Insurance claims are the make-or-break moments for policyholders—and the ultimate test of efficiency for insurance providers.

Yet, for many insurers, the claims process remains one of the most complex, risk-prone areas of their operations.

Between managing mountains of documentation, coordinating with assessors, and responding to policyholders quickly (and fairly), it’s no wonder that delays, errors, and fraud are still widespread.

Fraudulent claims alone account for nearly $40 billion in losses each year for U.S. insurers, with one in ten claims suspected of being fraudulent. Add in the rising expectations of digitally savvy customers who demand transparency and speed, and it’s clear that traditional claims processes are due for a transformation.

Built with AI, automation, and powerful analytics at the core, today’s insurance claims management platforms help insurers detect fraud early, streamline workflows, reduce manual intervention, and deliver faster, more accurate claim settlements. This isn’t just about keeping pace with technology—it’s about building trust and resilience in a market that’s evolving faster than ever.

For insurers, especially property and casualty (P&C) providers, this software isn’t a nice-to-have anymore—it’s a strategic asset. Whether you’re looking to cut costs, improve customer satisfaction, or enable remote teams to work smarter, claims management software is now essential to staying competitive.

In this blog, we explore in-depth a type of InsurTech known as claims management software, its features, and the best software available in the industry for P&C providers’ digital transformation projects.

Best Claims Management Software in 2026

What Is Claims Management Software?

Insurance claims management software supports insurance agents in managing their clients’ claims. It primarily facilitates the knowledge and information essential for evaluating claims with a centralized record system. These applications improve operational efficiency, reduce claims management costs, and automate insurance workflows through digital claims.

Claims management software decreases fraudulent claims by monitoring the authorization process and ensuring that all claim details, such as litigation, policy terms, and claim assessments, are recorded within a centralized system.

Insurance claim software automates the calculation and payment process, streamlines case management, and provides better overall claim insights.

Features of P&C Claims Management Software

Claims management software is built to simplify, streamline, and bring consistency to one of the most critical functions in insurance operations. With the right tool in place, P&C insurers can automate workflows, reduce human error, and deliver a smoother experience—for both their teams and their policyholders.

Here are the core features you’ll typically find in modern P&C claims management software:

- Electronic claims: Enables policyholders to file claims online through secure digital channels, with data stored safely in the cloud for easy access and long-term retention.

- Claims tracking: Provides end-to-end visibility into the claims lifecycle, from initial filing to final settlement. Insurers can standardize workflows—or tailor them to fit specific lines of business or service requirements.

- Document management: Organizes all claim-related documents in one centralized repository. Teams can easily upload, retrieve, and track documentation throughout the entire process.

- Reporting and analytics: Transforms raw claims data into actionable insights. Insurers can monitor key metrics like turnaround times, approval rates, and team productivity to continually optimize performance.

- Customer relationship management: Integrates with CRM systems to pull in real-time customer data, helping adjusters and agents provide more personalized and informed support during the claims process.

- Risk assessment and fraud detection: Leverages AI and data cross-referencing to flag suspicious claims early. These tools help carriers assess risk more accurately and minimize fraud-related losses.

- Payment processing: Facilitates fast, digital payments directly through the platform. Adjusters can view claim amounts, approve settlements, and trigger payouts in just a few clicks.

- Integration: Supports EDI (Electronic Data Interchange) and integrates with core insurance systems and third-party platforms, enabling seamless data exchange across multiple carriers and systems.

- Customer portal: Gives policyholders a self-service experience where they can submit claims, upload documentation, check status updates, and communicate with adjusters—all from one easy-to-use portal.

- Customizable rules: Allows insurers to define their own decision logic and business rules for routing, approvals, or exceptions—so the software works the way their teams do, not the other way around.

- Compliance checking: Helps ensure that all claims are processed in accordance with regulatory standards and internal policies. Built-in compliance features reduce legal risk and streamline audits.

Best Claims Management Software in 2026

Here’s a look at the top P&C claims management software platforms helping insurers modernize operations, streamline workflows, and deliver better policyholder experiences in 2026.

