Chatbots

With a proper setup, your agents and customers witness a range of benefits with insurance chatbots.

1. 24/7 Customer support

Insurance chatbots, rule-based or AI-powered, let you offer 24/7 customer support. No more wait time or missed conversations — customers will be happy to know they can reach out to you anytime and get an immediate response.

2. Easy claims processing and settlement

Forty-four percent of customers are happy to use chatbots to make insurance claims. Chatbots make it easier to report incidents and keep track of the claim settlement status.

3. Security

With quality chatbot software, you don’t need to worry that your customer data will leak. If you build a sophisticated automated workflow, you don’t have to give your employees access to customers’ sensitive data — your chatbot will process it all by itself. Ensuring chatbot data privacy is a must for insurance companies turning to the self-service support technology.

4. Multilingual support

How many languages do your agents speak? A chatbot can support dozens of languages without the need to hire more support agents.

5. Cost reduction

Chatbots helped businesses to cut $8 billion in costs in 2022 by saving time agents would have spent interacting with customers.

You also don’t have to hire more agents to increase the capacity of your support team — your chatbot will handle any number of requests.

6. Improve agent productivity

Sixty-four percent of agents using AI chatbots and digital assistants are able to spend most of their time solving complex problems. If you’re looking for a way to improve the productivity of your employees, implementing a chatbot should be your first step.

7. More engaged customers

Insurance chatbots helps improve customer engagement by providing assistance to customers any time without having to wait for hours on the phone.

Also, if you integrate your chatbot with your CRM system, it will have more data on your customers than any human agent would be able to find. It means a good AI chatbot can process conversations faster and better than human agents and deliver an excellent customer experience.

8. Lead generation

A chatbot is a perfect tool for lead generation without pressure. You just need to add a contact form for users to fill before talking to the bot.

Top 8 Use Cases of Insurance Chatbots

What exactly an insurance chatbot can do for you? Here are eight chatbot ideas for where you can use a digital insurance assistant.

1. Policy management

When integrated with your business toolkit, a chatbot can facilitate the entire policy management cycle. Your customers can turn to it to apply for a policy, update account details, change a policy type, order an insurance card, etc.

2. Advertising and promotion

Chatbots are often used by marketing teams to support promotional campaigns and lead generation. You can use your insurance chatbot to inform users about discounts, promote whitepapers, and/or capture leads.

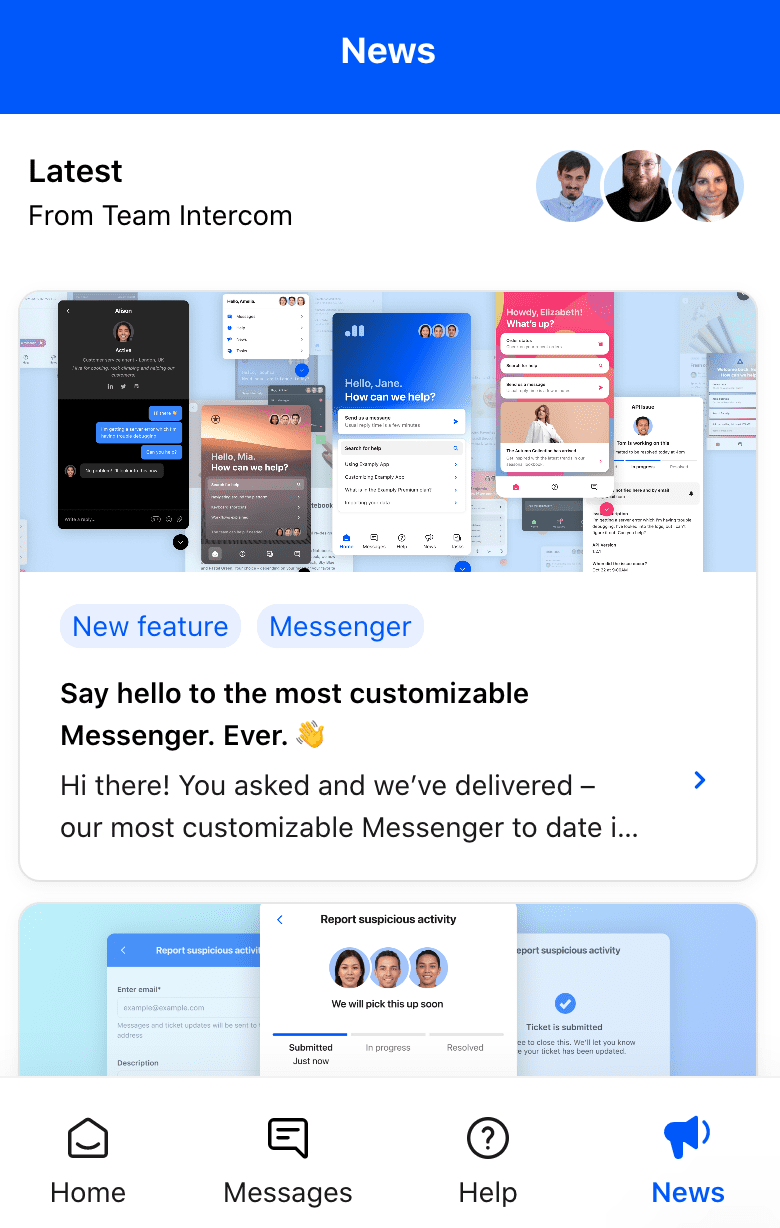

An example of Intercom using a chat box to promote new product features

3. Claims processing and settlement

Successful insurance companies use chatbots for claims handling. An insurance chatbot can tackle the entire claims and settlement process: from incident reporting to updating customers on the status of their claims.

Incidents themselves are stressful enough for policyholders. Adding the stress of waiting hours or even days for insurance agents to get back to them, just worsens the situation. A chatbot is always there to assist a policyholder with filling in an FNOL, updating claim details, and tracking claims. It can also facilitate claim validation, evaluation, and settlement so your agents can focus on the complex tasks where human intelligence is more needed.

4. Payment collection

Chatbots create a smooth and painless payment process for your existing customers.

If you have an insurance app (you do, right?), you can use a bot to remind policyholders of upcoming payments. A bot can also handle payment collection by providing customers with a simple form, auto-filling customer data, and processing the payment through an integration with a third-party payment system.

