Digital transformation has changed the way the financial services industry operates. Firms must evolve quickly or risk falling behind. To stay competitive, financial organizations must adopt the latest innovations and fully integrate them into their operations.

In this article, we’ll explore the critical technology, infrastructure, and workforce components shaping digital transformation in financial services.

We’ll examine new systems elevating personalized services, along with examples of overcoming common transition hurdles. In a sector where consumer trust and sensitivity run high, digital success relies on experiences that simplify rather than overwhelm.

What Is Digital Transformation in Financial Services?

Digital transformation in the financial services space means integrating modern technologies into institutions. It changes how these companies operate, serve customers, and empower employees. The goal is to improve efficiency, productivity, and experience.

For professionals, new software and technology power more personalized recommendations and advisory. Tasks that are manual and time-intensive can be automated and streamlined. This frees up the capacity to nurture client relationships.

For consumers, digital platforms expand access and convenience. Customers can independently explore options and self-educate. Virtual tools also make remote services possible.

Benefits of Financial Services Digitalization

Digital transformation impacts every part of the financial services industry, but what are the specific outcomes of embracing all this change? Here are a few of the top benefits.

1. Reduce operational costs

Legacy processes and outdated technology drain resources in financial services. Paper-heavy workflows, manual data entry, and having staff handle routine requests used to be the status quo. Now, all those things can drive up costs.

Digital transformation efforts increase profitability by cutting unnecessary expenses. For example, digitizing documents and integrations between systems reduces administrative work. Chatbots and self-service portals also minimize repetitive basic queries from customers.

These tools and updated working methods empower employees to focus on high-value activities like relationship-building and strategic planning. Technology can handle the time-consuming tasks efficiently at a fraction of the cost. The result is cost optimization across the board.

2. Improve customer experience

Financial services is a human-centric industry, but that doesn’t mean customers don’t expect options that allow them to be more independent. Self-service functionality empowers customers to manage simple interactions. Digital platforms allow them to access documents, check balances, make payments, and more without contacting advisors. This autonomy provides new levels of convenience.

Personalization improves customer service by responding to individual client needs and preferences. For example, advisors can tailor communications based on the data they have about customers. They can manage relationships more strategically.

The goal is to boost satisfaction throughout client journeys, not just during transactions. Implementing new systems can make providing quality assistance and relevant recommendations easier, improving customer experiences in banking.

3. Foster creativity and innovation

Financial advisors must constantly create new value for customers. Modern technology provides advisors with tools to develop original ideas and gives them time to brainstorm offerings to match what customers want now.

For example, a financial advisor could design a customized investment plan for a client that blends traditional stocks with newer assets like green bonds. Fast system updates also let advisors test innovations with real-time feedback.

Related Resources:

Financial Services Digital Transformation Challenges

While this time of change is exciting, it also comes with challenges to be aware of. Let’s explore a few of the most common digital transformation challenges for financial service companies, and how you can overcome them.

1. Digital upskilling and onboarding

As financial companies go digital, reskilling staff becomes critical. Studies show that technology is a top priority for leaders in the finance space, and the landscape changes fast. Employees must keep up with new technologies, from new enterprise systems to AI and analytics.

Tailored end-user onboarding programs help navigate these shifts. This is particularly important in finance, where nuance is key. Employees need to see how their tasks translate into a new digital environment.

Investing in expertise-building closes this gap while promoting continuous learning. This fuels a culture that embraces change. Plus, upskilled staff can drive value for individual clients and the bottom line.

