4 Ways Digital Adoption Platforms Drive Efficiencies in P&C Insurance

- February 25, 2021

The COVID-19 pandemic forced the property and casualty (P&C) insurance industry to expedite its digitalization efforts. When the World Health Organization (WHO) characterized COVID-19 as a pandemic in March of 2020, an industry traditionally slow to adopt digital solutions scrambled and tried to adapt to a changing environment where human interaction was limited or restricted.

The changes happened quickly. Suddenly, CIOs and CTOs started setting up infrastructure for a fully-remote workforce, policies and premiums were updated, claims processing had to become faster, and call centers learned to answer an inordinate number of calls.

Digitalization was no longer an option—it became a requirement. And P&C insurance companies that doubled down on digital differentiation to increase efficiencies in internal operations and the customer experience gained an edge. And with the help of a digital adoption platform (DAP), digital adoption across a newly remote workforce happened even more efficiently and effectively.

4 Ways Digital Adoption Platforms Drive Efficiencies in P&C Insurance

Digital adoption in insurance is growing at a rapid pace and taking many forms. This process can be made easier by leveraging a digital adoption platform (DAP) to help your business with the various facets of digital transformation.

Here are four ways that DAPs drive end-user adoption of new InsurTech technologies, and empower employees with contextual, moment-of-need learning and performance support.

1. DAPs Solve High Employee Turnover Rates

An extra 50% to 75% of their annual salary is spent every time an existing employee is replaced to cover recruiting and training costs. Poor training and onboarding is the underlying cause of high employee turnover.

A DAP can streamline onboarding by making your program more organized and the entire process more engaging.

Above: In-app onboarding task list created with Whatfix

Checklists give new hires a clearer idea of what they need to do and how it should be done. With a DAP, you can create walkthroughs for important processes and link them to specific entries in the onboarding task list instead of creating multiple video tutorials that require more time and effort. With this, your new hires can engage in hands-on learning rather than spending hours on a training session.

