Organizations often waste resources due to inefficient procurement spending during strategic sourcing.

McKinsey suggests that most organizations waste 4% of their total spend on procurement-related inefficiencies like transaction costs, not selecting preferred vendors when sourcing, and procurement non-compliance. To overcome this, organizations are transforming their source-to-pay (S2P) process with S2P and procurement software. Research shows that digital S2P processes can reduce procurement-related spend by up to 50% by optimizing the sourcing process.

In this blog, we explore how source-to-pay applications are a one-stop solution to streamlining strategic sourcing and procurement.

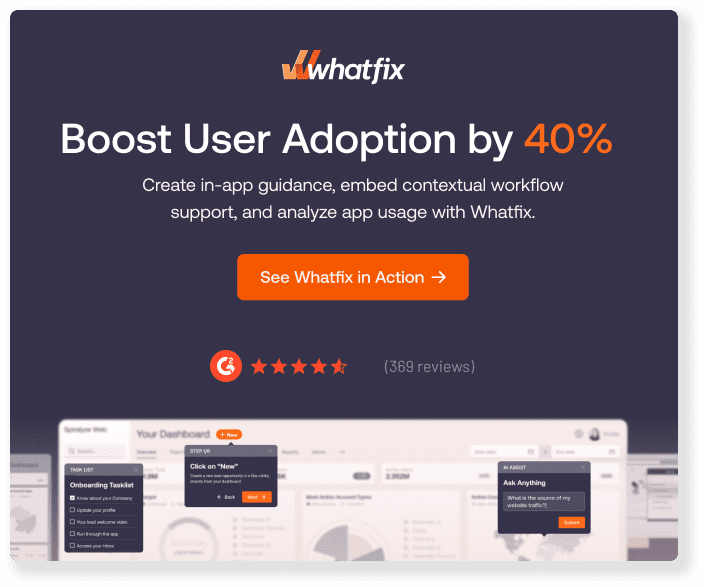

What Is the Source-to-Pay Process?

The procure-to-pay (P2P) process begins with purchase requisition and ends with the payment of goods via accounts payable. However, when you bring strategic sourcing into the scenario, there is a tightly integrated source-to-pay (S2P) process that allows procurement leaders to manage maverick spending, sourcing, and contracting for higher efficiency.

The source-to-pay process includes the following stages:

- Strategic sourcing

- Request for proposal

- Vendor management

- Contract lifecycle management

- Order management

- Invoice & payment processing

- Compliance and control

What Is Strategic Sourcing?

Strategic sourcing refers to the process of optimizing procurement and building a healthy supply chain that helps an organization reduce costs.

And by costs, we mean time, technical skill, and financial resources, not just the dollar amount spent on an order. For instance, you might spend $1,200 on one vendor, but their product takes weeks to set up, while another costs $1,500 but works out of the box.

To achieve that goal, strategic sourcing works on improving all the bits of the procurement cycle to find opportunities to reduce costs, source better supplies, save time, and ensure more robust supply channels that can withstand shocks. Examples include:

- Assessing and choosing vendors.

- Identifying opportunities to save time and money.

- Negotiating better deal terms.

- Ordering purchases on time, and from the right vendor.

- Receiving and inspecting deliveries to confirm they’re according to specifications.

- Three-way matching, approvals, and payments for delivering supplies.

9 Steps of the S2P Process

Due to varying business requirements, the source-to-pay process varies across industries. But the general S2P framework consists of the following nine steps:

1. Demand identification

The first step is demand identification. Procurement leaders identify a need for goods and services and better pricing opportunities.

Ask questions that will help you understand the structure of your procurement operations, any opportunities for growth, and any areas where challenges may be creeping in.

Some of these questions include:

- What products are we buying at the moment and at what price?

- Who are our current vendors and what does their performance look like?

- How long does it take our suppliers to ship orders?

- Are there alternatives to our existing suppliers and the supplies they offer?

- Can we negotiate volume discounts, better payment terms, pricing or better service quality?

- How can we rework our existing supply chain to reduce risk?