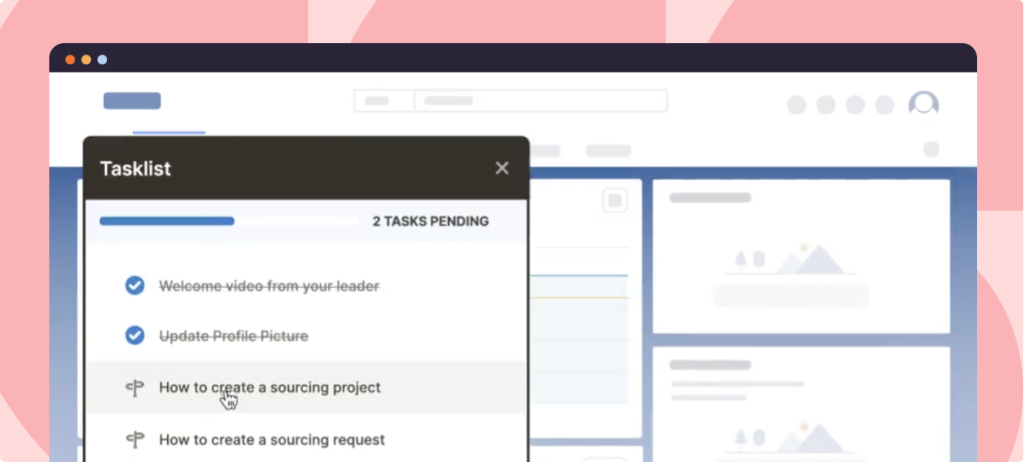

With a digital adoption platform (DAP) like Whatfix, financial service companies can empower their financial advisers and other staff with contextual in-app guidance and role-based training throughout their digital processes. This enables these technology end-users to be assisted in the flow of work and maximize the potential of their software tools.

→ Guide users through complex apps with contextual, role-based in-app guidance.

→ Support users at the moment of need with AI-powered Self Help and embedded workflow assistance.

→ Analyze user engagement to identify friction points and optimize business processes.

2. Data privacy and cybersecurity

Data privacy and cybersecurity are at the core of trust in finance. One breach can severely erode client and investor confidence. Accenture reports cyber incidents are on the rise for 68% of their clients in the private equity industry. While transactions are increasingly digital, privacy and security take center stage to guard sensitive information.

Then, there are strict regulations like GDPR to contend with. Non-compliance brings significant fines and credibility hits. Consider the extensive damage a leak could do to an organization’s bottom line and reputation.

Defense against these attacks requires constant vigilance. Security is not a task that anyone on your team can “set and forget.” Instead, you must stay on top of emerging threats and any vulnerabilities that could put your business at risk.

3. Integrating new technologies with legacy systems

Blending cutting-edge innovations with dated infrastructure creates roadblocks for financial services companies. Legacy systems are documented as a major barrier to banking transformation. Smooth integration between systems requires strategic effort and software implementation planning – consider hiring a digital transformation consultant to assist with integration.