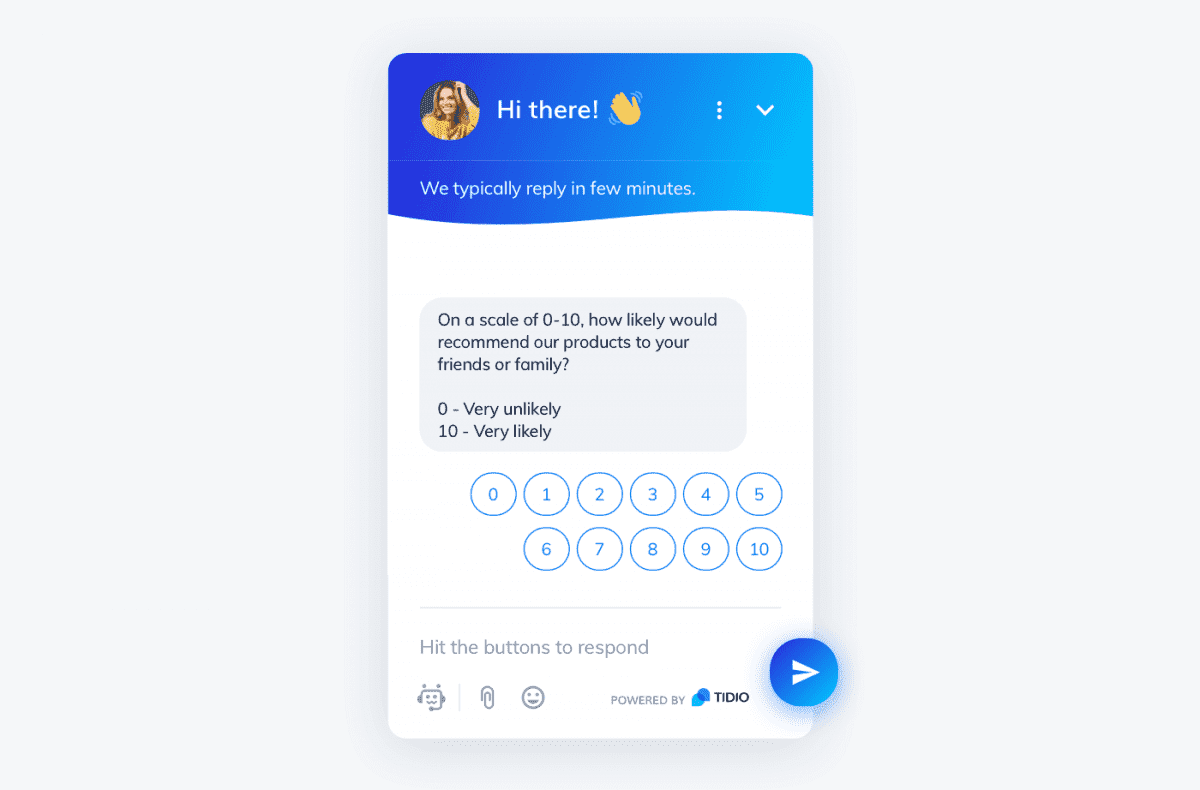

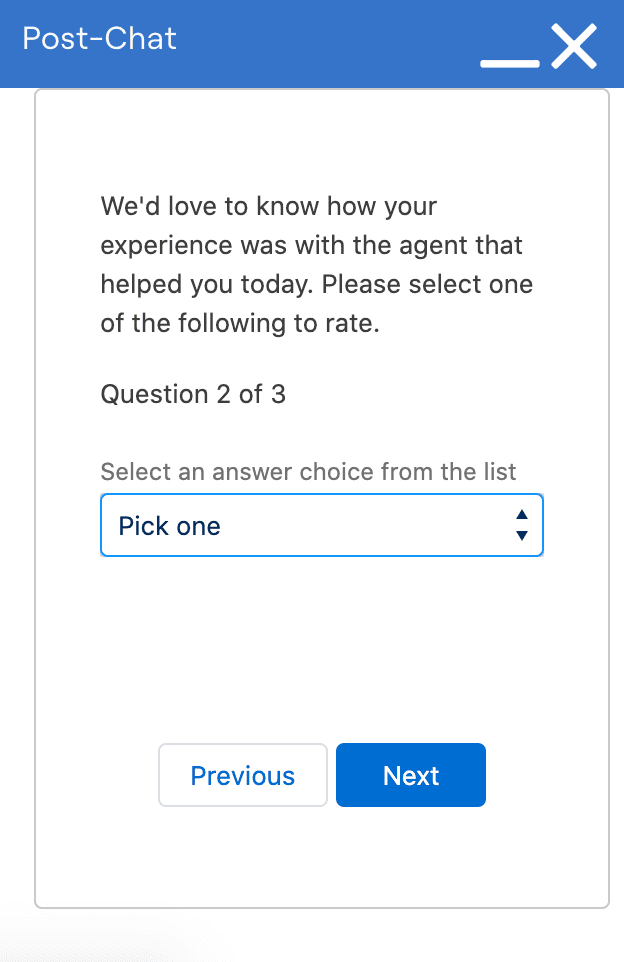

5. Feedback and loyalty

Another simple yet effective use case for an insurance chatbot is feedback collection.

Whether you choose to use a simple NPS (Net Promoter Score) survey or a detailed customer experience questionnaire, a chatbot helps you attract user attention and drive more answers than any other method.

It’s particularly effective to collect customer feedback after a chatbot has handled a request or processed a claim — in doing so, you’ll collect the data that helps you better train your chatbot and improve its performance.

6. Provide advice and information

The most obvious use case for a chatbot is handling frequently asked questions. A virtual assistant answers prospects’ and customers’ questions, triggers troubleshooting scenarios, and collects data for human agents to resolve complex issues.

Connect your chatbot to your knowledge management system, and you won’t need to spend time replying to basic inquiries anymore.