- What do the supply and demand patterns look like for our products and supplies? Does demand increase at certain seasons? Can we stock up before then?

- Do prices plunge at certain other times of the year? How can we ship inventory when it’s cheapest?

Before you can build a strategy to improve operations, you need a comprehensive analysis of your procurement ops’ current state, opportunities to save, potential risks to your supply chain, and any emerging problems.

Fixing supply chain bottlenecks and removing potential problems in your procurement workflow starts with stating them in clear terms. These can be:

- Late deliveries

- Overpriced supplies

- Invalid, unenforceable contracts

- Manual procurement processes that depend on email, spreadsheets, and word-of-mouth

- Supply disruptions that can’t be fixed quickly enough since there are no backup suppliers on call

2. Sourcing

You can automate the sourcing process using an e-sourcing application. This solution handles large data sets to derive actionable insights from historical spending and market trends. Potential vendors are identified, evaluated, and onboarded based on the organizational goals.

A portfolio of suppliers positioned to support your operations will ensure you have access to the inventory your business needs at the right price and with minimal risk to your company’s operations and reputation.

Such a network needs to be created deliberately, starting with asking potential vendors questions about:

- Their corporate reputation, i.e. ESG performance, fair trade agreements, environmental responsibility, employee satisfaction, etc.

- Historical business performance, profitability, revenues, Net Promoter Score, and growth metrics — you want to partner with vendors that are going to stick around for the long term, not those teetering on the edge of bankruptcy

- Timescales — how long does it typically take them to ship orders?

- References — who are their current customers?

3. Bidding

Across industries, common requests for goods or services are grouped into a few different categories depending on the type of information being requested and the scale of the ask. For instance, a request for information is much more straightforward and broad than a request for a proposal or bid.

Depending on the needs of a business or one of its specific departments, an employee will need to make one of the following types of requests to an external company for goods or services.

- Request for bid (RDB): When requesting bids from vendors, an RFB is sent out to obtain a statement outlining how much it will cost and how long it will take to perform a specific task. These are utilized when services are needed to complete a project for which the solution is straightforward or generally known. This type of request is also commonly used for government contracts because it can eliminate biases in selection and promote a level playing field.

- Request for information (RFI): A Request For Information is broader than an RFB. This comes into use when asking a company to demonstrate its capabilities or services, or it can be a simple request for additional information about the products it offers. This type of request is helpful for companies looking to find out the general possibilities in finding a solution to a problem or filling an equipment-related need.

- Request for proposal (RFP): Requests For Proposals often follow an RFI once all the responses have been received and assessed. These requests are used for more complex projects, which could be handled with different approaches or by professionals with varying levels of expertise. RFPs are often more detailed, including some questionnaire, and require a longer overall selection process.

- Request for quote (RFQ): A Request For Quote, also called a budget request, is directly aimed at learning about the pricing and budget a vendor will require for a service or product. These are often time-sensitive because the price of materials can fluctuate. This type of request includes several questions that will be used to compare responses, including general information, prices related to given products or services, deadlines, and the criteria that will be used for making a decision.

- Request for tender (RFT): A Request for Tender is similar to an RFB but is an open invitation often used for large-scale, technical projects. Because these are often used by government agencies or in the public sector, Tendering is usually a public affair aimed at ensuring transparency and fairness throughout the process. The request itself is often shared online and in other public forums.

4. Review & reward

When it comes to reviewing RFP, RFB, and RFx responses, the first step is to establish a clear evaluation criterion. This should include both qualitative and quantitative factors that align with your organization’s strategic goals.

For instance, consider aspects such as the vendor’s track record, financial stability, innovation potential, and compliance with regulatory requirements. It’s also essential to involve a diverse team of stakeholders in the evaluation process to ensure a well-rounded perspective. Utilizing a weighted scoring system can help prioritize the most critical factors and provide an objective framework for decision-making.

Once the evaluation is complete, the next step is to reward the most suitable vendors. This doesn’t just mean selecting the lowest bid or the most detailed proposal. Instead, focus on the long-term value the vendor can bring to your organization.