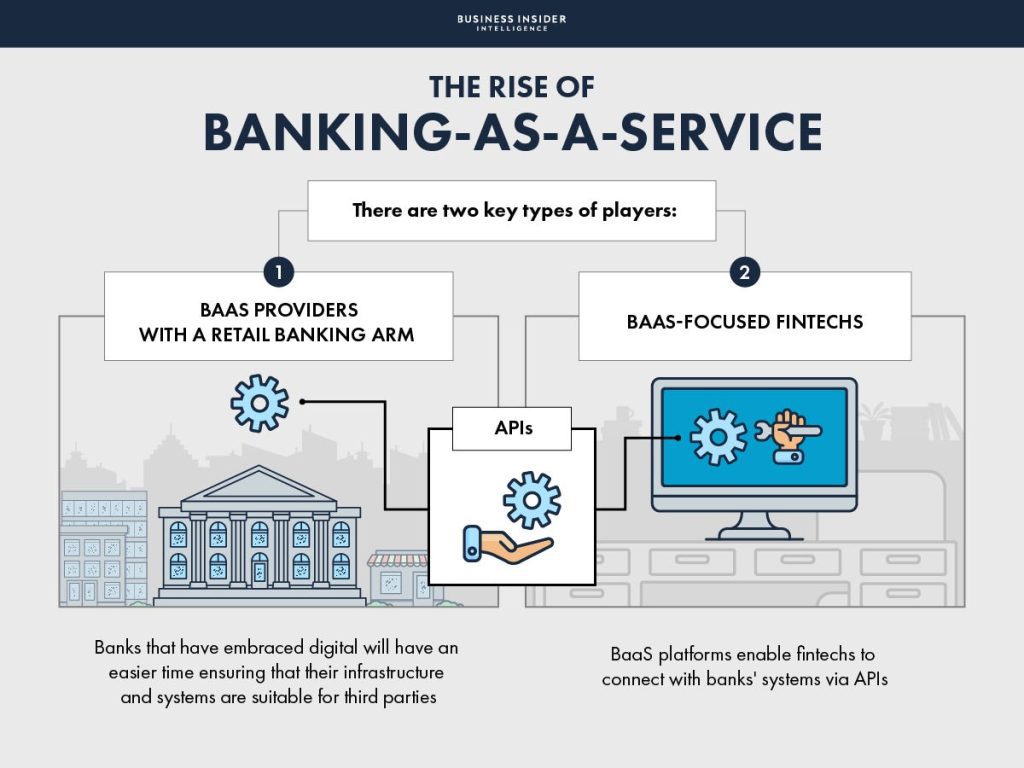

APIs (application programming interfaces) are one way to bridge old and new. Developers use these interfaces to build fresh financial apps that tap real-time data from existing systems behind the scenes. This gives banks sleek digital storefronts while keeping trusted old systems running smoothly out of customers’ sight.

4. End-user support at the moment of need

Strong end-user support defines digital transitions in finance. Consider a client trying a new mobile banking app. The quality of assistance they get, if they run into a problem, shapes whether they stay or go. This isn’t something organizations can afford to ignore, as 32% of financial customers switch firms after just one poor experience.

With a DAP like Whatfix, enable staff and customers with in-app support with Smart Tips and Self Help that provide additional support in moments of need. Self Help auto-crawls your FAQs, SOPs, knowledge base, help center, training resources, onboarding materials, and more, aggregating them into one searchable resource center that overlays your web and mobile applications.

5. Understanding end-user challenges and frustrations

Technology may open the door to new possibilities, but it isn’t always intuitive to staff or customers. Less than half of customers say that their primary banks’ mobile app experience is excellent.

Financial organizations need more information to combat that frustration. With a DAP like Whatfix, companies can track end-user behavior, gather feedback, and identify areas of end-user friction and improvement with Whatfix’s end-user behavioral analytics.

Then, use this data to optimize your product experiences and identify priority areas of improvement. Enable your additional technology end-users with contextual in-app guidance, information, and support to utilize technology fully and overcome friction areas.

Use its end-user analytics to continue to improve, creating a data-driven, end-user first flywheel for creating more friendly, optimal technology experiences for customers and staff alike.

6. New technology costs

Adopting new financial technologies requires strategic cost-benefit analysis. While everything technology offers is promising, the money for this change must be accounted for. This may mean firms need to reevaluate priorities.

Maintenance costs also pile up quickly. Less than 10% of banks fully capitalize on new technologies, often due to unplanned costs. The initial investment in technology is one early part of the process. Institutions must also consider how other ongoing costs will fit into their planning and budget.

7. Regulatory compliance

Before jumping into digital transformation in financial services, you must vet online tools and automated workflows to ensure they align with their region’s legislation. Non-compliance is bad for business and it can come with large fees.

In the highly regulated financial sector, compliance must be considered. That means making sure it’s a priority in your team and for any vendors you may choose to work with as part of your transformation strategy.

With a DAP like Whatfix, ensure your data is clean with Field Validations and Smart Tips. Field Validation alerts end-users with error messages to ensure fields are entered incorrectly, not at all, or in the wrong format. Smart Tips provides contextual information on how to enter information correctly and presents additional help for local laws.

Examples of Financial Services Digital Transformation

There are an endless number of options available in digital transformation, but what solutions apply to financial services? Explore these examples of tools and systems that can apply to your business.

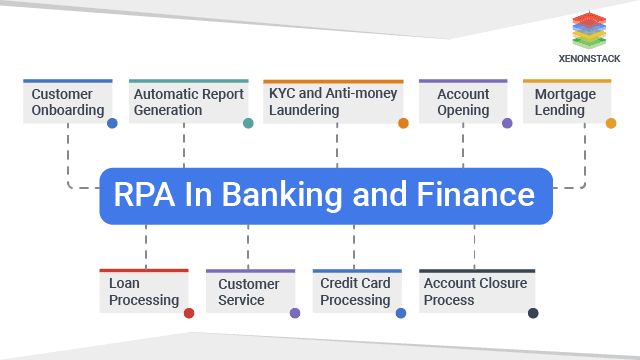

1. Robotic process automation (RPA)

Financial companies rely on many data-heavy processes running behind the scenes. Tasks like compliance reporting and performance tracking eat up employee time. Robotic process automation (RPA) offers help.