1. Duck Creek

- G2 Rating: 4.4 out of 5 stars

- Best for: End-to-end claims processing with configurable workflows for large insurers.

Duck Creek Claims is a powerful, cloud-based solution that helps insurers handle claims with speed, accuracy, and agility. Designed for P&C insurers, it automates end-to-end claims processing, offers built-in compliance checks, and gives adjusters the tools they need to handle complex claims scenarios confidently.

Key features:

- End-to-end claims lifecycle management

- Configurable business rules

- Claims intake and assignment automation

- Real-time insights and dashboards

- Fraud detection and risk scoring

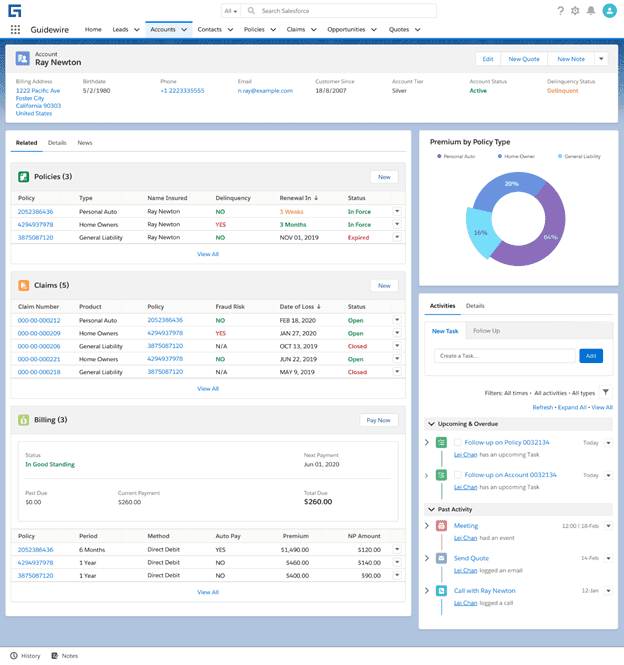

2. Guidewire ClaimsCenter

- G2 Rating: 4.5 out of 5 stars

- Best for: Integrated claims operations within a comprehensive insurance platform.

Guidewire ClaimsCenter is an enterprise-grade claims management system trusted by global insurers. It eliminates manual processes and empowers cross-functional teams with collaborative tools, real-time data, and rule-driven workflows.

Key features:

- Claims intake and routing

- Policy and billing integration

- Customer and agent portals

- Performance tracking and analytics

- Automation of repetitive tasks

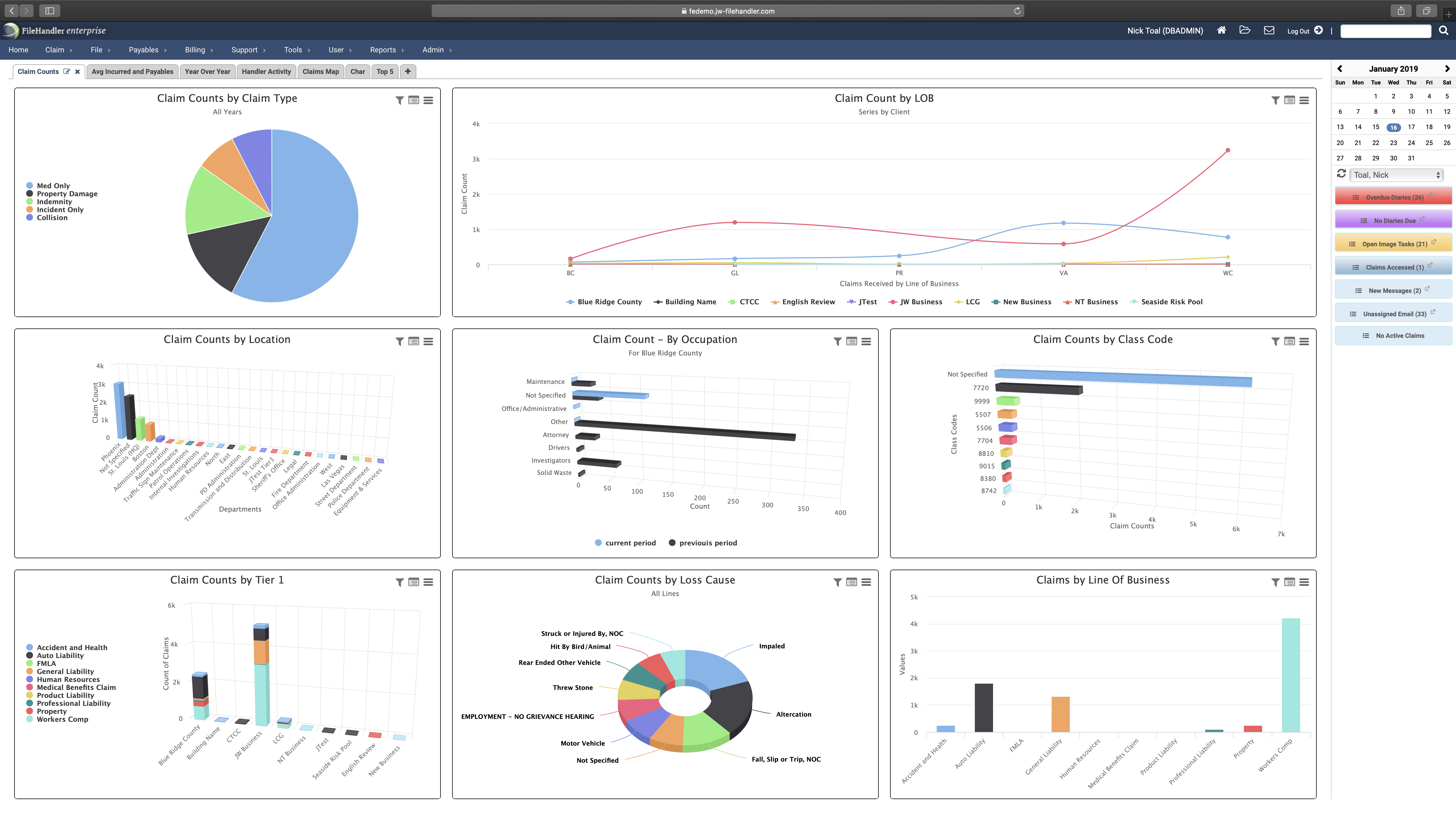

3. FileHandler Enterprise

- G2 Rating: 4.4 out of 5 stars

- Best for: Simplified, cloud-based claims management with strong case tracking and documentation.

FileHandler Enterprise is built for scalability and flexibility. This platform streamlines claims handling and risk management with workflow automation, deep reporting capabilities, and seamless data management, especially for PEOs and TPAs.

Key features:

- Case and policy management

- Claim resolution and tracking

- Forms and document management

- Imaging and attachments support

- Risk assessment and fraud alerts

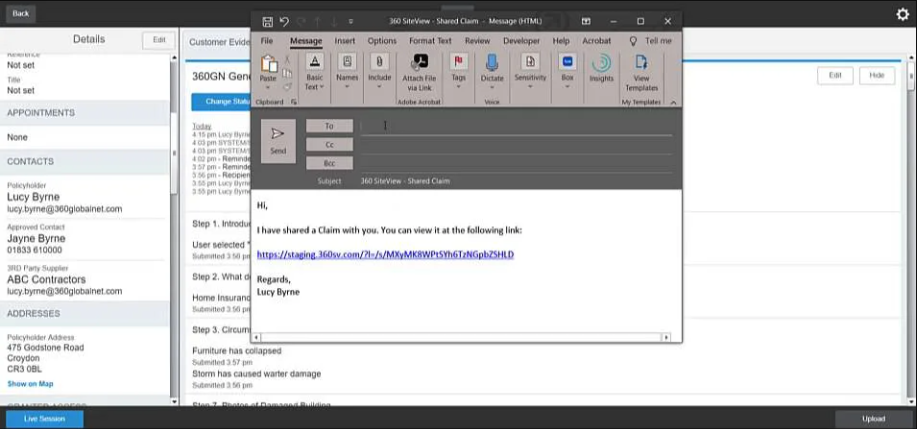

4. 360SiteView

- G2 Rating: 4.5 out of 5 stars

- Best for: Field-driven claims inspections and evidence capture with mobile support.