Consider offering multi-year contracts to vendors who demonstrate exceptional potential for partnership or providing performance-based incentives to encourage continuous improvement and innovation. Effective communication of the evaluation results and the reasons for selection will ensure transparency and build trust with potential vendors, paving the way for fruitful future collaborations.

5. Contract negotiation & management

Post selection, the supplier is moved to the vendor management database, and contract terms and pricing negotiations begin. Once both the parties agree upon the contract terms, it moves to the signing stage.

After contracts are signed, vendors are retained for the duration of their contract lifecycle and then long enough to comply with tax-related and company-related document retention policies.

6. Purchase order

Post contract signing, there is a transition to the procurement process, and a purchase order is created for the selected supplier.

7. Invoice processing

The accounts payable team receives vendor invoices and is responsible for the entire e-invoicing process, from processing invoices, getting approvals, and generating accounting reports.

8. 3-way matching

A three-way match is suggested once an invoice is received. The accounts payable team compares the purchase order, the goods receipt, and the supplier’s invoice before approving the invoice for payment. A 3-way match helps determine whether the invoice should be paid partly or entirely.

9. Payment

The accounts payable team makes and reconciles payments to conclude the source-to-pay process, keeping suppliers informed about the status of their payments.

Challenges in Source-to-Pay Automation

S2P is a complex process, and the absence of a digital S2P integrated application suite can pose these three major challenges:

1. Non-compliance

Corcentric research suggests that S2P processes have around 50% value leakage due to a lack of compliance. Organizations use multiple, disparate systems leading to decentralized compliance, making it difficult to maintain transparency in the overall process.

2. Poor Data Visibility

It becomes difficult to maintain data visibility for the complete process unless there is an automated flow of data from one application to another to avoid any gaps.

3. Poor Collaboration

Collaboration becomes a challenge in the case of different applications as the solutions are configured by different people at different time frames, leaving scope for optimization but not collaboration.

4. User adoption

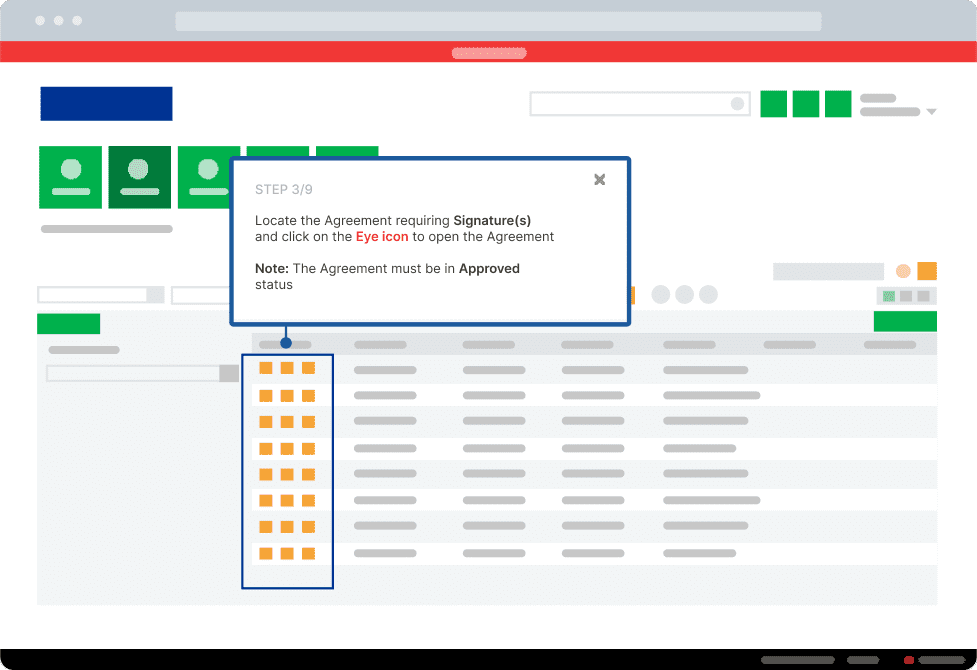

A significant challenge of source-to-pay and related digital procurement transformation projects is supporting end-users through change, providing end-user training for S2P applications, and ultimately driving user adoption.