Bots powered by RPA can automatically pull data from different systems into spreadsheets and forms. This handles repetitive work like consolidating customer names or inserting transactions into dashboards.

With robots doing time-intensive clerical work, human employees direct their specialized skills toward more rewarding initiatives. Additionally, bots perform consistently without errors that humans might make.

2. AI-powered fraud detection

Artificial intelligence is changing fraud defense in finance. Sophisticated AI algorithms analyze massive transaction datasets to pinpoint activity indicative of fraud, malicious cyber threats and money laundering. These adaptable systems also learn independently over time, progressively getting better at identifying emerging attack patterns to prevent fraud proactively.

To reduce the incidence of check fraud, one global bank partnered with Cognizant Digital Business to build a solution based on artificial intelligence (AI) machine learning to speed up check verification and lower costs. By automatically comparing various factors on scans of deposited checks to those in the database, the model flags potential counterfeits in real time, saving millions in fraud losses.

3. Banking-as-a-Service (BaaS)

Banking-as-a-Service eliminates the need for companies to build standalone banking infrastructure. Instead, banks provide tailored solutions for lending, payments, account management, and more. Digital banking platforms give financial service businesses a way to provide seamless customer experiences.

This infrastructure-sharing model also allows non-financial brands to deliver branded financial experiences embedded within their products. For example, a retailer can offer payment plans and exclusive credit lines instead of requiring customers to apply through external channels.

4. Brokerage trading platform

Opening a brokerage account is the first step many people take in their investing journey. Brokerage trading platforms can make the process more accessible and attractive to new clients. This technology also offers new convenience to experienced investors.

These platforms offer tools for market research, real-time data, automated trading, and portfolio management. The democratization of trading through brokerage trading platforms has changed the conversation around investing.

RNDpoint worked with a bank to develop a brokerage app. Only 3 months after the app’s launch, the app helped users complete 10,000+ deals with securities and 275 deals with currencies. It also onboarded 5,000+ new clients for the brokerage account and individual investment account service.

5. CRMs for financial advisors

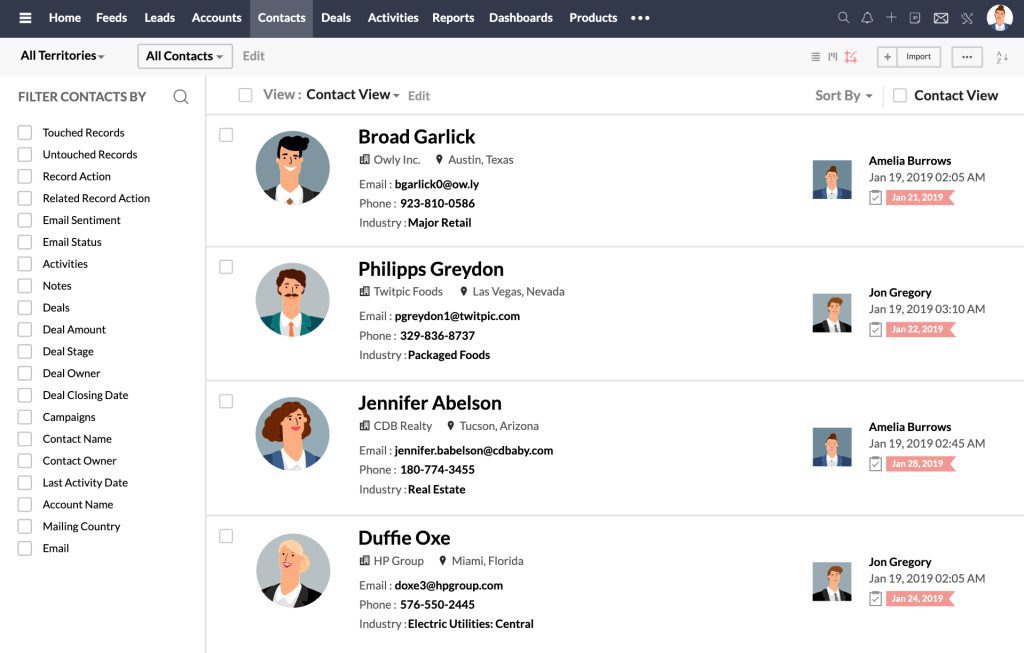

Personalization is no longer a buzzword, and it’s not as simple as including clients’ names in communications. People expect to have relevant interactions with financial advisors, and CRMs can make that possible.