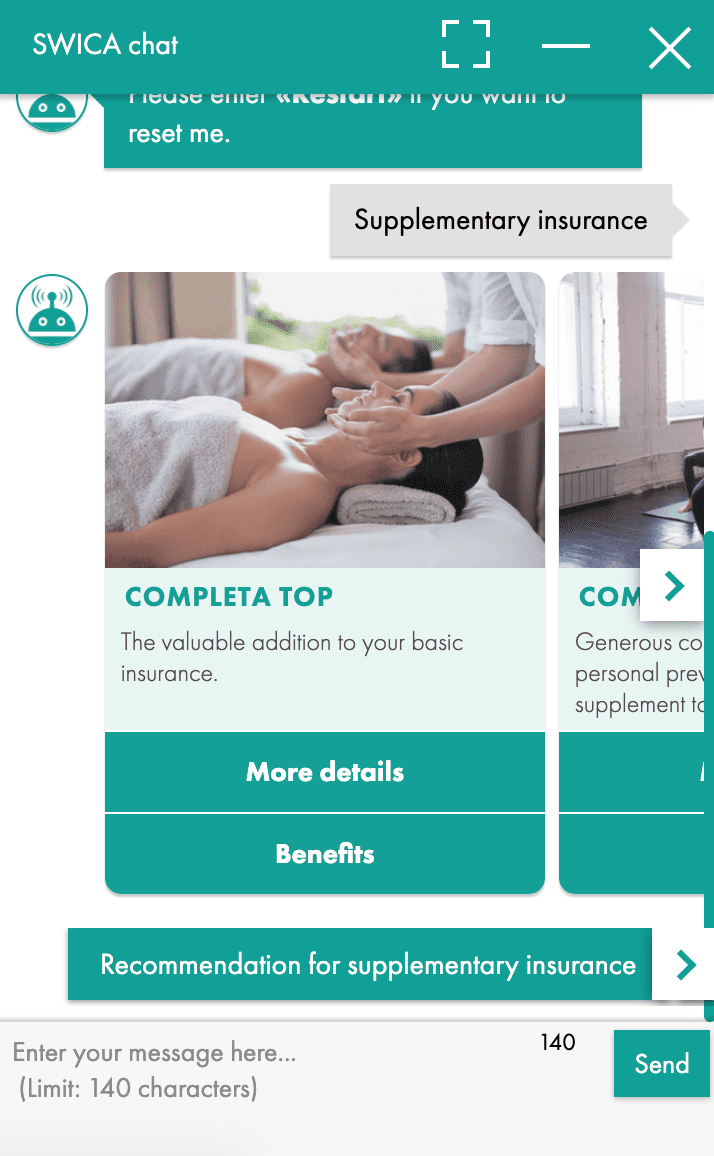

7. Cross-selling and upselling

Using a chatbot to gain new customers is good. But the marketing capabilities of insurance chatbots aren’t limited to new customer acquisition.

You can run upselling and cross-selling campaigns with the help of your chatbot. Upgrading existing customers or offering complementary products to them are the two most effective strategies to increase business profits with no extra investment.

Feed customer data to your chatbot so it can display the most relevant offers to users based on their current plan, demographics, or claims history.

How SWICA cross-sells with the help of a chatbot

8. Fraud detection

McKinsey predicts that AI-driven technology will be a prevailing method for identifying risks and detecting fraud by 2030. Clearly, AI chatbots will be a part of the process.

But you don’t have to wait for 2030 to start using insurance chatbots for fraud prevention. Integrate your chatbot with fraud detection software, and AI will detect fraudulent activity before you spend too many resources on processing and investigating the claim.

5 Examples of Insurance Chatbots

Successful insurers heavily rely on automation in customer interactions, marketing, claims processing, and fraud detection. Let’s look at some examples of insurance chatbots to prove it.

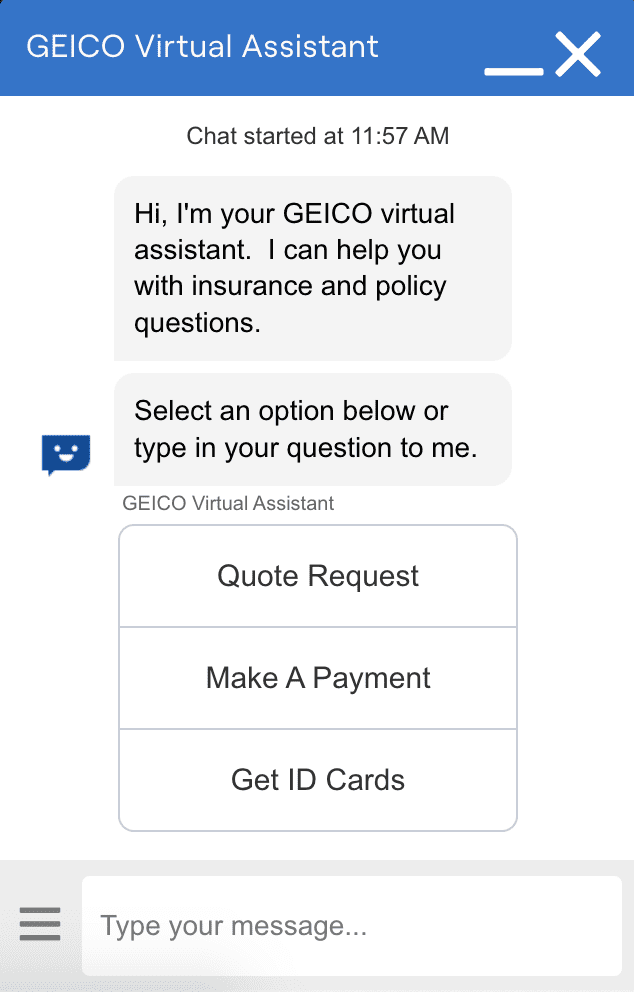

1. GEICO

GEICO, an auto insurance company, has built a user-friendly virtual assistant that helps the company’s prospects and customers with insurance and policy questions.

GEICO’s virtual assistant starts conversations and provides the necessary information, but it doesn’t handle requests. For instance, if you want to get a quote, the bot will redirect you to a sales page instead of generating one for you.

On the positive side, the chatbot is capable of recognizing message intent. If you enter a custom query, it’s likely to understand what you need and provide you with a relevant link.

When the conversation is over, the bot asks you whether your issue was resolved and how you would rate the help provided. Users can also leave comments to specify what exactly they liked or didn’t like about their support experience, which should help GEICO create an even better chatbot.