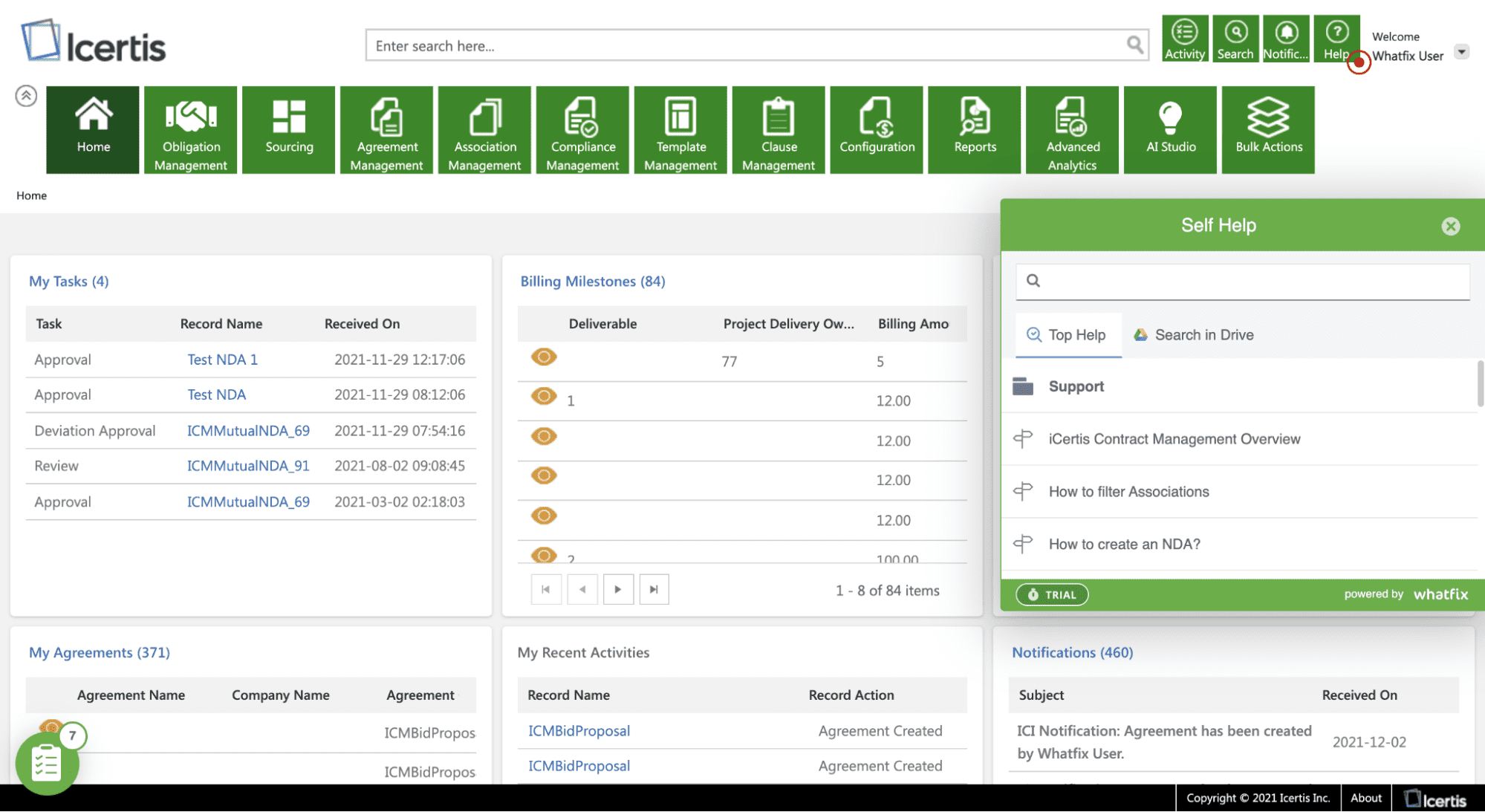

DAPs can also aggregate all of your premade help content and other support documents for easier access and contextualized self-help – helping new hires locate answers to their queries with the click of a button.

2. DAPs Increase Employee Productivity

Another problem that the pandemic brought was the need to adjust quickly to changes while maintaining the same level of productivity. Six out of 10 insurance agents weren’t prepared to start working from home as this was not part of their insurance agent training. Because 60% of processes required paper trails and human interaction, P&C insurance companies couldn’t expect their employees to maintain the same level of efficiency when they moved into the digital world.

Integrating a DAP gives employees an opportunity to increase productivity in three specific ways: semi-automated or AI-generated forms, access to contextual self-help, and in-application announcements.

Above: In-app self-help wiki created with Whatfix

Creating forms is easy with a DAP. Sending a known prompt to a chatbot and answering subsequent questions can generate the exact condition your employee needs within seconds. Apart from AI-generated forms, a DAP can also pre-fill and validate entries to speed up specific processes while reducing errors.

If an employee is confused about a particular process, they can quickly click on the self-help menu and access the existing walkthroughs and documents required. The DAP tracks unsuccessful search terms that can be later used to create more help content for users.

DAPs can quickly alert employees when specific tools aren’t working or things are being updated using in-application announcements. If you’re announcing a feature update, then employees can check the new walkthroughs that accompany the announcement and learn how to use the new feature within minutes.

On-demand content and training through DAP drastically increase employee productivity and reduces the margin of error.

3. DAPs Improve Customer Experience

The insurance industry has been known for its low customer interaction suggesting that most insurers cannot collect enough data from their customers to offer personalized policies and services. But like digitalization, personalization is also becoming a requirement. Customers expect their insurers to provide an on-demand, digital tool at the moment of need.

A DAP can solve both of these problems. One of the most significant advantages of a DAP is the amount of data that can be tracked – customer behavior, successful and unsuccessful search queries, total walkthroughs accessed, and more.