Specialized CRMs empower financial advisors. By centralizing client data, portfolios, and communication, advisors gain a better understanding of who they’re serving. CRMs offer analytics that power personalized engagement.

One financial advisor used Eqisoft and got centralized client data from the CRM to identify great candidates for cross-selling, and then track the sales process to completion. With the help of this system, the advisor was able to boost revenue by 30%.

With Whatfix, you reduce the learning curve by can creating in-app guided overlays that help users learn a product’s interface, its capabilities, and contextual tasks for different types of users. For example, if your advisors are implementing a new CRM, you can create contextual guided onboarding tours and interactive walkthroughs. You can support your CRM end-users throughout their day-to-day with moment-of-need support and contextual help, all embedded in your finance CRM platform.

6. Wealth management and RIA platform

Wealth management and RIA platforms integrate advanced technology for elevated service. Robust analytics, portfolio management tools, and communication features make tailored financial advice.

For example, machine learning algorithms can analyze a client’s past investment behaviors, major financial decisions, and external signals like career changes to detect major life events. Advisors can then initiate timely conversations to realign investment theses or tax strategies based on changing priorities like saving for a home or planning for retirement.

The result is personalized wealth management that’s only possible with today’s technology. As advisors combine analytics, lifestyle factors, and their emotional intelligence, they can create plans that resonate with each individual.

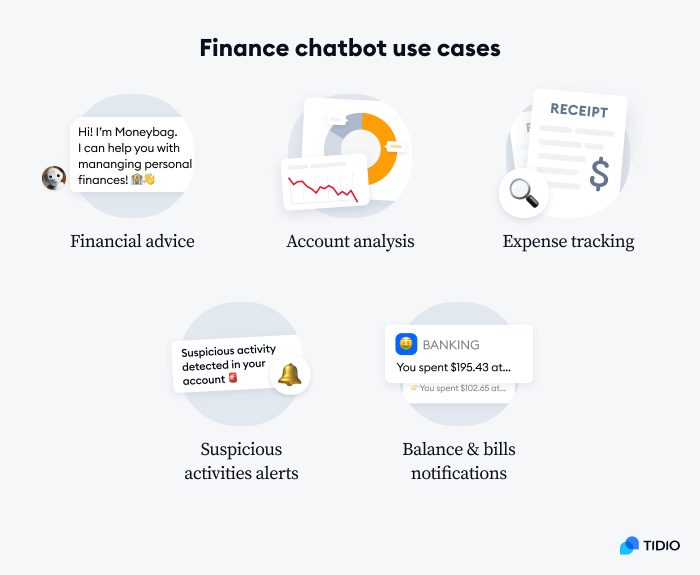

7. Chatbots and virtual financial advisors

Chatbots and virtual advisors drive 24/7 support in finance. They also continually improve as the technology evolves. That means your organization can invest in one of these solutions now and benefit from it for years.

Powered by natural language processing and machine learning, virtual agents handle everything from checking savings rates or credit balances to notifying customers of suspicious purchase attempts for fraud prevention. Cloud infrastructure allows endless scale for multiple inquiries.

8. Blockchain and cloud technology

Blockchain and cloud solutions are transforming finance by powering secure, transparent transactions. The technology’s decentralized design promotes safety along with transaction clarity. This can speed up processes and deter fraud.

Meanwhile, cloud infrastructure provides the always-on availability and scalability necessary for real-time data processing across finance. AI-based cybersecurity modules detect threats and deploy patches faster than siloed on-site hardware can.

9. Adoption of digital workplaces

Financial institutions want to keep talent, boost agility, and better serve customers. Upgrading to modern digital workplace environments helps. But change can be tricky without the right tools, systems, and guidance in place.

Deloitte predicts that by 2025, the skills required by finance professionals will dramatically change as new combinations of technology and human workforces enter the workplace. That means financial services organizations must focus on the foundation of those required skills to keep up with competitors.