Organizations spend millions on complex technology implementations with custom-built workflows designed for their use cases. This requires dedicated performance support that enables users to correctly use this application – or organizations risk S2P transformations that fail to achieve business outcomes.

PRO TIP

S2P applications click better with Whatfix. IT teams can easily create replica sandbox environments for web-based procurement software for user testing and hands-on training, without risking live software usage. Use Whatfix’s no-code editor to create in-app guided Tours and Task Lists to drive new user proficiency quickly. Guide experienced users through complex workflows and infrequently done tasks with Flows and Smart Tips. Provide on-demand performance support with Self Help, providing end-user help when and where users experience friction.

Learn more about Whatfix for S2P applications now!

Benefits of S2P Process Automation

Source-to-pay automation will reduce maverick spending, minimize supplier risk, and streamline the entire S2P process. Digital transformation of the S2P cycle can help organizations maximize ROI and build a robust supplier network.

Here are key benefits of digitizing the S2P process:

1. Risk diversification & minimization

Most organizations were exposed to supplier risk during the pandemic. Post this; organizations focused on building resilient supply chains and diversifying the risk by creating a robust network of suppliers.

S2P automation provides a single source of truth and empowers the sourcing team to drive higher value from digital procurement and strategic sourcing processes. It further helps build a collaborative relationship between all stakeholders.

Much of the work done in the strategic sourcing process is introspective. Strategic sourcing takes a long, hard look at an organization’s procurement operations. It seeks to find holes to plug or gears to oil so they can operate more efficiently.

A single point of failure in your supply chain can put your company’s operations on hold, increase your costs substantially, or expose your company to legal liability.

Strategic sourcing and S2p automation identify those cracks in your procurement operations and help plug them up.

2. Reduce direct and indirect costs

Strategic S2P automation helps businesses discover opportunities to save and identify challenges that lead to indirect expenses (late shipping, repairs, out-of-stock products during peak season, etc.) so they can be avoided. It starts by taking stock of which supplies a business buys, from whom, and for how much. Analyzing expenses helps businesses see opportunities to:

- Buy cheaper products (or close substitutes)

- Cut back on spending & figure out how to get volume discounts

- Find alternative products

- Figure out how to speed up inventory deliveries

- Project demand patterns based on historical data

3. Create a more efficient procurement operation

S2P isn’t just an ongoing effort to make the right procurement decisions daily.

If done right, strategic sourcing will help you create reusable policies and playbooks for managing repeat tasks like screening potential suppliers, verifying claims, and fighting fraud long after the initial efforts are put in place —it helps create new pillars on which you can build your supply chain safely.

This takes the form of:

- Switching to e-procurement solutions designed to digitize and automate the procurement process, i.e. one source of truth, instead of managing your procurement operations across spreadsheets, emails, and human memory

- Nailing down verbal and informal agreements with suppliers into detailed contracts

- Automating repetitive tasks, like three-way matching, invoice approvals, and payments

- Creating reusable templates for choosing suppliers and selecting a new product and service lines to purchase

4. Increased compliance

The automated source-to-pay process follows a guided buying approach to ward off any contract or policy violations before they even happen. Source-to-pay solution guides the user through the purchase requisition process providing value by ensuring off-contract spending is curbed, and the buyer is guided to the correct suppliers, products, and services.

5. Build healthier vendor and supplier relationships

A healthy relationship with your suppliers will either make or break your business.

While procurement focuses on the day-to-day aspects of communicating with suppliers, issuing orders, inspecting deliveries, and making payments for supplies, strategic sourcing focuses on helping businesses to:

- Get better pricing terms from your suppliers

- Create alternative supply channels to help reduce risk in your procurement operations

- Make sure vendors are paid on time

- Build reliable communication channels & create standards both parties should expect and respect

Strategic sourcing helps a company build healthy relationships with suppliers, starting with intelligent contracts, de-risking your supply chain, and communicating effectively with your suppliers to make sure everyone abides by the terms of your contract.