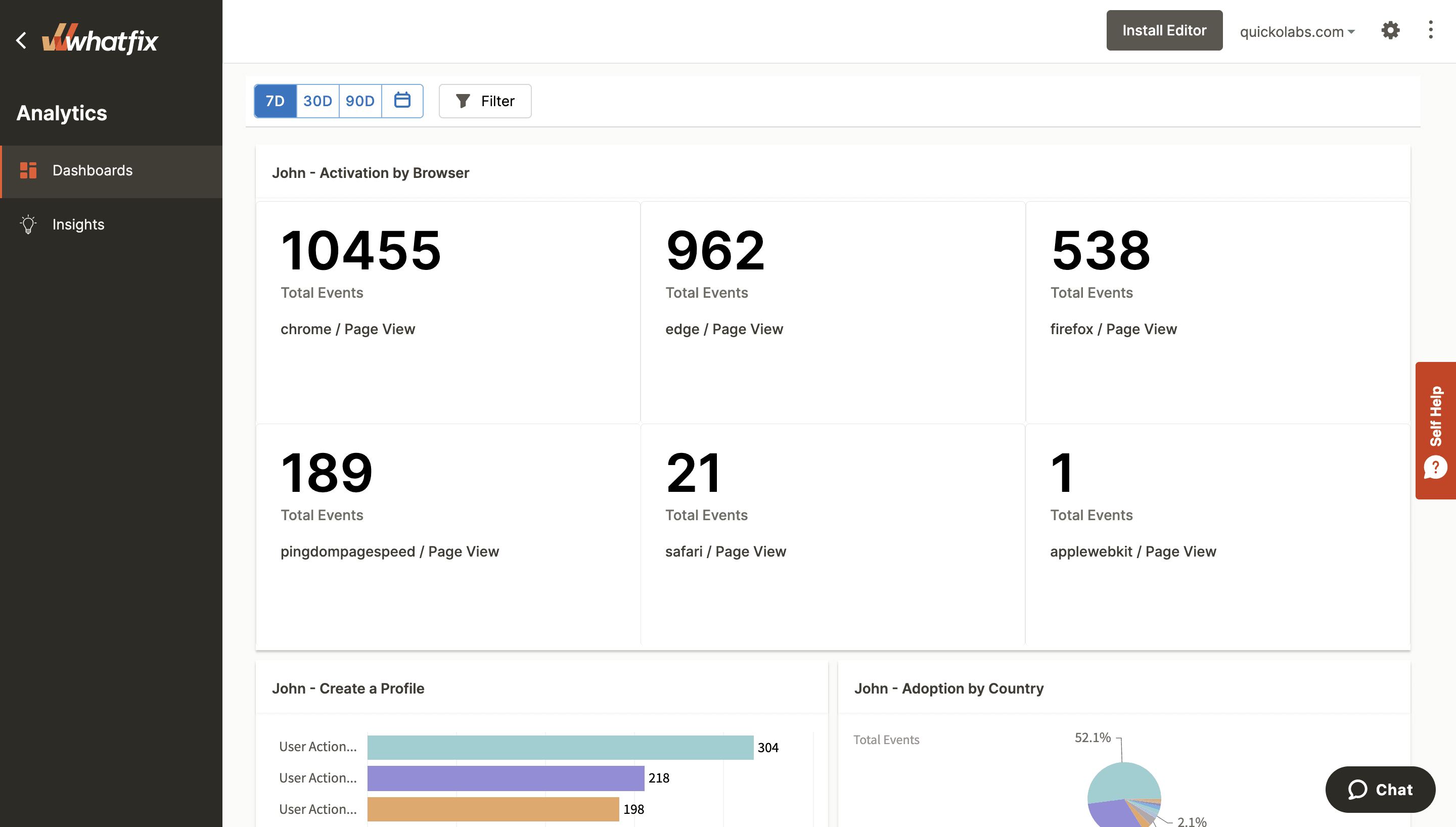

Above: See how your employees and customers are using your new digital technologies with Whatfix’s behavior and event data.

You can also ask for feedback directly in your portal, making customers more inclined to give feedback. By learning more about your customers, you can improve the customer experience and give them better solutions for their specific needs.

Above: Create real-time employees and customer feedback with Whatfix’s in-app surveys

4. DAPs Reduce Burden on Support Teams

Customer support can be costly and time-consuming. And because of the pandemic, support teams have been handling an influx of customer calls about possible policies and premiums updates. Apart from that, the recently-remote customer support team has to learn about new or changing processes and how to respond to these queries.

A DAP can encourage users to turn to self-help solutions to get answers without human interaction. Instead of asking your customers to wait an hour for the next live agent, they can get help from an automated chatbot or the contextualized self-help menu. Instead of asking your team member who has an answer to a specific question about a policy, they can turn to the aggregated self-help menu and run a walkthrough or watch a video.

Above: Create interactive step-by-step walkthroughs with Whatfix

A DAP aggregates all of your tool-specific help content and makes it much easier for your customers and support team to find the information they need using a self-help menu. You can also set up contextual pop-ups for hard-to-understand processes and in-application messages when something is going to be updated.

A DAP can also identify the main points of confusion by tracking interaction with walkthroughs and help desk entries. Apart from that, it can also track user behavior so that you can see what features your customers and your team are interacting with the most.

By redirecting queries away from your support team, DAPs save you time and money in support hours.

While COVID-19 undoubtedly brought about much change, integrating a DAP with your existing tools and platforms can help your team better adapt to the new digital environment and set them up for success.

As the world becomes more digital and customers expect some kind of digitalization from their insurers, we only have two choices: adapt or fall behind. A DAP can kickstart your journey into digitalization and help you sustain that growth and level of excellence.

Book a demo with Whatfix to see all of this in action and find out how Whatfix can provide solutions catered to your specific needs.

Thank you for subscribing!