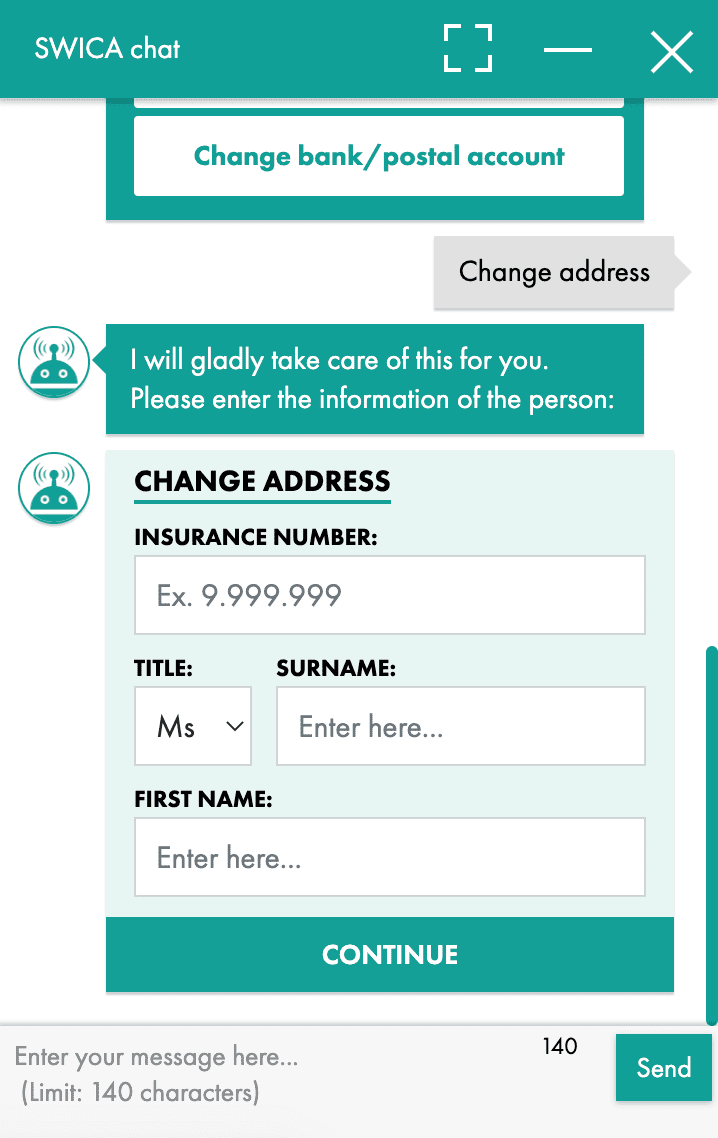

2. SWICA

SWICA, a health insurance company, has built a very sophisticated chatbot for customer service.

Not only the chatbot answers FAQs but also handles policy changes without redirecting users to a different page. Customers can change franchises, update an address, order an insurance card, include an accident cover, and register a new family member right within the chat window.

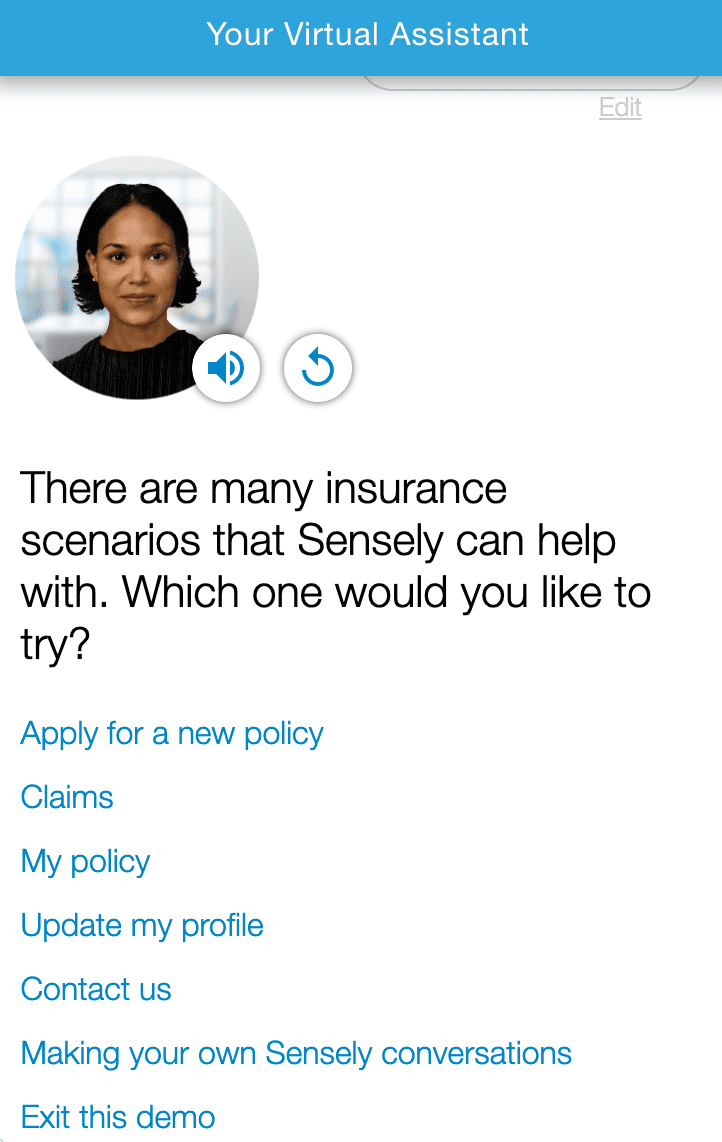

3. Sensely

Sensely is a conversational AI platform that assists patients with insurance plans and healthcare resources.

Sensely’s services are built upon using a chatbot to increase patient engagement, assess health risks, monitor chronic conditions, check symptoms, etc. Every time a customer needs help, they turn to Sensely’s virtual assistant. This is one of the best examples of an insurance chatbot powered by artificial intelligence.