6. Seamless technology integration

A tightly integrated source-to-pay suite enables a seamless workflow across the S2P lifecycle by inter-connecting all the modules and ensuring consistent data flow. Procurement teams can easily plug-in data, maintaining the ease of information flow.

Best Source-to-Pay Software Applications

Streamlining and automating the entire source-to-pay process would be impossible without technology. These seven procurement-related software tools will help you build more effective S2P operations:

1. SAP Ariba

- Pricing: Custom-pricing

- G2 Review Rating: 3.9

SAP Ariba offers procurement and supply chain solutions enabling more effective collaboration on contract management, control of suppliers, and invoicing. It’s a sophisticated solution for large companies and enterprises willing to automate the entire procurement lifecycle. The platform covers all the critical features, including:

- Sourcing

- Purchasing

- Catalog creation

- Risk management

- Intelligent spend management

- Invoice management

- Discount management

Read our blog post to learn more about SAP Ariba implementation.

2. Zycus Strategic Sourcing Suite

- Pricing: Custom-pricing

- G2 Review Rating: 3.5

Zycus is a cognitive source-to-pay platform that guides buyers toward the right purchasing paths using its intelligent self-learning engine powered by Merlin AI. It seamlessly integrates critical features like requisition, catalog management, approval, purchase orders, invoice management, analytics, and others.

3. Coupa Procurement

- Pricing: Starts at $11 per user, per month

- G2 Review Rating: 4.1

Coupa ticks all the checkboxes for an e-procurement platform designed for businesses that want to optimize their supply chain operations, bring spending under control, streamline purchases, and simplify invoice processing and payments.

- Get complete visibility into your supply chain, from procure to pay

- Create and manage purchase orders

- Draft contracts from templates, customize on a case-by-case basis, and get them approved quickly

- Compare offers from different vendors and lace orders with the perfect supplier

Read our post to learn more about Coupa implementation.

3. Jaggaer

- Pricing: Custom-pricing

- G2 Review Rating: 4.5

JAGGAER offers complete digital transformation across the source-to-pay cycle with modular solutions on a unified digital platform that integrates easily with your existing ERP solution and accounting systems.

Jaggaer runs the world’s largest procurement, sourcing, and spend management platform for growing business, with a network of 4 million suppliers across 70 countries.

It combines all that capability into a SaaS platform where businesses can manage supplier relationships, order inventory worldwide, process contracts, quotes, orders, invoices, and payments, and get detailed analytics into their supply chain operations.

From the service scope, Jaggaer looks more like a full-service procurement and sourcing enablement engine for multinational companies in manufacturing, aerospace, and heavy machinery, which might also explain their premium pricing.

4. GEP SMART

- Pricing: Custom-pricing

- G2 Review Rating: 4.2

GEP SMART is a unified source-to-pay solution offering end-to-end procurement functionality for direct and indirect spend management from a single, cloud-native platform.

5. Workday Strategic Sourcing

- Pricing: Contact for quote

- G2 Review Rating: 4.8

Workday Strategic Sourcing is a SaaS-based e-sourcing and vendor management platform designed to help growing companies run efficient supply chain operations.

It offers a complete procurement stack with features like contract management, supplier relationship, dynamic negotiations, reporting, and 360-degree visibility that surfaces opportunities to cut costs and save.

6. Ivalua

- Pricing: Custom-pricing

- G2 Review Rating: 4.0

The Ivalua Platform is built on a single code base with a highly configurable cloud. The solution is highly flexible to tailor all your business requirements, allows you to scale up or down, and be assured of the highest security and performance standards, irrespective of the device.

7. Precoro

- Pricing: Starts at $35 per user, per month

- G2 Review Rating: 4.7

Precoro is a full-stack sourcing engine for managing the entire procurement process. Precoro equips companies of all sizes to:

- Forecast targets (for individual departments and your entire organization) with historical data

- Create a library of customizable contract templates

- Identify and vet suppliers for different products

- Order inventory with a few clicks

- Combine, process, and analyze procurement and sourcing data from one source of truth, and

- Collaborate with multiple teams members throughout the procurement process

Precoro is one of the more affordable sourcing and procurement platforms — at least for smaller companies — but its features more than make up for any reservations you may have with the modest pricing.

