It’s the age of all things ‘digital’ — especially in the banking and finance sector, where the growth of fintech is making young customers a flight risk for traditional banking institutions.

Digital transformation is a must-have initiative for all successful financial institutions. Artificial intelligence (AI), big data, mobile applications, chatbots, customer experiences, and digital-only banks are just some of the disruptive forces shifting the way we act on our finances.

But all new things come with a learning curve.

Digital adoption helps banks thread the line between innovation and confusion with tools and tactics that put the customer experience first.

What Is Digital Adoption In Banking?

Digital adoption in banking refers to the process of integrating and utilizing digital technologies and solutions to enhance customer experiences, streamline operations, and improve overall efficiency within the banking industry.

It involves the adoption of digital channels and tools, such as mobile banking apps, online account management platforms, chatbots for customer support, and digital payment solutions. By embracing digital adoption, banks can offer customers convenient and accessible banking services, facilitate self-service options, and provide personalized experiences based on data-driven insights.

Digital adoption in banking is a transformative journey that aims to meet the changing expectations of tech-savvy customers, drive innovation, and stay competitive in the rapidly evolving financial landscape.

Shankar Ramamurthy, Global Managing Partner of Banking and Financial Services at IBM

Examples of Digital Adoption In Banking

Digital adoption in banking picked up speed dramatically during the pandemic, but the trends we saw are here to stay. The need to go contactless was a catalyst for financial institutions to invest in more mature yet straightforward digital solutions, and what came out of that was a slew of technologies that many of us are familiar with today:

1. Contactless payments

Contactless payments weren’t new when the pandemic came around, but they weren’t always available in all retail locations. But today, everyone from big-name retailers to local mom-and-pop shops and stalls in farmers’ markets has access to credit card terminals that support contactless payments.

Businesses are confident in collecting payments through mobile wallets, QR code transactions, and digital payment apps like Venmo, Zelle, and CashApp, because banks have invested in digital infrastructures to seamlessly and quickly process these transactions.

In fact, the global payment processing company, Mastercard, will be phasing out the magnetic strips that credit cards have been using to enable billions of transactions since the 1960s, acknowledging this new era in banking.

2. Mobile banking

As the world closed its doors, app-based transactions kept businesses running. Whether it was for opening new accounts, applying for digital loans, managing investments, or reciecing financial advice, banks centralized their core offerings into a digital platform that consumers could navigate from home 24/7.

This was also an important move to keep up with the e-commerce industry that needed digital infrastructure to support high volumes of online transactions that weren’t just occurring during regular business hours.

From the beginning of 2020 to the end of 2022, downloads for mobile banking apps grew by over 200 million worldwide, reaching 550 million downloads.

Naturally, this new behavior led to new expectations from their banks — like on-demand services, personalized recommendations, and third-party integrations that enable all sorts of financial transactions and incentives.

3. Digital-first banks

In response to the demand for faster banking and on-demand services, digital-only banks — also known as neobanks — like Chime, Varo, and Current rose to prominence over the past few years.

Unlike traditional financial institutions, these banks operate solely through online channels, primarily smartphone applications. Varo doubled its user growth in 2020, while Current quadrupled their revenue. What drove users toward these digital banks was their ability to transmit funds more quickly and by minimizing extra fees or balance requirements.

When the pandemic pushed millions of Americans into unemployment, these banks won over consumers by simplifying the process of opening up accounts to receive stimulus funds.

4. Open finance

Open finance, or open banking, is a practice in which financial data is made accessible to third parties through secure network connections. The goal of this data sharing is to make it easier for consumers to integrate their core banking capabilities into other services for easier transactions or financial visibility.

For example, platforms like Stripe and Plaid make it easier for businesses to give customers quick and safe ways to pay for goods and services online through their banks. If consumers and businesses don’t have this interoperability, it becomes extremely difficult to support the scale of our online interactions.

We would have to hop from one app to another to verify financial information and enable transactions, or worse yet, we would stifle the growth of new online businesses that require this access to secure online payments to deliver products to consumers.