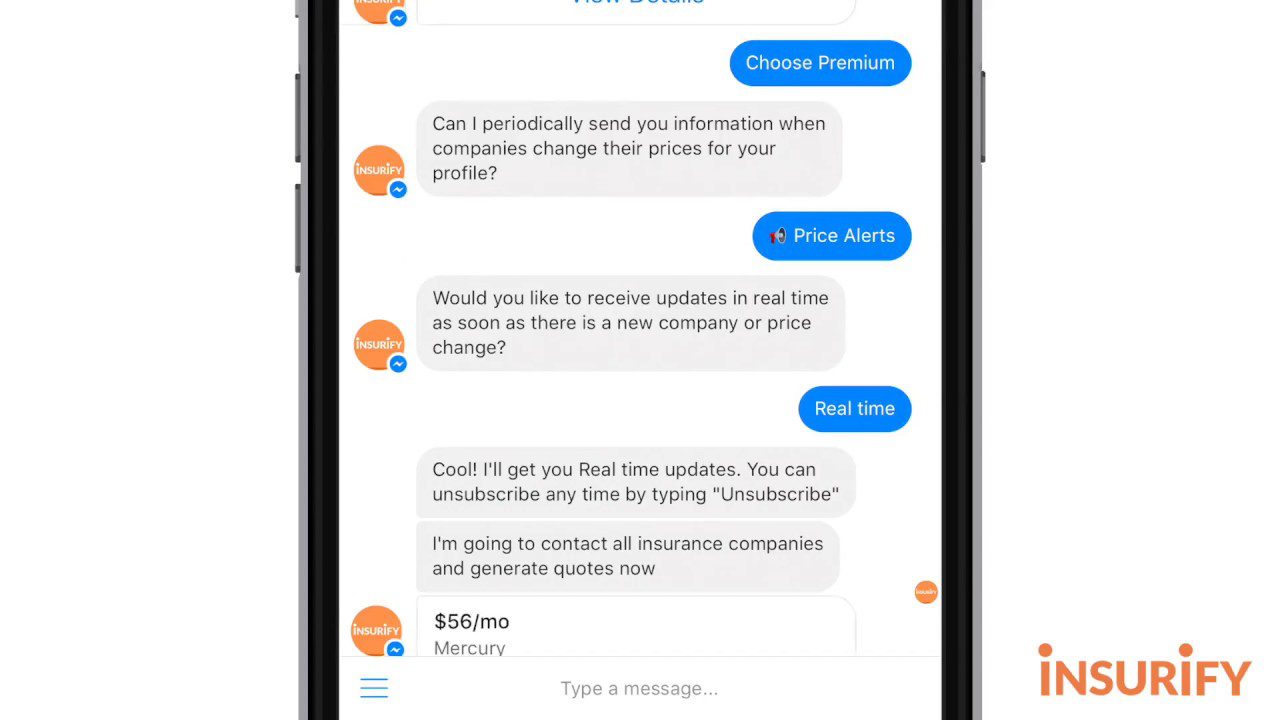

4. Insurify

Insurify, an insurance comparison website, was among the first champions of using chatbots in the insurance industry.

Its chatbot asks users a sequence of clarifying questions to help them find the right insurance policy based on their needs. The bot is powered by natural language processing and machine learning technologies that makes it possible for it to process not only text messages but also pictures (e.g. photos of license plates). It operates within the Facebook Messenger app.

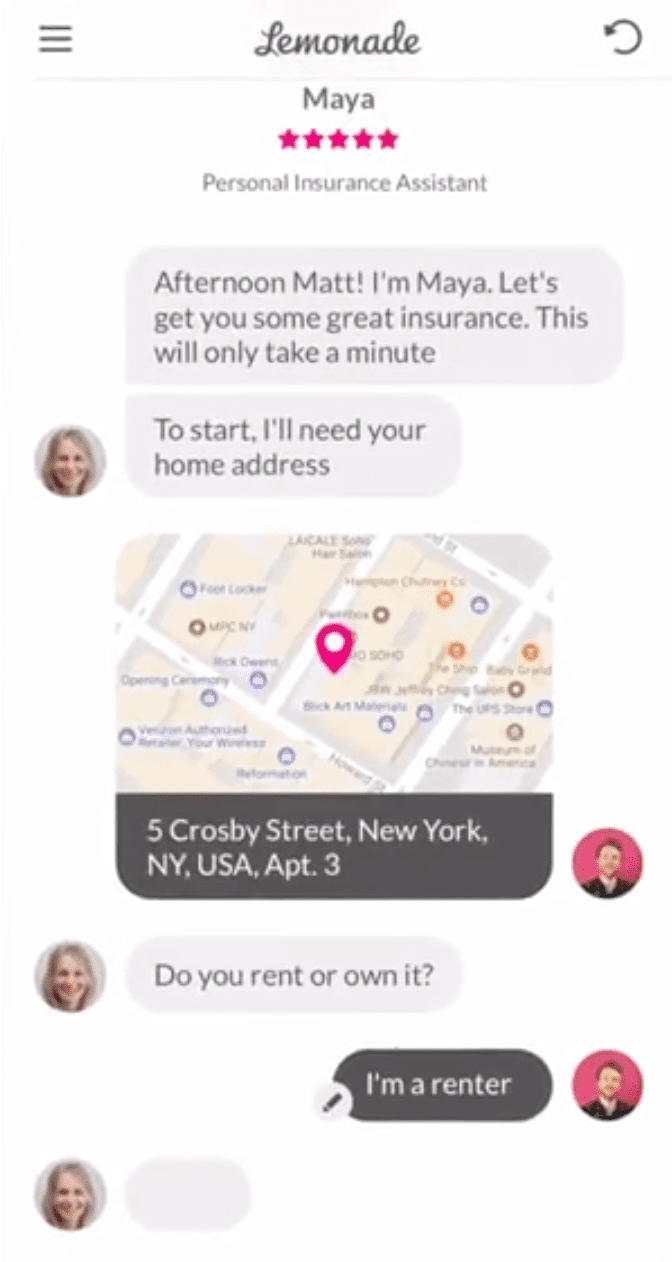

5. Lemonade

Lemonade, an AI-powered insurance company, has developed a chatbot that guides policyholders through the entire customer journey. Users can turn to the bot to apply for policies, make payments, file claims, and receive status updates without making a single call.

A few years ago, Lemonade’s chatbot, Maya, broke the world record by processing and paying the $979 claim in under 3 seconds.

5 Best Tools for Creating Insurance Chatbots

Want to build an insurance chatbot as soon as possible? Here are five tools that can help you with it.