S2P & Procurement Software Clicks Better With Whatfix

Whether you’re migrating to a new cloud-based procurement system from a legacy S2P application, investing in your first enterprise procurement application, getting your an S2P implementation back on track, or want to drive more value from your procurement application, Whatfix is your digital adoption partner to support your end-users with a contextual S2P adoption plan that achieves technology ROI and drives procurement business outcomes.

With a DAP like Whatfix, accelerate your eProcurement and source-to-pay transformation timeline and maximize its ROI by enabling end-users with contextual in-app experiences and tailored support – driving maximum S2P business outcomes and future-proofing your procurement processes with user-centric technology.

Whatfix drives S2P transformation by making sense of complicated enterprise software – providing end-users contextual in-app guidance and assistance at critical moments – in the flow of work – to maximize their productivity.

With Whatfix, create user-centric application experiences that enable all end-users – from accounting, finance, vendor management, and legal – from beta test to years after the deployment, by:

- Providing IT teams and application owners with a solution to quickly create a sandbox S2P application environment to beta test with users before deployment, conduct usability tests, and provide hands-on training with Whatfix Mirror.

- Accelerating S2P application user onboarding during migration and onboarding new employees onto the procurement application, with in-app Tours, Flows, and Task Lists providing hands-on, interactive training within the S2P application. Use Task Lists to gamify new user onboarding by awarding certifications to those who complete the checklist.

- Guiding eProcurement users through complex business workflows with Flows and providing critical knowledge at crucial moments in user workflows with Smart Tips, helping to provide learning in the flow of work that is always working in the background of your digital procurement processes.

- Supporting S2P users with on-demand Self Help to improve knowledge transfer, drive awareness of support resources, and reduce IT workload by deflecting S2P-related processes and IT issues– all in a helpful “user assistant” module that overlays your procurement application UI. IT teams can integrate any knowledge repository to Self Help and add any resource to the help center, including entries that prompt an in-app guided Flow, links to third-party vendor resources, links to S2P SOPs and process documents or drive folders, links to company policies or compliance materials, video embeds, and more.

- Communicating any new S2P and procurement process change, application update, new feature launch, upcoming deadlines, new regulations, new vendors, and more with in-app Pop-Ups that overlay your application’s UI.

- Collecting feedback from your procurement end-users with in-app Surveys to understand user sentiment and collect qualitative data from your different users to understand various perspectives.

- Analyzing end-user behavior, adoption, license usage, and Whatfix content engagement with Guidance Analytics or our more robust, comprehensive Product Analytics.

- Translating in-app Whatfix-build content to over 70 languages automatically, depending on where your end-users are located – as well as empowering end-users to export any in-app content into text documents, slide decks, GIFs/videos, and more to provide offline training and support for global workforces.

Whatfix ensures your DAP implementation is up and running quickly, driving S2P ROI from the start, with our Smart Solutions and Professional Services team.

Smart Solutions are out-of-the-box templates, integrations, and analytic reports that help you kickstart your DAP journey on S2P solutions like SAP Ariba, Procoro, Coupa, Icertis, and any web-based procurement software.

Our Professional Services team supports your deployment with a team of dedicated Whatfixers to help you build your initial in-app experiences and train you on how to create Whatfix content. All new Whatfix customers are set up with:

- A “digital adoption assistant” to accelerate your content authoring and build your adoption strategy,

- A “digital adoption program manager” to help drive project governance.

- 24/7 customer support.

- Access to the Whatfix customer community, Center of Excellence, and monthly customer roundtables.

We know an S2P implementation and eProcurement migration project is a major IT challenge for your organization. Whatfix is an insurance policy for this essential, business-critical digital procurement investment.

Whatfix maximizes application ROI by enabling users to correctly and comprehensively use the S2P platform and its contextual procurement workflows – driving business outcomes with better employee experiences for the modern age.

Request a demo of Whatfix DAP for S2P now and get started on your S2P adoption journey today!