Benefits Of Digital Adoption In Banking

When financial institutions roll out digital transformation initiatives, it’s easy to spend too much time focusing on the technology instead of the people the technology is empowering.

“Successful digital adoption involves customer-centricity, employee buy-in, and metrics,” says Leo Smigel, founder of the trading blog Analyzing Alpha. “Creating tools that directly meet customer needs is key, not just pushing tech for its own sake.”

Whether it’s redefining traditional banking services or introducing new systems that make financial investments and planning more accessible, a commitment to digital adoption helps banks cut through the buzzwords and experience the following benefits:

1. Enhanced customer experience

It’s safe to say that typical banking processes weren’t designed for 24/7 accessibility. Customers were limited by the operational hours of physical branches, the availability of banking representatives, or their own scheduling limitations. Those who aren’t native to the digital banking era can recall long lines and having to clear out hours in their day to accommodate potential wait times for banking inquiries and appointments.

Digital adoption removes friction for customers by allowing financial institutions to provide:

- Self-serve support and immediate service through AI-powered chatbots, virtual assistants, and identity verification.

- Personalized banking-specific user onboarding processes that incorporate emerging technologies like machine learning and natural language processing to assess and filter through customer feedback, form fills, and historical data.

- Multi-channel avenues for customers to conduct banking activities and communicate with financial institutions from different devices.

- Proactive reminders, recommendations, and notifications to help customers stay on top of deadlines, opportunities, or suspicious activity.

2. Improved operational efficiency

While customers enjoy faster and safer services, digitized products and services give financial institutions the ability to optimize their resources for more strategic value-adds to the business. By migrating banking tasks to online channels, banks are able better maximize:

- Automated workflows: Banks can build robust digital processes that automatically funnel customer queries to the right departments or the next stage of a defined process. All this can be done without any paperwork, data entry, or manual back-and-forth communication between multiple parties.

- Self-service channels: Giving customers 24/7 access to online banking services pushes banks to boost the quality of self-service support, like in-app guidance, onboarding task lists, and resource centers. Customers can learn about a platform independently and get simple questions answered on their own, allowing banking support teams to focus their time on larger or more urgent concerns.

- Comprehensive data management: Digital adoption empowers banks with better tools to act on large volumes of data quickly and securely. For instance, banks that use a digital adoption platform (DAP) like Whatfix to track online user interactions, capture customer data, and accelerate decision-making with deep insight into the way customers use financial products and the bottlenecks that impede the quality of their experience.

3. Expanded market reach and competitiveness

Providing customers and internal employees with digital-first operations give banks the flexibility to:

- Explore and build innovative new services: Streamlining banking activities into digital platforms gives banks more opportunity to introduce new offerings that add value to existing services. For example, more robust data collection can power personalized recommendations and digital advisory services that are more mature and well-integrated into a customer’s suite of products.

- Appeal to new user segments: Digitization gives banks the ability to target their audience better and deliver a message that resonates. If you can slice and dice your customer data to understand who they are, what products they enjoy, and what they like or dislike the most about your services, you can build personalized marketing campaigns and product optimization strategies that set your product up for success in desired markets.

For example, younger consumers are the most likely to switch to new financial institutions if they deem a banking service unsatisfactory. Although this poses a big risk for traditional financial institutions, it signifies a big opportunity for banks to draw on the needs of this segment and create compelling messaging and product experiences that younger customers would be drawn toward. - Serve wider geographies: Banks today are no longer held back by the operational cost of having personnel and ATMs on the ground to enable activity. If customers and employers are properly trained on how to use digital channels for all relevant banking activities, banks can easily scale their services to more locations — all they would really need is for their customers to have access to the internet and a device that can support the banking application.

- Collaborate with new players: When banks embrace new technologies, they’re able to innovate faster through third-party integrations and partnerships within and outside the financial ecosystem. This is where the principles of open banking can really drive new business. Application programming interfaces (APIs) allow banks to integrate with different kinds of software for more holistic solutions that bridge banking capabilities to everyday interactions. For example, Bank of America integrated with Zelle to appeal to customers that would rather use instant digital payments instead of online wire transfers. This integration was met with great enthusiasm, with customers sending $27 billion through Zelle in early 2020.