1. Haptik

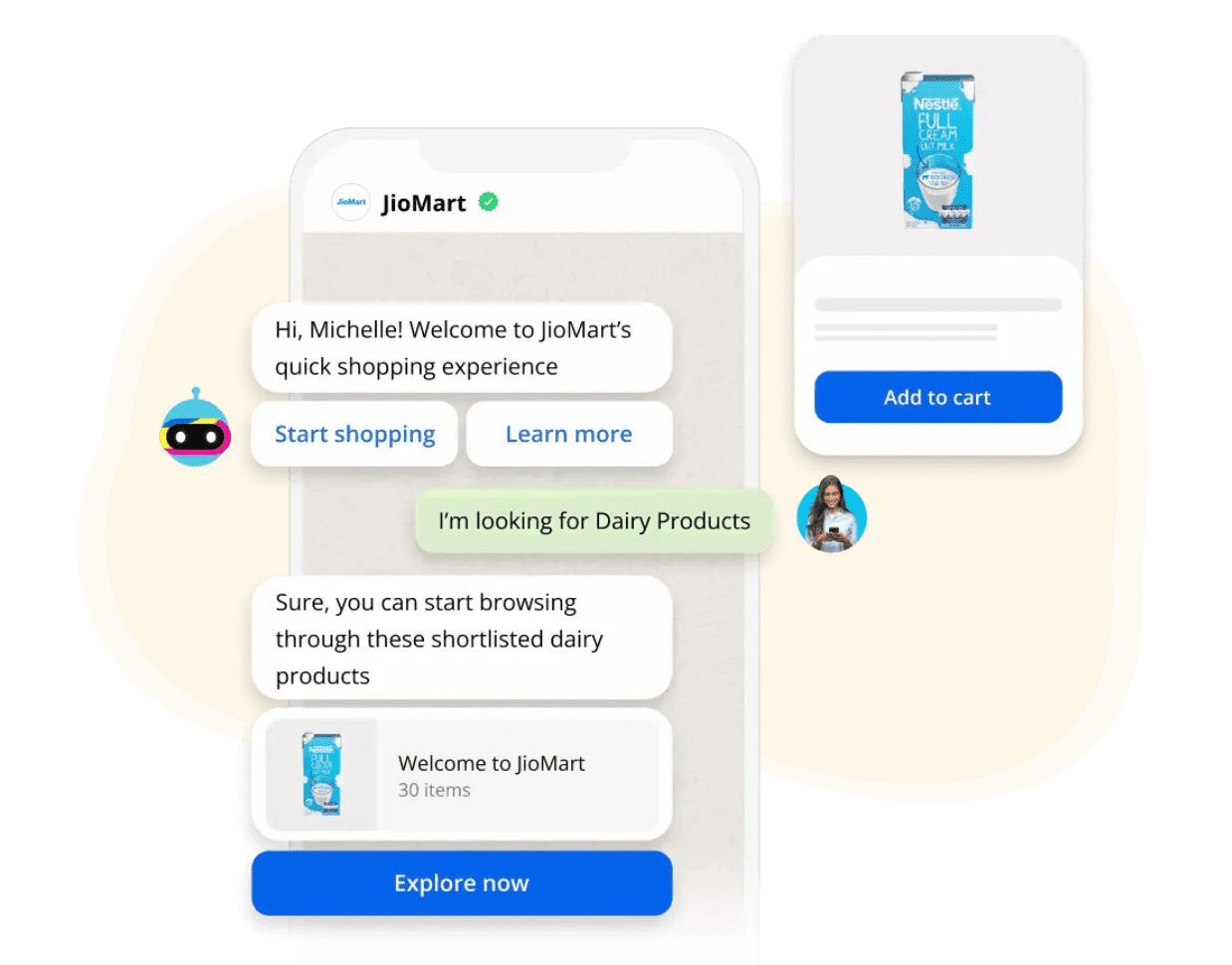

Haptik is a conversation AI platform helping brands across different industries to improve customer experiences with omnichannel chatbots.

Haptik’s intelligent virtual assistants help insurance customers manage their policies, make payments, and fill claims efficiently. With Haptik, you can build an insurance chatbot for your website, Facebook Messenger, Instagram Direct, SMS, and Google Business Messenger.