When platforms and support align, digital transformation empowers staff instead of causing frustration. Simplified workflows and collaboration unite teams around a core purpose. That’s when challenges turn into opportunities. This focus on people-first technology can pay dividends in retaining talent.

Financial Services Digital Transformation Trends

It can be challenging to know where to start with digital transformation in financial services. However, you can get an idea of what makes sense for your organization by paying attention to trends in the industry. These are some of the trends influencing the financial landscape.

1. Mobile banking services

Mobility is no longer just a convenience, it’s something customers have come to expect from all of the companies they do business with. The number of digital banking users in the United States is expected to grow year-on-year between 2021 and 2025. By 2025, digital banking users in the country are forecasted to reach almost 217 million.

Banking apps also bring financial access to remote areas where brick-and-mortar locations need to make economic sense. Having an app and mobile support options available can expand your reach. It can help you connect with more potential customers who may need a branch in their area.

2. Payment innovations

Cash may be king, but people rarely handle physical cash during transactions now. Between contactless cards, digital wallets, and peer-to-peer platforms, the last decade sparked a payments revolution that’s still gaining momentum.

Behind the scenes, blockchain and tokenization secure transactions while open banking APIs share payment details between apps and merchants. This reduces friction while empowering innovation like prompts to repay friends after splitting a bill.

3. Advanced analytics from big data

Sophisticated analytics comb through demographics, transactions, clicks, and more, unlocking customer insights hidden in data. Predictive models tailor engagement across channels and lifecycle stages, boosting relevance. Meanwhile, AI powers hyper-personalization like proactive warnings of unusual purchase attempts.

Big data also informs portfolio strategy, quantifying risk factors in economic policy changes or real estate investing scenarios. Intelligence from massive digital feeds helps institutions match services to individuals more meaningfully while optimizing performance.

4. Embedded financial services

Embedded finance weaves relevant financial products into retail, gig platforms, and life management apps end-users already engage with daily. Customized loans, insurance, and installment payment plans simplify purchasing decisions where customers are most receptive.

Contextual integration provides users with specific options they need when they need them. For example, Uber drivers can activate cards, get earnings deposits, and get cash back when they refill fuel.

Embedded services use visibility into non-financial companies’ customer insights and expanded reach. This way, they can drive mutual value. The outcomes benefit end-users, partners, and institutions alike.

Financial Services Technology & Software Clicks With Whatfix

Accelerate your digital transformation in financial services by enabling your employees and customers with contextual in-app guidance and real-time support with Whatfix’s digital adoption platform (DAP).

Whatfix enables financial enterprises with its no-code Visual Editor to create in-app, moment-of-need support and contextual guidance. This reduces time-to-proficiency and achieves new levels of productivity and proficiency through better software adoption. It also provides customers with self-service, personalized, and guided user experiences.

Whatfix empowers a data-driven approach by analyzing tech experiences with end-user behavioral analytics and event tracking. This identifies areas of friction in your digital processes and tech experiences, allowing you to create optimal, contextual user journeys across various end-user segments. Use Whatfix’s Visual Editor to overcome these friction areas with additional in-app guidance, nudges, queues, and support.

How does it work? Whatfix empowers financial organizations to:

- Create in-app Flows and Task Lists that guide employees and customers step-by-step through digital processes and applications.

- Enable end-users with Self Help, providing a searchable help wiki that connects to all your help and support documentation, FAQs, help desk articles, and more – that overlays on your digital UI.

- Notify end-users of application process updates, compliance changes, company announcements, and more with Pop-Ups and Beacons.

- Provide contextual Smart Tips that give end-users timely information that nudges them to take the correct in-app action.

- Use Field Validation to ensure data is entered in full, in the correct format.

- Collect end-user feedback such as NPS, training and onboarding feedback, and bug identification with In-App Surveys.

- Analyze end-user behavior with User Actions and Enterprise Insights by tracking custom in-app events to optimize user journeys, segment users into cohorts, identify areas of friction, and more.

With Whatfix, you can understand how technology is being used and what is being underused. This makes it easier to adjust software training and adoption strategies. All to provide a seamless experience for clients or customers and your staff.