Framework For Successful Digital Adoption In Banking

According to a report by Gartner, worldwide banking and investment IT spending is forecasted to total $652.1 billion in 2023. Understandably, it’s a big investment to build a data infrastructure that’s secure and stable enough to protect sensitive financial information while providing interoperability with a growing ecosystem of new financial apps and services.

Banks can prevent risk and operational chaos by keeping these guiding principles in mind:

1. There isn’t a single strategy for everyone

A strong digital adoption strategy isn’t made by following in the footsteps of others. It begins with a diagnosis of the problems impacting financial institutions, which could range from customer-facing issues to internal process inefficiencies.

Somesh Khanna and Heitor Martins write in a report by McKinsey that although most established financial institutions have the tools to evolve and grow their digital stronghold, these banks are held back by “uncertainty about how to best build on core strengths to create sustainable outcomes.”

In the report, Khanna and Martins share a few strategies that banks use to accelerate digital growth. Here’s how these strategies can shape digital adoption tactics:

- Growing into relevant ecosystems: When exploring new avenues for digital growth, banks often move beyond their core services and provide value in adjacent ecosystems, like accounting or retail financial products. With digital adoption, banks must prioritize the processes that allow these ecosystems to talk to each other and bring users through a seamless product journey. What digital workflows can you put in place to allow a smooth shift between these ecosystems?

- Building a one-stop shop for financial products: Some banks aggregate financial products to give their consumers a central location to search for solutions that meet different financial needs. Digital adoption built around this strategy would emphasize creating organized channels for partners and customers to find each other, whether that’s through personalized messaging or in-app guidance.

- Creating value for customers beyond bank-centered moments: When banks engage with customers beyond just banking, it builds long-term trust. For instance, some banks partner with other organizations to give customers different kinds of solutions they can turn to throughout their financial planning or decision-making process. The digital tools that support these value-driven interactions must serve the purpose of reducing friction for customers as much as possible through user experience enhancements, proactive recommendations, on-demand support, and more.

2. Envision your role as a digital citizen

Due to the increasing levels of digitization within banking products and services, banks can turn to major technology companies for inspiration.

Companies like Netflix and Spotify have turned their products into digital experiences that customers can explore on their own with minimal intervention or dependencies on others. On both these platforms, AI-powered recommendation systems and easy-to-follow navigation help customers move along the product journey and discover new content. Banks often centralize entire suites of functionalities within a single app or customer portal, allowing them to adopt a similar approach and use intuitive features to guide users through the app experience without any dependencies.

For example, Shine Bank used the principle of never leaving its users alone when navigating the app. Arnaud Babol, Growth Engineer at Shine, says that when users land in the Shine app, they should be accompanied. “[Users] should always know what should be [their] next action, and you should always know what you want to make [your users] do next,” he writes on the Shine blog.

3. Turn to experts to fill in infrastructure gaps

Implementing new digital initiatives can be a big resource lift, especially if banks are restructuring their entire technology infrastructure to accommodate new products and processes. The good news is that banks don’t have to take on all the technical hassle on their own. Instead of stretching your engineering bandwidth and pulling resources away from core initiatives for backend infrastructure upgrades, banks can partner with digital banking solutions and digital adoption platforms like Whatfix to adopt new UI enhancements and workflow automation without any code. Here are a few things banks can do with these ready-made solutions:

- Provide 24/7 support: Whatfix’s digital adoption platform enables banks to provide self-serve support channels that users can access at any point to troubleshoot simple issues and navigate through app journeys accurately. These channels include in-app help centers, digital adoption platforms, and pop-ups to provide 24/7 end-user support.

- Boost digital security: With digital banking platforms, banks can integrate their new platforms with pre-built enterprise-grade features like multi-factor authentication, biometric identification, and automated alert systems that flag unfamiliar logins.

- Implement new client engagement features: Digital banking solutions allow customers to access to enhance their online portals and mobile apps with additional features aimed to boost customer engagement with digital channels. These solutions allow banks to use API integrations to implement capabilities like financial management dashboards, online bill payments and money transfers, budgeting tools, automated workflows for application reviews, and more.