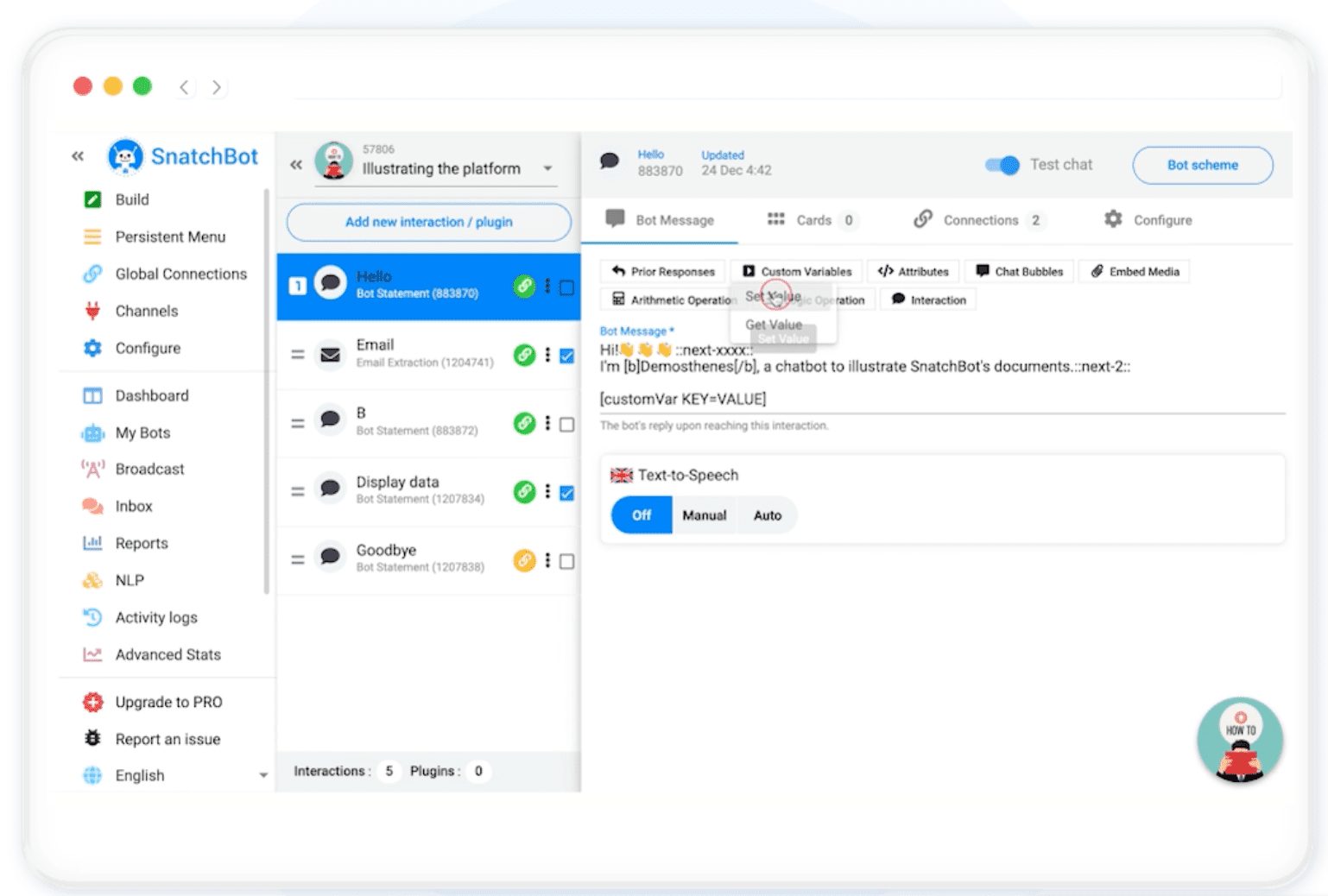

2. Snatchbot

SnatchBot is an intelligence virtual assistance platform supporting process automation.

The platform has little to no limitations on what kind of bots you can build. You can build complex automation workflows, send broadcasts, translate messages into multiple languages, run sentiment analysis, and more. SnatchBot’s virtual assistants can be employed on multiple channels.

With a transparent pricing model, Snatchbot seems to be a very cost-efficient solution for insurers.

3. Inbenta

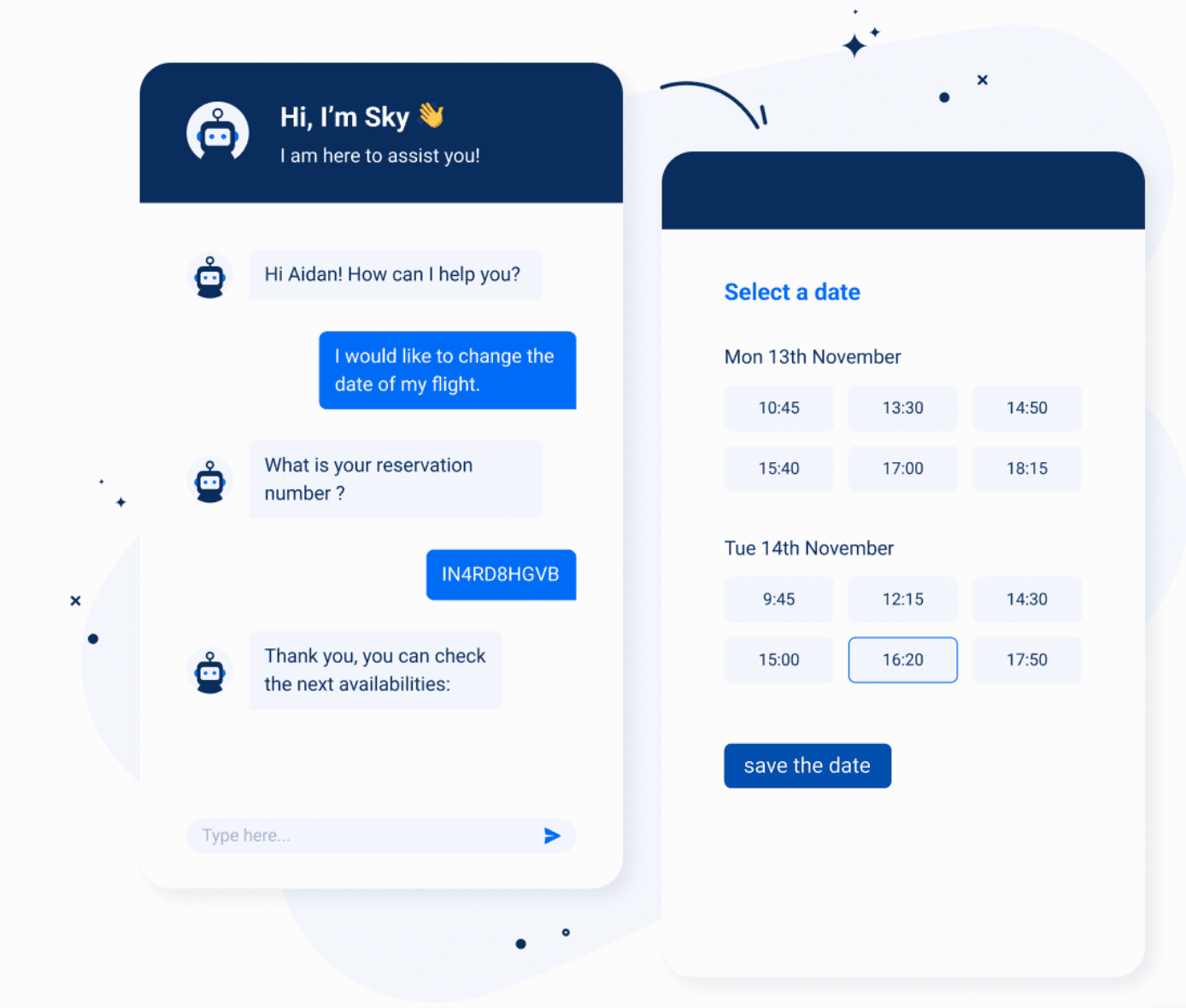

Inbenta is a conversational experience platform offering a chatbot among other features. It uses Robotic Process Automation (RPA) to handle transactions, bookings, meetings, and order modifications.

Inbenta claims to offer conversational AI with zero training required.