360SiteView by 360Globalnet offers a no-code, cloud-native platform designed to reduce friction across the insurance value chain. It supports full claims lifecycle automation and improves visibility into every stakeholder’s actions in real time.

Key features:

- End-to-end claims tracking

- Role-based workflow automation

- Real-time customer updates

- Intelligent rules and audit trails

- Omnichannel communication support

5. A1 Tracker

- G2 Rating: 4.8 out of 5 stars

- Best for: Flexible, enterprise claims tracking across complex workflows and compliance needs.

A1 Tracker is a versatile web-based platform that supports all lines of insurance. It offers flexible customization and helps insurers manage claims, compliance, policies, billing, and risk—all from one dashboard.

Key features:

- Claims intake and tracking

- Compliance and audit management

- Co-pay and deductible management

- Customer and broker portals

- Business process control

![]()

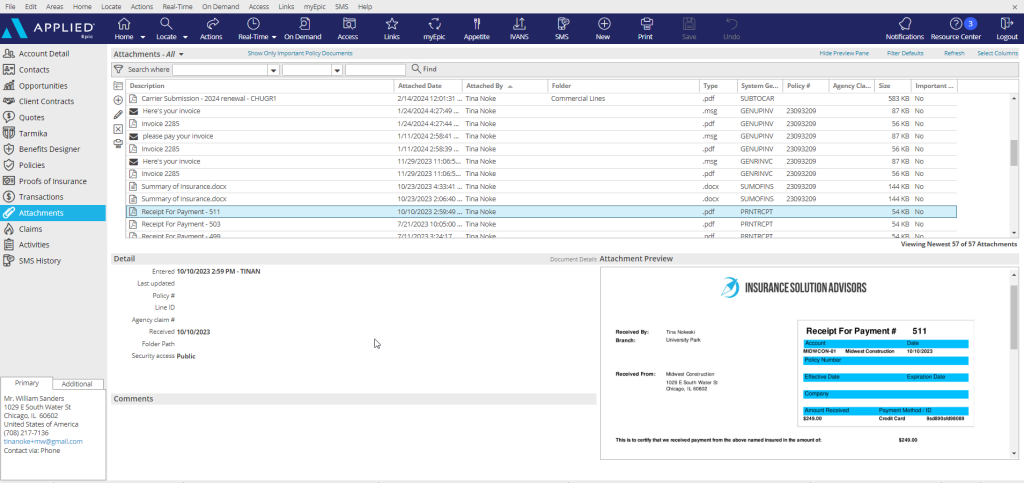

6. Applied Epic

- G2 Rating: 4.4 out of 5 stars

- Best for: Claims and policy management integrated within a unified insurance agency system.

Applied Epic is a cloud-based agency management platform that consolidates data and simplifies operations. It integrates with CRMs and other systems to streamline customer interactions and automate key insurance workflows.

Key features:

- Claims and policy management

- Sales and task automation

- Reporting and dashboards

- Email and CRM integration

- Invoicing and payment tracking

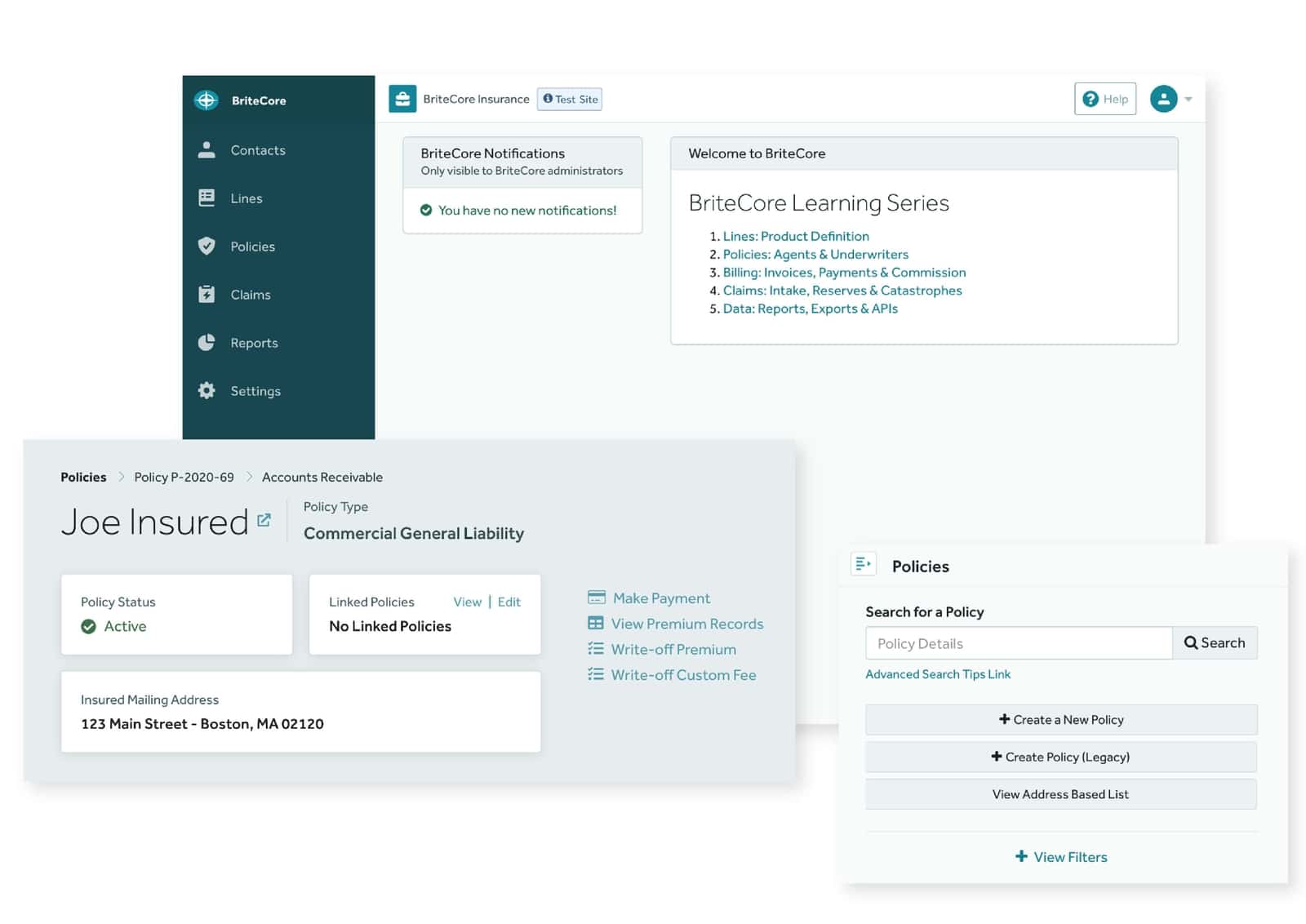

7. BriteCore

- G2 Rating: 4.3 out of 5 stars

- Best for: Modern, configurable core system with native claims, policy, and billing automation.

BriteCore is a cloud-first, all-in-one insurance platform for P&C carriers. It supports every part of the policy and claims lifecycle and updates continuously to improve performance, resilience, and security.

Key features:

- Claims and policy administration

- Document imaging and reporting

- Agent quoting and contact management

- Billing, underwriting, and CRM tools

- Cloud-native infrastructure

8. Snapsheet

- G2 Rating: 4.1 out of 5 stars

- Best for: Digital claims handling with rapid estimate creation and customer-centric workflows.