4. Provide comprehensive training programs

A 2023 survey of the financial services industry discovered that 56% of enterprises saw an increase in customer support tickets, signaling a bigger need for financial institutions to invest in ways to help customers explore financial products with minimal bottlenecks and dependencies.

Effective training programs for both customers and employees are a keystone of all digital adoption efforts. Banks can use dynamic training content embedded right within their digital solutions to deliver the following benefits:

- Accelerate new user onboarding: Deploy user onboarding checklists and guided product tours to help users complete key actions needed to get set up with digital channels, like verifying profile information, linking key accounts and services, integrating with third-party apps, and updating preferences.

- Highlight important or underused features: Use pop-ups, beacons, and smart tips to call attention to different on-screen elements like buttons, tabs, and menus that house useful information and links. This is especially useful in feature-rich platforms that have many pages users can potentially explore.

- Deliver self-service education and troubleshooting: You don’t want your users to be held back by the availability of your customer support team. Training can also be delivered on their own time with in-app knowledge hubs that are well-organized and easy to search.

- Eliminate drop-offs and user frustration points: Digital adoption platforms make it easier for banks to deliver dynamic training content at specific points in the user journey. They automatically track in-app events and interactions so banks can pinpoint areas of users friction or identify screens with the most or engage with the least.

5. Collaborate with fintech companies

Fintech companies are organizations built on digital-first infrastructure and organizational management. Traditional banking institutions can accelerate their digital initiatives and adoption by partnering with fintech companies and leveraging their technological foundations to deliver higher-quality online experiences.

On the other hand, fintech companies draw on the resource availability and industry expertise of traditional banks that better understand the processes and requirements of key financial transactions.

One example of this collaboration is between Mastercard and the digital payment solution, Raistone, which was recognized as one of the top fintech partnerships in 2022. Raistone’s platform is a perfect example of why customers are leaning toward fintech solutions — faster payments and flexible payment terms. Mastercard partnered with Raistone to integrate the fintech’s accelerated payment capabilities with their virtual card technology.

Through the partnership, both parties are able to improve on existing credit card infrastructure and give more businesses access to quicker payments and simplified financial operations.

6. Establish change management with clear KPIs

Yakov Kofner, founder of FSI Digital Transformation Weekly, says that the final level of digital maturity is a KPI-centric operating model, but it can take financial institutions years to achieve that level of impact from digital initiatives.

Instead, he recommends organizations optimize their KPIs for their existing maturity level instead of worrying about what the best fintechs are doing.

For example, Ramp is one of the fastest-growing SaaS startups, even beyond the fintech space. When scaling growth, they operated on the idea of tracking milestones in days rather than weeks or months and instilled this mindset in all their internal meetings. This speed and precision helped them assign the right change management KPIs for each phase of their growth.

Having tools to help you collect robust data with this level of precision can help you validate the effectiveness of change management strategies. Right from the get-go, you can kick off in-depth reporting with user-centric metrics that showcase what users are interacting with your platform for, how users are adopting your platform, and how satisfied they are with your platform

7. Stay informed about regulatory requirements and compliance standards

As banks strengthen their digital experiences, security remains the primary factor that influences the feasibility of all initiatives. Digital banking regulations are market-specific, and they are evolving consistently as more mature solutions emerge in the market. Examples of areas covered by digital banking regulations include:

- Electronic know your customer (eKYC) guidelines that help banks verify their customer’s identities

- Open banking regulations that redefine the consumer financial information that is made available by data providers

- Ecosystem diversification regulations that help nonbanks (like fintech) compete fairly and provide customers with innovative services

- Cloud compliance regulations that dictate how banks can host data securely on cloud-based infrastructure

Banks can stay on top of these evolving regulations by conducting regular audits and assessments to ensure all digital practices are free of risk and are up-to-date with local regulations.

7 Companies Leading Digital Banking

From customer-centric applications to digital empowerment initiatives, financial institutions worldwide are incorporating digital adoption strategies to diversify their services and deliver a stronger customer experience in banking.