4. Acquire

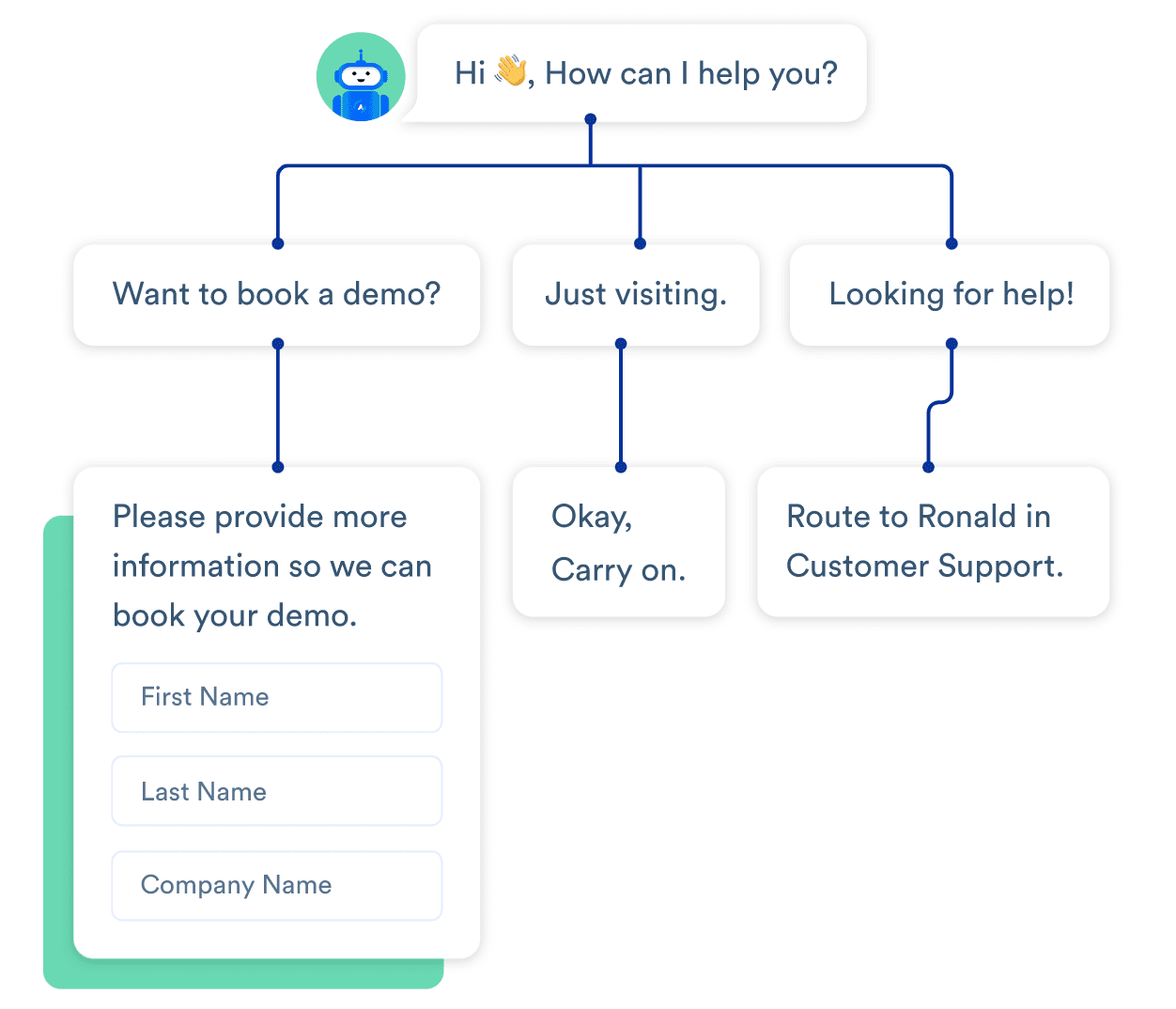

Acquire is a customer service platform that streamlines AI chatbots, live chat, and video calling.

With Acquire, you can map out conversations by yourself or let artificial intelligence do it for you. To create complex sequences and routes, no coding skills are required.

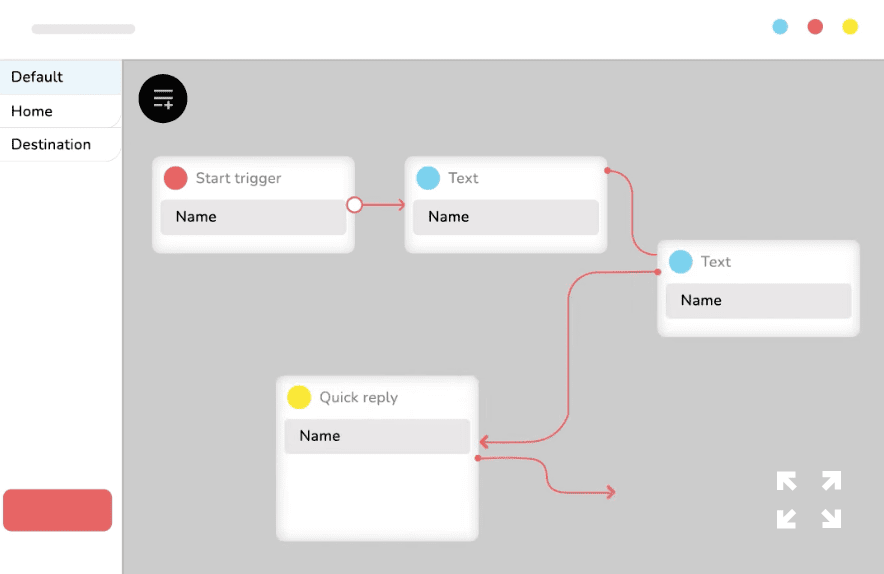

5. Yellow.ai

Yellow.ai is a conversational AI platform for enterprises. The platform offers a comprehensive toolkit for automating insurance processes and customer interactions.

If you’re looking for a highly customizable solution to build dynamic conversation journeys and automate complex insurance processes, Yellow.ai is the right option for you.

Whatfix facilitates carriers in improving operational excellence and creating superior customer experience on your insurance applications. In-app guidance & just-in-time support for customer service reps, agents, claims adjusters, and underwriters reduces time to proficiency and enhances productivity. Whatfix DAP also enables your customer-facing reps to be more productive and quickly assist customers with real-time help, intelligent nudges, and self-service support – improving overall NPS and customer satisfaction scores.

Learn more about embracing digital transformation for your insurance business today!

Thank you for subscribing!