Snapsheet is known for pioneering digital auto claims. It brings intelligent automation and seamless integrations to carriers, MGAs, and TPAs, making it easier to deliver fast, transparent claim experiences.

Key features:

- Electronic claims and mobile-first tools

- Adjuster management

- Claims tracking and analytics

- Forms and workflow management

- Appraisal services integration

Screenshot

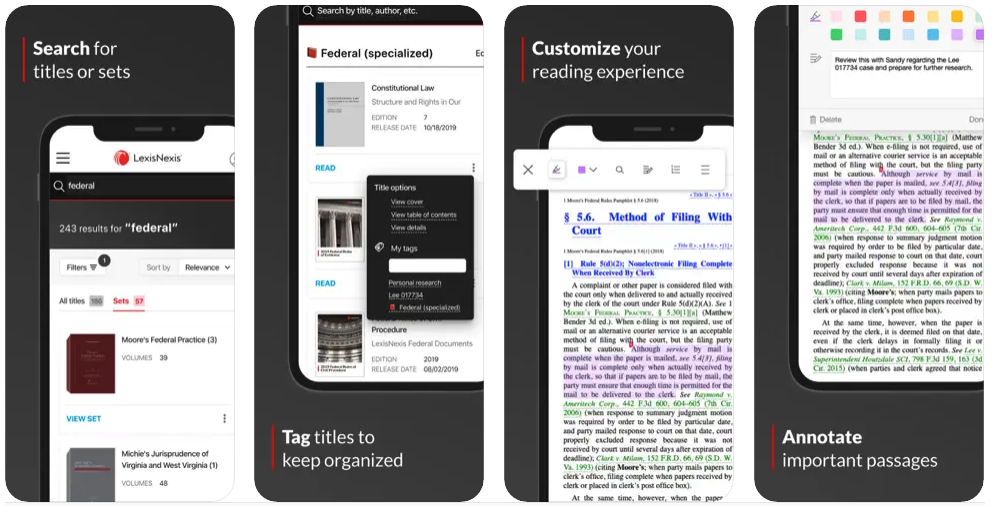

9. LexisNexis Carrier Discovery

- G2 Rating: 4.7 out of 5 stars

- Best for: Claims risk assessment and fraud detection through powerful analytics and data insights.

LexisNexis Carrier Discovery enhances claims decisions with rich, real-time insurance carrier data. It’s especially useful for call center scripting, fraud prevention, and streamlining the adjusting process.

Key features:

- Insurance carrier discovery

- Policy management tools

- Fraud detection capabilities

- Adjuster support and scripting

- Claims tracking insights

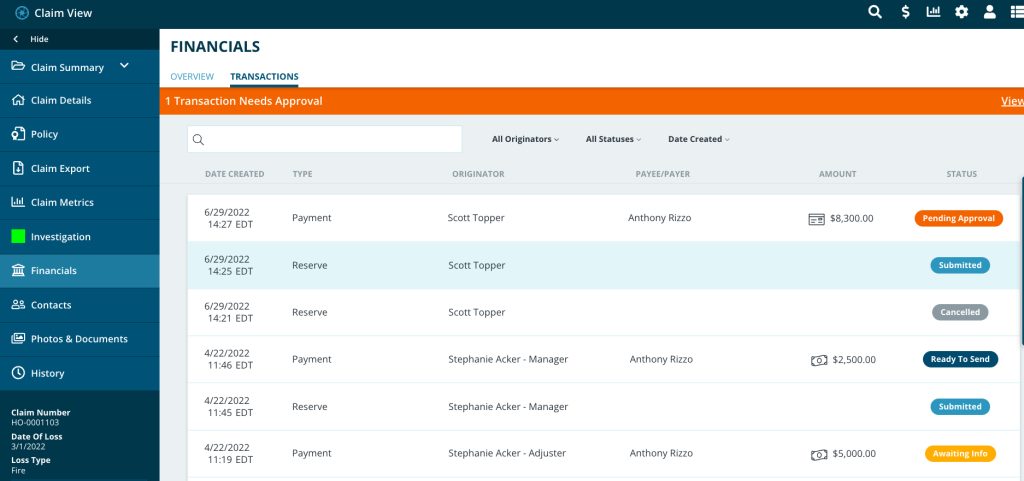

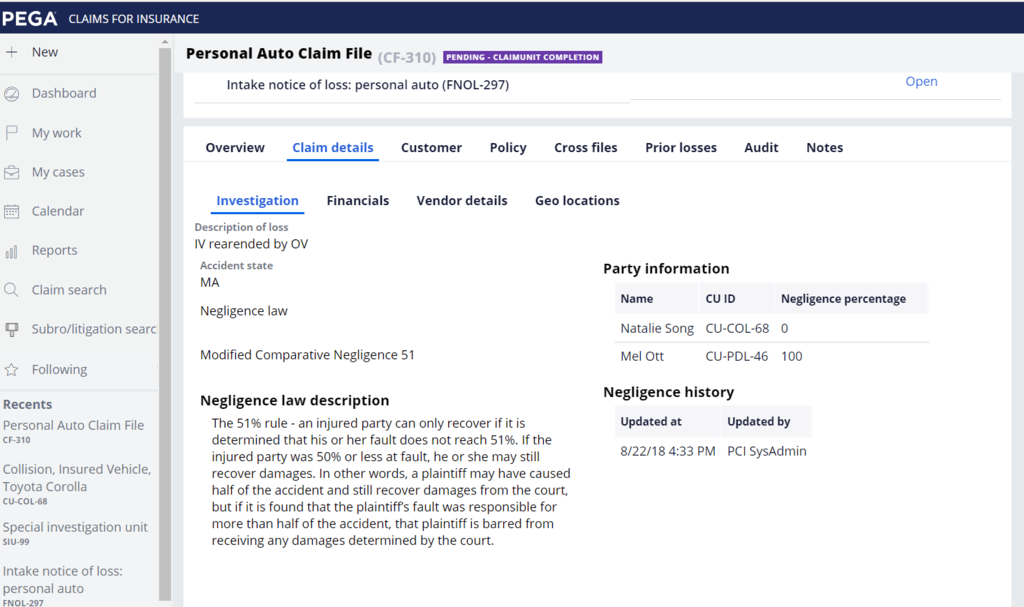

10. Pega Claims Management

- G2 Rating: 4.2 out of 5 stars

- Best for: AI-driven claims automation and decisioning at enterprise scale.

Pega Claims Management delivers a low-code platform for insurers to configure dynamic workflows. It supports agile transformation by enabling fast automation of business rules and streamlined decision-making.

Key features:

- Customizable, rule-driven workflows

- Claims process automation

- Enterprise-level scalability

- CRM and underwriting integration

- Real-time reporting and insights

How to Drive Adoption of Claims Management Software

Rolling out a new claims management system is just one piece of the puzzle. The real impact comes when claims teams adopt the software fully and use it effectively, day in and day out. That’s why change enablement, smart onboarding, and continuous support are non-negotiables.

To ensure your investment delivers long-term value, here are some key strategies to drive meaningful adoption across your claims organization:

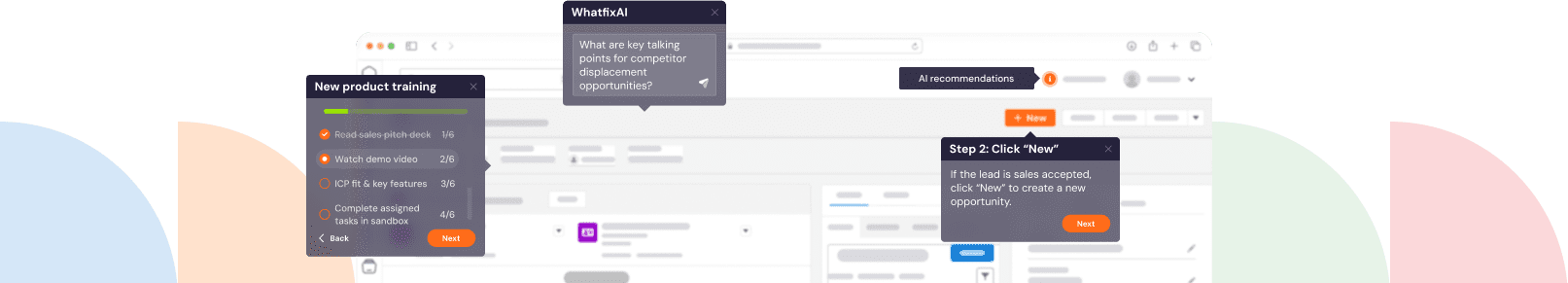

- Make onboarding intuitive and tailored with Whatfix Mirror: Traditional training alone doesn’t cut it. With Whatfix Mirror, you can clone your live claims environment and create interactive, role-specific training experiences. Claims agents get hands-on practice in a safe, simulated space that reflects the exact software they’ll use, helping them build muscle memory and confidence before ever touching a real claim. Utilize AI roleplaying features to help build confidence with your claims agents before they’re in the field.

- Support claims agents in the flow of work with a digital adoption platform (DAP): Learning shouldn’t stop after onboarding. With Whatfix’s in-app guidance, agents get real-time help while using the software, whether they’re processing a new claim, updating policy details, or following compliance steps. Tooltips, interactive walkthroughs, and self-help widgets keep workflows moving without disrupting productivity or requiring support tickets.

- Benchmark time-to-completion and identify process friction with Whatfix Analytics: Once the software is in place, visibility is everything. Whatfix Analytics lets you measure how long key processes take, where users drop off, and which steps are causing confusion. These insights help you pinpoint what’s working, what’s not, and where to optimize—whether that’s redesigning a workflow or adding a quick tooltip at the right moment.

- Create a feedback loop with your claims teams: The best way to improve adoption is to ask the people using the platform every day. Encourage ongoing feedback through surveys or informal check-ins, and then act on it. Small tweaks based on agent input, like simplifying a form or improving system messaging, can dramatically improve satisfaction and efficiency.

- Celebrate early wins and show impact: Adoption sticks when people see the payoff. Highlight improvements in claims cycle time, error reduction, or customer satisfaction. Show agents how their work is becoming easier and more impactful, and they’ll be more likely to keep embracing the tool.

Insurance Claims Management Clicks Better With Whatfix

Insurance claims management isn’t just about software—it’s about the people using it, the processes they follow, and the pressure they feel to get it right the first time. The right platform can bring structure and speed to complex workflows, but adoption ultimately determines success.

That’s why forward-thinking insurers don’t just invest in new tools—they invest in how teams experience and engage with those tools every day.

Whatfix helps bridge that gap. By supporting claims agents directly in the flow of work, simplifying onboarding with real-time guidance, and providing insights into where users struggle, Whatfix helps teams move faster, with fewer errors and more confidence.

When your software clicks with your people, everything else starts to click.

Learn more about Whatfix for claims management software adoption.

FAQs

1. What are the benefits of implementing claims management software?

A claims management software expedites your claims processing and settlement by minimizing the turnaround time, reducing operational costs, and improving accuracy. It further automates the payment and calculation process, streamlines case management, and provides better claim insights.

2. What are the key considerations while choosing claims management software?

With a variety of insurance management software available in the market, you should look at the following criteria before implementing a new software:

- Type of Deployment: Depending on the requirement, two types of deployment are available: on-premise or cloud. While on-premise offers more customization and requires a team of IT experts, cloud software is accessible via web browser and saves a lot on the implementation cost.

- Integration: Enterprises use multiple applications such as CRM, procurement solutions, CLM, and advanced business intelligence systems. You must discuss the integration options to connect these applications with the claims management system.

Cost: Although most vendors offer custom-based pricing. The cost of claims management software can range from $10/user/month to over $200/user/month.