Here are seven examples of enterprise banking organizations that have successfully moved the needle in digital adoption:

1. HSBC

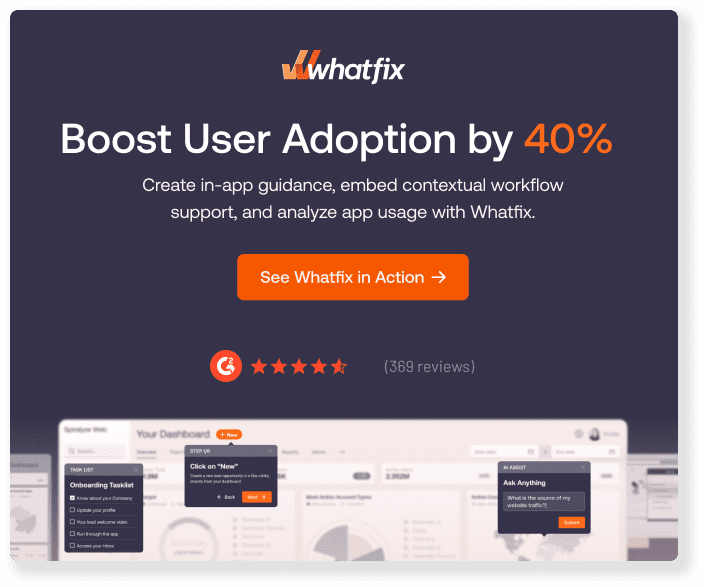

HSBC launched its Fraud and Cyber Awareness app in 2021 in an effort to use digitization as a primary means to educate customers about banking cybersecurity.

The app provides personalized alerts about potential scams, nudging customers and businesses toward more mindful behavior when they partake in online transactions. App users get a centralized location to view all information related to cybersecurity, like educational resources, interactive quizzes, and fraud reporting capabilities.

Since the app is integrated into HSBC’s banking ecosystem, the bank can make more accurate recommendations to customers about how they should protect their money. The successful adoption of this app has led to hundreds of thousands of British pound sterling (GBP) fraud.

2. ICICI Bank

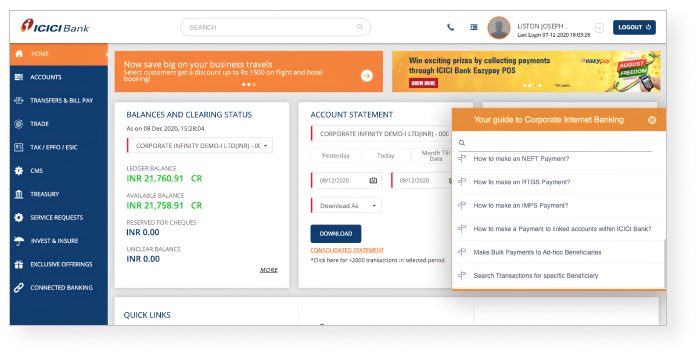

ICICI Bank is a leading private bank in India with award-winning digital banking initiatives.

Its Corporate Internet Banking (CIB) platform is an integral part of these efforts, empowering corporate customers with more control over their digital transactions. But educating these customers on how to maximize this platform was essential.

ICICI Bank supplemented its digital adoption efforts with Whatfix’s digital adoption platform to build trust with its users and make banking support resources accessible 24/7 for smoother transactions.

With this form of in-app guidance, ICICI Bank was able to boost customer engagement early and reduce support queries by 50%. It also allowed the bank to move beyond traditional banking expectations by opening up more channels to communicate with users, understand their behavior, and improve customer-facing initiatives.

3. TD Bank modernizes legacy banking technologies

TD Bank used early warning signs of the pandemic as a driver for its transformation. The company rapidly modernized its legacy applications, focusing on expanding its current technology rather than adopting new applications.

Following its efforts, TD Bank was better able to handle high demand. It tripled its capacity for mobile deposits in preparation for possible branch closures. The company also launched a virtual assistant to handle customer questions. The assistant conducted over 75,000 customer sessions in its first week and freed up support staff to focus on more serious issues.

As a result of TD Bank’s updates, engagement in digital channels rose 30% in Canada and 17% in the US between February and April. Self-service support options enable customers to quickly find answers to their questions without putting in a support ticket. This frees up your customer service staff to focus on other tasks. It also lessens frustration for consumers. They spend less time on hold and can find answers to their questions at any time of day or night.

4. Citibank adopts a “mobile-first” digital banking strategy

In 2018, Citibank found that mobile banking apps were one of the top three most-used applications. As a result, the company shifted its strategy to develop mobile banking as its own experience rather than as a supplement to the website and physical branches.

The company surveyed and worked with over 50,000 customers to identify which features it should focus on first. Citibank prioritized mobile options that consumers regularly use, including digital payments and investing. The company expects that this shift to mobile and its other digital banking transformation efforts will save them $600 million in 2020 and improve their banking customer experience.

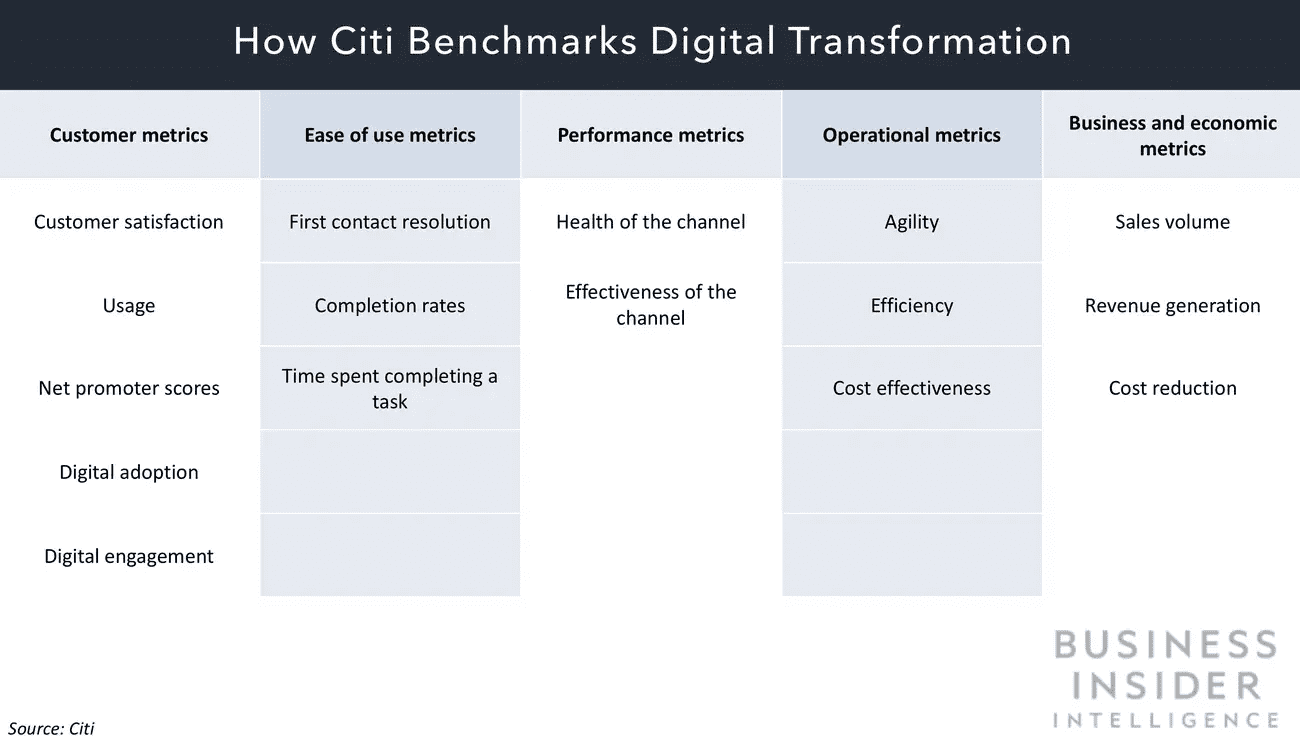

The key takeaway? Use customer information to drive your digital banking transformation decisions and determine what features to prioritize. Follow Citibank’s lead and set customer-focused metrics to measure the success of your efforts. By focusing on features customers are already interested in, you can increase your odds of successful end-user adoption.

5. BBVA launches “DIY” transactions

BBVA took the self-serve aspect of digital banking a step further. It now offers do-it-yourself (DIY) options for 94% of its products and services. Consumers can conduct most of their banking needs without visiting a physical branch.

BBVA branch employees now spend less time dealing with everyday tasks like deposits. They can focus more on financial consulting and advising customers on new products. This pivot resulted in US branches selling 42% more products per month.

Self-serve options also increase efficiency. There’s no need to wait in line, and customers can perform tasks faster. This helped reduce BBVA’s average cost-per-transaction by 31%.

The takeaway? Build mobile banking apps and websites so customers have a similar experience across your digital offerings. If the design and navigation setups are consistent across channels, it’s easier for customers to learn new applications.

If you offer services in multiple countries, make your applications as uniform as possible across locations. BBVA coordinates development across countries to ensure a unified experience. According to the company, using the same framework for all their offerings and locations leads to a shorter time-to-market for new products and services. It also means faster roll-out in new countries.

6. BMO implemented new in-branch experience improvements

BMO Harris Bank implemented several new technologies and processes in-branch as part of their digital transformation. The company aimed to take the convenience people expect from digital banking and apply it to the in-person experience.

Adobe found that 75% of people still value in-person branches. By upgrading their physical locations, BMO increased banking efficiency for people who don’t use mobile technology or who prefer to conduct some banking in-person.

The bank implemented real-time check scanning and processing. This reduces the need for paper deposit slips, and customers can access their money in hours instead of days. It also upgraded its technology so that customers can get a debit card as soon as they open an account, rather than having to wait for the bank to mail one.

These efforts significantly increased the speed of transactions and reduced the overall number of people visiting branch locations. Just reducing the number of forms to process has saved thousands of employee work hours.

The takeaway? Automate administrative processes to improve efficiency both online and in physical locations. Adopt e-forms and e-signatures to reduce the need for physical forms.

BMO increased efficiency by 40% by automating form generation and moving to e-signatures. Automation helps standardize processes across locations. It makes onboarding customers and staff more manageable and more uniform.

7. J.P. Morgan accelerated product development cycles

The product development side of digital banking platforms is just as important as the customer-facing aspects. J.P. Morgan’s early-stage product team, called AreaX, is responsible for moving from concept to working prototype within 6–12 weeks. They can work quickly because they focus on developing the most basic form of the product first.

The team tests the viability of the bare-bones product to see if it’s worth investing more time and money. The company stated, “While accepting failure is a challenge, failing fast and figuring out what went wrong early is much cheaper than developing the wrong product.”

Once the team determines a viable product, they hand it off to a larger team to develop and refine it further.

The takeaway? Having a specialized team with specific goals helps keep employees focused on the digital transformation and not distracted by working on other projects. J.P. Morgan achieves super-fast initial product development because that’s all the AreaX team does.

The company also has a Digital Innovation (DI) team. It watches for digital banking trends and potential expansion opportunities and helps guide what the AreaX team will focus on. For example, they helped with the decision to roll out digital-only banks in the UK. The decision was based on current trends: In the first half of 2019, digital-only banks increased their customer numbers by 170%.

Drive Digital Adoption in Banking With Whatfix DAP

The costs of poor digital transformation in banking are high. Low user engagement across digital channels leads to low customer satisfaction, revenue loss, and, ultimately, customers churning and turning to competitors.

Whatfix’s digital adoption platform helps banks bridge the gap between customer expectations and unfamiliar tools and processes. Banks can deploy personalized in-app guidance that not only walks new customers through digital products and workflows but also nudges existing customers toward important features and announcements.

With powerful self-help content centralized within the app and robust analytics that capture user behavior, banks can continuously optimize their applications according to real-time customer trends at any point in the user journey — whether it’s for onboarding, re-engaging with inactive customers, or even maintaining strong relationships with existing customers.

Want to learn more about how Whatfix enables your digital adoption efforts? Click here to schedule a free demo with us today!